French billionaire’s group is the operators biggest shareholder but a rise of 33% in Millicom’s share price this year also ups the ante in financing the deal

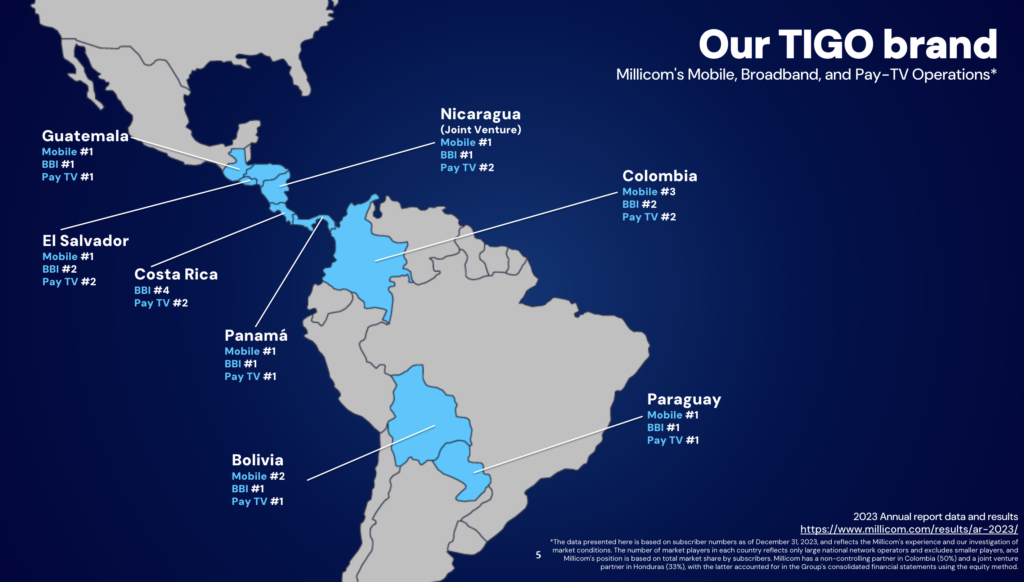

French telecom billionaire Xavier Niel is considering the acquisition of Millicom International Cellular. Niel’s group is already Millicom’s biggest shareholder with a 29% stake, according to data from the London Stock Exchange Group, cited by a Reuters report. Millicom provides telecom services in Latin America through its TIGO brand (see graphic below).

The report says Niel is investigating finance options for an offer price of $24 per common share which would value Millicom at $4.1 billion (€3.788 billion). The transaction would be through Atlas Investissement, which is a wholly-owned unit of Niel’s NJJ Holding which, in turn, owns the stake in Millicom.

Niel’s possible move was reported originally by Bloomberg News which suggested that rises in Millicom’s share price could make it harder for Niel to finance the deal: Millicom’s shares have gained about 33% this year.

Official confirmation

After reports in the media, Atlas issued a statement saying, “In light of media reports, Atlas Investissement announces that it is exploring a potential all cash tender offer for Millicom securities. In connection with such preliminary efforts, Atlas is exploring financing options to support an offer price of 24.0 USD per common share, and its SEK equivalent per SDR.”

Millicom, which has its headquarters in Luxembourg, also put out an official statement: “The Board of Directors of Millicom International Cellular confirms that it received today a non-binding expression of interest from one of its shareholders, Atlas Luxco… The Board of Directors will carefully review any offer, should one be made. There is no certainty that a transaction will materialize nor as to the terms, timing or form of any potential transaction.”

Long term goal

Niel’s Luxembourg-based telecom firm was said to be in talks with Apollo Global Management and Claure Group about a potential bid for Millicom last year. During the discussion, Niel upped his stake in Millicom.

The talks ended in June 2023.

Niel has telecoms investments in nine countries in Europe with nearly 50 million active subscribers combined and more than 10 billion euros of revenues, Atlas said.

Atlas Investissement said it was independent of Iliad Group and Iliad Holding.

The billionaire is the founder and owner of Iliad, which has opcos in Poland (through the Play brand), France and Italy (under the Free brand).