Robert Gerstmann, Co-Founder of Sinch and its Chief Evangelist, explains why he thinks RCS will ultimately be a win for operators

Three UK and Virgin Media O2 are partnering the cloud communications platform Sinch to enable businesses to send messages to customers who use Apple devices, based on the Rich Communication Services (RCS) protocol. Previously, the operators only supported RCS messages from businesses to Android users.

The operators claim RCS business messaging (RBM) on the iOS platform offers businesses “unparalleled opportunities to engage with customers, including through…MVNOs…like Tesco Mobile and Giffgaff”.

Mobile Europe recently interviewed Robert Gerstmann, Co-Founder of Swedish company Sinch and its Chief Evangelist, for his take on the RCS opportunity for operators, which has progressed at a glacial speed. During 2024, Sinch delivered more than 1 billion RBM for businesses worldwide.

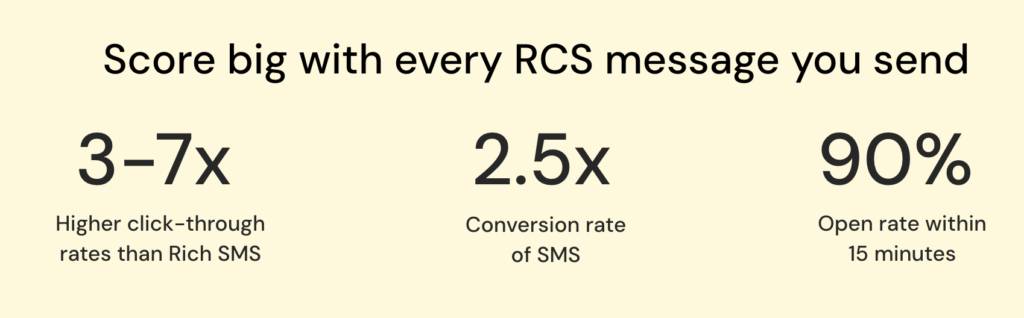

Source: Sinch, January 2025

Gerstmann says that in the BM mix today, 99% of SMSs are one way with a brand sending messages like, ‘Don’t forget your doctor’s appointment’ or ‘Here’s a one-time password’. If users want to reply to request a different course of action or more information, they have to go via a different communication channel such as phoning, which is tedious and slow.

How we got here

And yet although the GSMA launched the idea of the RCS protocol back in 2008, it has had little impact while newer messaging platforms also turned into two-way BM channels. For instance: WhatsApp which is used in 180 countries including the world’s most populous, India; Line tops the ranking in Japan; KakaoTalk in Korea; and WeChat in China and beyond.

SMSs traffic continued to plummet in most markets when an unlikely champion emerged for RCS in the shape of Google. It has suffered failed attempts at developing a messaging standard and Gerstmann observes, “I think it was a marriage of necessity.”

With Google’s considerable weight behind it, RCS made some headway but, Gerstmann says, progress was slowed by infighting between mobile operators, “various traditional telecom vendors including Ericsson Samsung and Mavenir” and Google about how the ecosystem should be structured. Google – the begetter of Android – won and came to dominate the tech stack for RCS and now provides the entire stack to operators as a kind of service provider.

Another milestone in the RCS saga is that Apple released iOS 18.1 in September, which for the first time included support for RCS on iPhones. This is how CNET summed up the development, “With RCS messaging, you can enjoy features like typing indicators and the ‘Delivered’ status message while messaging Android users. It also helps ensure high-quality videos and pictures are sent when texting between iPhone and Android devices. And with the iOS 18.1 update, Apple brought RCS Business Messaging to iPhones, which means you’ll be able to chat with some businesses in Messages rather than a buggy webpage.”

Gerstmann says iOS entering the fold is “a huge thing for RCS…before this, if the follow up were on iPhone and Android, we could not have a group chat over SMS, it would break because of the iMessage and SMS incompatibility. What’s also happens if you want to send video over SMS today between iPhone and Android, the quality degraded. That doesn’t happen if you use, say, WhatsApp or Facebook Messenger.”

