Proposed new group would stretch from Thailand to Indonesia and have 300 million customers.

It would become one of Asia’s largest mobile infrastructure companies with about 60,000 towers, with €11.61 billion annual revenue.

Axiata and Telenor said they expect to save about $5 billion through consolidation and the efficiencies of greater scale after the merger, but provided no details.

Under the proposed deal’s terms, Telenor would hold 56.5% and Axiata the rest: Axiata’s main shareholder is the Malaysian sovereign wealth fund.

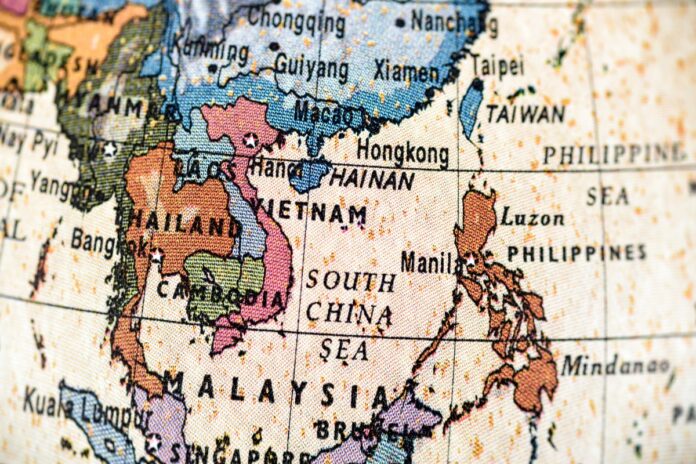

Both companies have operations in Malaysia, Thailand, Bangladesh, Pakistan and Myanmar, but the Bangladeshi operations are not included in the proposed merger.

Telenor already makes more than half its annual revenues in Asia.

New directions

Telenor has pulled out of some of its eastern and central European activities after a bribery scandal in Russia.

It is also in the sights of a Norwegian activist investor, Constructive Capital, which is pushing it to sell off some of its tower infrastructure and increase its debt to push up the share price.

Sigve Brekke, President and CEO, Telenor Group, said about the proposed merger with Axiata, “I am confident this will create significant value for shareholders and will be beneficial to our customers”.

Telenor is also buying a big stake in the Finnish operator, DNA, and looking to acquire the rest.

They hope to complete the merger in Q3 this year.