The new FibreCo, plus a wholesale deal with Telefónica, completes the transformation of Vodafone Spain’s fixed line strategy, delivering full FTTH services nationally

Vodafone Spain and MasOrange have announced plans to create a new fibre network company in Spain, dubbed FibreCo for now. FibreCo will bring together network assets of Vodafone Spain and MasOrange to create a 100% fibre-to-the-home network covering 12.2 million premises across Spain. The announcement was made by British investment fund, Zegona Communications, which acquired Vodafone Spain for £5 billion (€5.877 billion) in May 2024.

Financial details of the contract were not disclosed but the FibreCo is expected to have a run-rate EBITDA of circa €480 million after three years. Zegona and MasOrange plan to bring a third-party financial investor into FibreCo, which will lead to MasOrange retaining 50% ownership, Zegona holding 10% and the financial investor 40%. Zegona said initial interest from investors is strong, reflecting the “high quality and utilisation of FibreCo, its already built FTTH infrastructure and the multi tenant nature of the company”.

FibreCo will benefit from from having virtually all its FTTH network already built and with nearly 40% existing network utilisation, providing FTTH services to over 4.5 million Vodafone Spain and MasOrange customers. The new wholesaler is also committed to rolling out XGS.PON. Vodafone Spain will use FibreCo to provide services to its existing and future retail and wholesale customers within FibreCo’s footprint.

In November 2024, Zegona announced it had signed binding contracts with Telefónica Spain to create a new fibre network company covering 3.6 million premises across Spain and to renew its fibre wholesale access contract with improved terms. Zegona will hold 10% of that company as well. Zegona said the combination of these transactions with the new FibreCo with MasOrange completes the transformation of Vodafone Spain’s fixed line strategy, delivering full FTTH services nationally.

The transaction is subject to customary regulatory approvals. FibreCo completion together with the introduction of the third-party investor is expected by the end of the first half of 2025.

“Entering this FibreCo partnership with MasOrange, alongside our recently announced agreements with Telefónica, transforms Vodafone Spain’s fixed line strategy,” said Zegona chairman and CEO Eamonn O’Hare (above).

“The combination will give guaranteed access to a future-proof all fibre national network with attractive economic terms and will enable substantial cost savings across the business,” he said. “Monetising these two FibreCos is expected to deliver very significant Zegona proceeds, generating the ability to reduce leverage and provide a return of capital to shareholders.”

Spain is world-standard

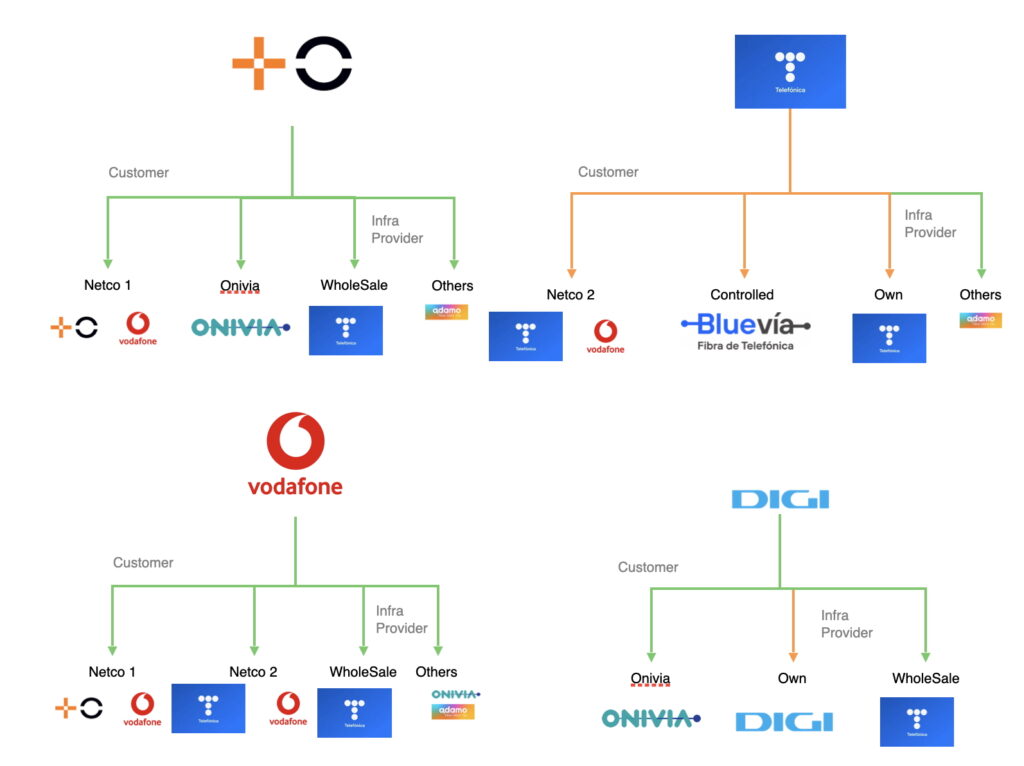

As we reported last April, the high overbuild ratio in Spain has led operators to open their networks, creating a highly complex wholesale ecosystem with a large number of operators and agreements between them. Even then, consolidation loomed large on the horizon and the process is well and truly underway. In this emerging model the traditional players want to remain the InfraCos supplying the market with both wholesale and retail services, while retaining the ability to bundle for their own customers.

“In mid-summer, a series of operations were announced, of which the creation of ‘FibreCo’ is the largest and the last to sign the corresponding contract, which allow the creation of what we call ‘the triangle of superNetCos’,” Spanish and Latin America telecom consultancy Nae director Joaquín Guerrero told Mobile Europe. “MasOrange, Telefónica and Vodafone have closed strategic agreements to share their fixed fibre access networks. Two of the vertices of this triangle will give rise to new companies that will own the FTTH infrastructure.”

He added: “They will be NetCos (or network companies) that will rent that infrastructure to operators and open their capital to new investment groups. The third, between MasOrange and Telefónica, will be managed in a more traditional way, through a long-term rental contract or IRU, according to the jargon of the sector.”

Guerrero said The spanish fibre-to-the-home industry and its ecosystem stand out as one of the most sophisticated worldwide, setting a benchmark for Europe and the rest of the world in the creation of these structures. “Once these changes are implemented, the majority of fixed customers of the main telecommunications operators in Spain will be connected to networks owned by other companies,” he said.