Not even DeepSeek’s market reality check has dampened the hyperscale data centre industry as fear of missing out replaces market reality in some cases

In 4Q24, webscale – or hyperscale – capex grew an astounding 78% YoY, to push the annual total just over the $300 billion benchmark, according to MTN Consulting’s latest report. Perhaps more astounding is that webscale capex surpassed telco capex in 2024 – one for the regulators to ponder whether they are focusing all their energy on the right sector.

“Key webscalers retain ambitious buildout plans for 2025, in part to curry favour with politicians looking for big announcements to brag about,” said MTN Consulting chief analyst Matt Walker. “Capex plans have not been adjusted since Deepseek or the tariff-induced stock market crash, but it seems likely many of these companies will gradually come to their senses.”

“Generative AI is a bubble,” he added. “There is no way current levels of spending can continue.”

Walker may well be right as the MTN report comes at a time when multiple reports have appeared suggesting Microsoft is actually walking away from some of its huge data centre commitments globally.

After declining 3% in 2023, webscale capex grew at incredibly fast, unsustainable rates in 2024: up by 26%, 53%, 61%, and 78% YoY in the four quarters of the year. Q4 FY24 capex of $100.2 billion pushed the annualised total to $304.4 billion, up 56% YoY, and another all-time high. Investor interest in generative AI has spread rapidly, driving GPU spend in the data centre. Some companies claim they are struggling to procure all the GPUs they want, and prices are unusually high, both due to Nvidia’s market power. Nvidia’s net profit margin for the quarter ending 31 January 2025 was 55.85%. The chipmaker’s average net profit margin for 2024 was 53.25%, a 96.49% increase from 2023.

Walker reckons the current investment spike would seem to be inspired by a mix of hype and fear of missing out, as GenAI brings with it a plethora of legal and regulatory risks and relative lack of proven business models.

MTN said the most recent webscale capex is focused on outfitting existing data centres: from 48% of annualised capex in 2022, Network/IT and software capex was 60% of total capex in 2024. The biggest capex outlays in 4Q24 came from Amazon ($27.8bn), Microsoft ($15.8bn), Meta ($14.4bn), and Alphabet ($14.3bn). These four accounted for over 70% of single quarter spending.

Double bubble trouble?

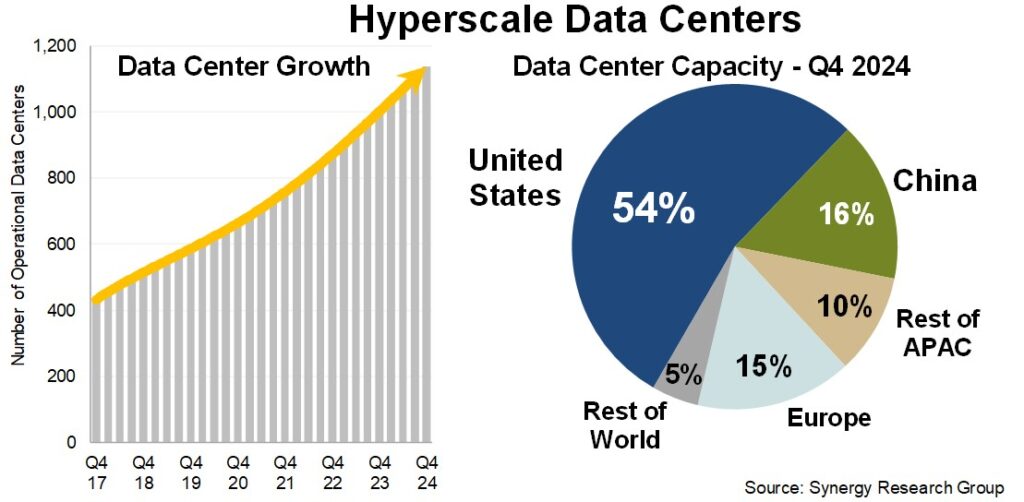

Synergy Group recently said the number of large data centres operated by hyperscale providers increased to 1,136 at the end of 2024, having doubled over the last five years. They added it has taken less than four years for the total capacity of operational hyperscale data centres to double, as the average capacity of newly opened facilities continues to climb. The United States still accounts for well over half of total worldwide capacity, measured by MW of critical IT load, with Europe and China each accounting for about a third of the balance.

Synergy forecasts that it will take less than four years for total hyperscale data centre capacity to double once again. Each year will see a reasonably steady 130-140 additional hyperscale data centres coming online, but overall capacity growth will be driven more by the ever-larger scale of those newly opened data centres.

Naturally, the companies with the broadest data centre footprint are Amazon, Microsoft and Google. In aggregate the three now account for 59% of all hyperscale data centre capacity. They are followed in the ranking by Meta, Alibaba, Tencent, Apple, ByteDance and then other relatively smaller hyperscale operators.

Pedal to the metal

MTN said annualised revenues for the webscalers has reached almost $2.6 trillion. Topline growth has been driven by the big 4: Alphabet, Amazon, Meta (FB) and Microsoft. For six straight quarters, all of these companies have recorded double digit revenue growth.

Webscale free cash flow margins averaged out to 16.3% in 2024, a bit lower than the 18.6% average of 2023. Unlike Nvidia, the average net profit margin for 2024 was 19.9%, a bit higher than 17.5% in 2023. Net margins are around the same level as in the year before Covid, but free cash flow margins have dropped recently due to high capex spend.

“Meta, Tencent and Microsoft were 1-2-3 for FCF margins in 2024 overall,” said Walker. “The ecommerce specialists Amazon and Alibaba are the laggards, as usual. In gauging webscalers’ ability to fund their capex, their recent levels of free cash flow profitability is one factor to consider.”

He added: “The overall level of average margins is a bit low relative to history, and it’s moving in the wrong direction. Webscalers can afford this for a few quarters, but not for a few years.”