Will Apple trigger rapid growth, finally?

So finally,now Apple’s onboard, will we see rapid growth, with consumers being able to receive and exchange all kinds of rich content including video, images, audio and even text with brands?

Yes, but not immediately sums up Gerstmann’s response: “I think it’s going to take a little bit of time, like an S curve…because we need the mobilization…of the entire ecosystem, meaning for a business to really use these new channels is much more difficult than to leverage SMS. SMS is ‘fire and forget’. It takes time and effort to create an appealing looking message for consumers and you need to be ready if the consumer responds. That puts a lot more requirements on your tech stack.

He continues, “Getting that tech stack in order will take some time and investment. Some businesses will do it themselves, but much more so, they will rely on third parties and that whole software ecosystem – companies like Salesforce or Adobe or HubSpot…marketing platforms, support platforms, CRM systems etc, that they use today to send SMS messages. They all need to be RCS-enabled and that’s going to take a couple of years.”

Show me the money

Where is the payback for all that extra effort and cost? Gerstmann says, “Here’s where you need bots powered by AI to manage a lot of the conversations, then you need to be able to hand over to a human agent if the bot doesn’t solve the individual’s problem. So that’s all part of this package that brands need.”

He continues, “Brands spend a lot of money on these contact centres. If you can automate that by, let’s say 60 or 80% of queries being diverted to messaging of which a large share is handled by the bot, that’s a massive cost saving, even though the unit cost might be higher for the actual message and you need initial investment in the tech stack. Long term, though, your operating costs are much, much lower.”

He adds, “If you can self-serve in a nice way with a bot that ‘understands’ what you want to achieve. That’s the care use case driver: you get an appointment reminder from your physician, realize you can’t make it and are offered choices in the messaging flow, tied to the booking engine of the doctor’s office so the recipient can request rescheduling the appointment .

“You can reschedule that appointment in your own for a time that works for you and stream it for the physician. That’s a cost saving and a win for customer experience and marketing. Right now about 30% of global SMS is probably marketing but being able to send an enticing videos explaining whatever product or services you are pushing is much, much nicer.

“Plus, through a carousel, consumers might be able to scroll through whatever shoes Nike are selling on this day, and tie them to Apple Pay or Google Pay, so customers could go into transaction mode and buy a product through the RCS.”

In other words, RCS could remove a lot of friction points for interchanges and transactions. This is why, Gerstmann reckons, “Messaging as portion of a company’s total consumer communications will increase and take share from voice, from apps and from email because of the new characteristics of these rich channels.”

Operators – the next layer of the onion

What do the operators get out of it? Gerstmann says, “Here’s the next layer of the onion – RCS versus WhatsApp. I think that’s going to be the interesting. I think we will go from calling it as a monopoly situation with SMS side, where each mobile operator has kind of controlled the messaging traffic to their subscribers, to a situation where you have two competing channels, and that’s close to a duopoly with WhatsApp, outside East Asia.”

He muses, “Mobile operators don’t have 100% control over their subscribers anymore. When it comes to BM, the brand has a choice of channel, which is a potential negative for the mobile operator…However with RCS, if you look at where pricing is starting to land, it looks like a simple one-way message with no bells and whistles will be priced the same way as a text message today. That’s not an insignificant source of income for mobile operators as they monetise is each message.

“Secondly, once you get into conversational back and forth conversation between the brand and the consumer, that’s very likely to be priced higher than a simple text message today. Hence, that’s an increase in revenue for the mobile operator and, on top of that, this is just moving all the SMS traffic towards RCS traffic, plus you will have these new use cases and make more money per message. The unit economics will be better. So net, it’s a positive business case for the carriers.

“Finally, another strand is they pay a revenue share for the more conversational use cases to Google, but I don’t think they pay Google for basic messages. On the other hand, the two-way exchange is net new traffic, it’s not cannibalisation of SMS. So it’s swings and roundabouts. My guess is there would be more money in it for the carriers at the end of the day than in the SMS world, even though they will lose X per cent of the market to WhatsApp.”