The operator panellists shared their candid experiences around how their service delivery and cultures are changing to stay competitive, internally and through partnerships

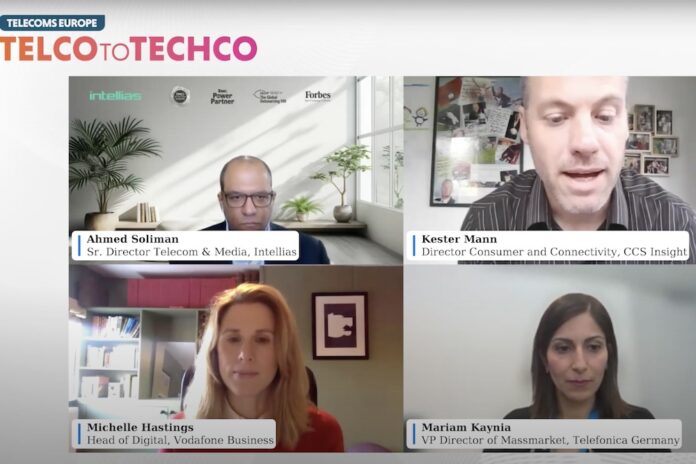

The discussion took place at our recent Telecom Europe Telco to Techco virtual event, moderated by CCS Insight consumer and connectivity director Kester Mann. Our panellists were Telefónica Germany VP director of massmarket Dr Mariam Kaynia, Vodafone Business head of digital Michelle Hastings and Intellias senior director telecom & media Ahmed Soliman.

Telcos aren’t as agile as hyperscalers

Intellias’s Soliman said the adoption of current tools and open-source technology is vital for telcos to innovate and stay competitive. Despite the industry’s regulation constraints, integrating open-source solutions like OpenAI offers opportunities for advancement. Soliman also addressed the disparity in talent acquisition and flexibility between telcos and technology firms like hyperscalers. While the latter can readily acquire talent and pivot with ease, telcos face challenges in upskilling their workforce and adapting to rapid changes.

He underscored the importance of investment strategies, noting how technology companies have historically been quicker to identify and acquire innovative platforms like Skype and WhatsApp, revolutionising communication.

Hyperscaler competition has changed

Telefónica’s Kaynia agreed that telcos are slower than hyperscalers at this, but she said: “it’s simply because of our legacy landscape that makes it hard to adapt as fast as some of the others do.”

She also addressed the evolving relationship between telcos and hyperscalers in tackling enterprise networking requirements. Emphasising a spirit of partnership over competition, she highlighted the necessity of collaboration to meet the demands of a rapidly changing market.

“It’s not about comparing [to hyperscalers]. It’s a partnership that is required and this is how we also operate in the industry,” she said. “We are not competing, we are not trying to say take each other’s lunches, we actually need each other in order to be able to become more digital and more efficient and more agile towards our customers as a whole.”

Kaynia acknowledged the unique capabilities that hyperscalers bring to the table, emphasizing a desire to leverage these without duplicating efforts internally. Conversely, telcos offer expertise and established customer relationships that are invaluable in delivering comprehensive solutions.

“It’s really more about a hybrid collaboration across the whole system to bring together the different players need from cloud providers…solution providers…telcos…system integrators and only jointly can we really deliver what the market needs,” she said.

Addressing the complexities of the current landscape, she attributed much of the challenge to the rapid evolution of customer demands alongside the need for telcos to manage both stagnant revenues and increasing costs. “If you put the whole landscape together, it is more complex because you want to deliver more you want to do much more for our customers and be more agile and efficient and, at the same time, we need to manage the both revenue as well as the cost side of it,” she said.

Vodafone’s Hastings agreed that it is becoming increasingly clear what each party now brings to the table to get the right outcomes for customers. But first you need to understand what the customer wants. Do they need more oxygen in the P&L, are they reducing costs, have they spotted a business opportunity, is their IT estate too complex? “Depending on what’s driving that behaviour will ultimately depend on the right answer and whether that is to partner with a telco directly or whether that’s to use an integration partner instead,” she said.

She added that AI is changing this equation once again with customers asking “where am i going to be using that AI, where’s my data…I think [the issue is] starting to understand some of those questions to then be able to make the right decisions about who do I partner with who’s going to help me to fill perhaps the gaps in knowledge that I might have, or the gaps that I might have around my IT estate.”

Data leverage example

Soliman gave the example how telco marketing teams can benefit when vast amounts of network data and customer data are abstracted to deliver insights and develop new services. “You have the [customer] data, you have coverage heat maps, you have the status of the devices so how can I abstract this to [help] marketing promote new products and services,” he said, adding that new tools like GenAI help with this.

Marketing should be able to ask a simple question in layman terms and this massive, complex database that telcos have, with all its data points, should be able to give them actionable insights liking where to launch a service in their footprint.

Do telcos have the right culture?

Telefónica’s Kaynia said implementing cloudification and microservice architecture is not an easy task but the operator is doing this to be more efficient so it can have independently deployable components or features – the exact principle behind agile DevOps. “We cannot survive with this this,” she said. “If you’re not agile enough, it means we are not fast enough to adapt.”

And this impacts culture. “If we are not fast enough to be able to launch something deploy it independently with CI/CD and DevOps, [then] we can’t even get fast enough feedback to be able to adopt and then be able to calibrate as per our customers’ needs, which means we will be holding either ourselves back or the market back,” she said. “I see it as a fundamental enabler to have that right culture to move to the agile ways of working; to move towards DevOps, in order to achieve everything we talked about in terms of digitalisation and higher speed.”

Vodafone’s shift in core competencies

Hastings said she had seen “a real shift” at Vodafone in “bringing some of our core competencies and core capabilities back in house and being quite selective about where we do partner.” As a result, the telco is in the process of creating significant development and engineering hubs.

“When we think about things like digital transformation, but then really importantly, data transformation and look at where we have the skills where we need the talent and then marry that to culture, you start to kind of touch on quite an important dynamic between those two things,” she said, highlighting the intricate relationship between skill sets and cultural values.

Hastings underscored the significance of fostering a culture that empowers individuals to take ownership and initiative, stressing the importance of attracting and retaining talent within the organisation. “I think having the right environment to attract talent, to fill the right skills to then enable them to ultimately be successful. And ultimately help all of us to progress,” she said, emphasizing the role of a conducive environment in nurturing talent and driving collective advancement.

Acknowledging the ongoing evolution of organisational culture, she added: “Have we gotten it 100% right yet? No, I doubt any company…I hope no company would ever say that they do. Right? Because culture is always evolving, right? It’s always improving. There is always something that we can do better.”

The discussion also explored:

• How AI is impacting operations and new services at Vodafone and Telefónica Deutschland including the use of GenAI

• The complexity around finding the real AI use cases that are linked to the actual value the return on investment, or linking to revenue

• The importance on AIOps in creating automated feedback loops

• The role telcos can play in supporting SME’s undertaking digital transformation

• Examples of larger telcos using digital with their huge databases to develop new services

• Telefónica Germany’s shift to a microservice architecture

• Giving customers more control over their services

• The consequences of automation

• The three key objectives of digital transformation: enhancing operational efficiency, fostering innovation, and prioritising cybersecurity

• Are telcos competing with hyperscalers or partnering and how has this changed as enterprise network needs have evolved?

• What mindset changes have to happen before telcos can fully embrace digital transformation as part of their culture?

• If telcos are not agile they are not fast enough to adapt

• How do telcos collaborate as an entire industry so they can utilise thre same standards and respond to customer needs quicker

• Emerging co-sourcing and best-sourcing models are seeing customer look for upskilling and this has implications for telcos