UK altnet association suggests BT of charging customers up to 30% more per month for the same product in areas with no infrastructure competition

Challenger telco association the Independent Networks Co-operative Association (INCA) has slammed UK regulator Ofcom for putting the fibre broadband market at risk by implementing regulation that “assists” BT.

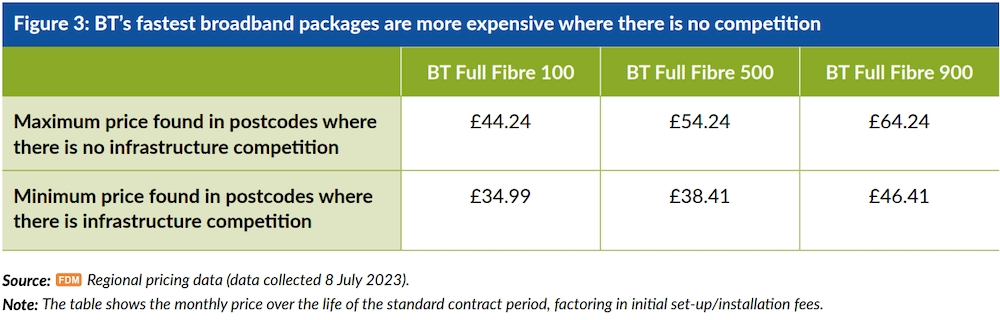

As a result, BT is discounting broadband prices by up to 30% – up to £15 more every month – where infrastructure competition exists meaning in some areas without infrastructure competition, the incumbent is effectively charging that amount more for the same broadband product, according to INCA’s new report.

INCA was particularly scathing about Ofcom suggesting that despite the growth in full fibre networks – 52% of UK homes now have access – the regulator is implementing regulation that assists BT while harming new infrastructure builders, like altnets, especially in rural areas.

“8m premises are today served by Altnet fibre and 10m by BT fibre. BT fibre is there only due to the presence and competitive threat of the altnets,” said INCA chairman Tim Stranack. “No regulatory intervention can replicate the impact of real competition and this has been proven in recent years in UK telecoms.

“The government adopted the right policy, the market responded with enthusiasm…The differences between government policy statements and Ofcom actions are putting these benefits, to businesses and consumers, at risk,” he added. “The material differences between government policy statements and Ofcom interventions put at risk the dynamic benefits competition brings to consumers and businesses.”

The report suggests consumer demand for altnet fibre is being artificially restrained because large ISPs, which control 90% of the retail market, are reticent to switch their customers from BT’s Openreach network – which is then exacerbated by Openreach tying them in with various packages. This also, said INCA, gives Openreach the opportunity to overbuild.

“ISPs are also using this [24-month] fixed term to enforce above inflation annual price increases on ‘trapped’ customers. The large ISPs all increased their prices for ‘trapped’ customers in April 2023 despite accepting deflationary wholesale discounts from Openreach,” stated INCA.

INCA said structural separation would reverse the current situation where BT, as the largest retail broadband ISP in the country, has publicly stated that it will never use another network provider other than Openreach and to remove differences in conditions between altnet fibre network builders and BT.

Delivering government policy

INCA recommends several steps to “address regulatory failings” including: improving the transparency of Ofcom’s decision making and showing how each decision delivers against government’s policy objectives; clearing up consumer confusion over the use of the term fibre; incentivising large national internet service providers to use altnet networks; and, something it has been calling for since 2016, the structural separation of BT and Openreach.

“INCA considers the continued integration of the physical infrastructure parts of Openreach with the remainder of Openreach, and with the remainder of BT Group, to be the underlying cause of many of the issues identified in this report”, said INCA chief executive Malcolm Corbett.

“Enough time has been allowed for functional and legal separation to deliver and both have failed. It is therefore time for a full structural separation of the passive infrastructure components of Openreach from the remainder of the group,” he reprised.

We are competitive

For its part, BT dismissed the report’s findings with a spokesperson saying: “The UK broadband market is highly competitive. Even in areas where Openreach is the only network provider, there remains huge competition at a retail level, with over 600 companies able to provide services over their network.”

The incumbent was alluding to the fact that Openreach does offer wholesale broadband services, used by many ISPs, from connection. Therefore, BT aside, it is not clear whether INCA’s report factored in any price variations implemented by Openreach’s wholesale ISP customers between competitive urban areas and less competitive rural postcodes.