Hold the bunting: the NetCo has been officially formed, but there still maybe legal and other challenges to come

Despite threats of legal action from its biggest shareholder, Telecom Italia (TIM) has officially set up its NetCo comprisingits domestic fixed networks assets, associated operations and 20,000 staff.

This is after TIM’s board agreed the sale to the US private investment firm KKR for €18.8 billion, which could rise by up to €2.2 billion if certain future performance thresholds are met.

Also, the government’s Treasury department is to invest up to €2 billion in acquiring a 20% stake in the NetCo so that it has oversight of what it deems to be a strategic national asset.

Not nearly enough?

Even so, this is a lot less than the €30 billion that TIM’s biggest shareholder, French media conglomerate Vivendi, insisted the assets were worth. It owns 24% of TIM and is threatening legal action regarding the sale.

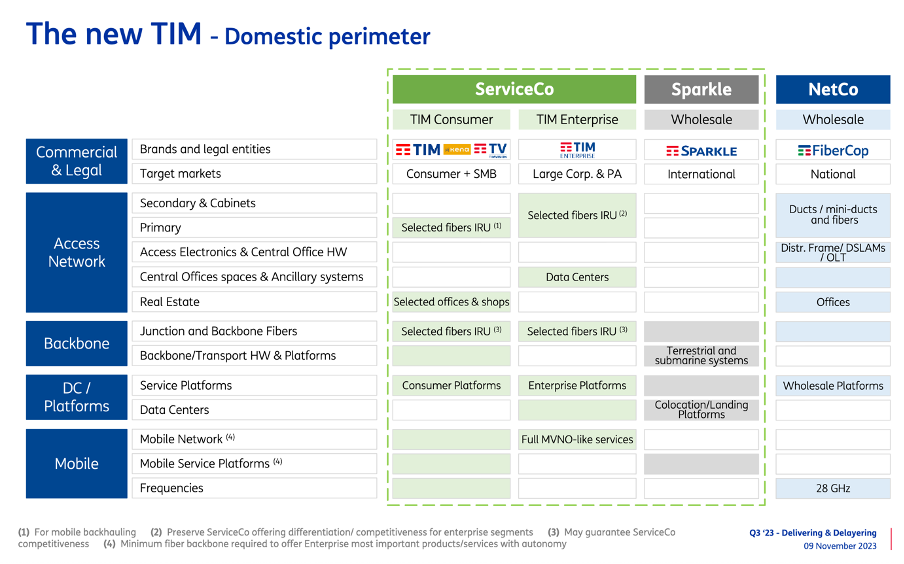

The NetCo includes the fixed network infrastructure and related properties, the wholesale business and the whole stake in TIM’s power management subsidiary, Telenergia.

Source: Telecom Italia

Some 20,000 staff will also be transferred to KKR, more than 19,000 of them work in the wholesale and networks divisions, and about 900 more will move from various corporate functions.

However, not all the loose ends are yet tied up. There is the threat of legal action from Vivendi which believes the decision about the sale should have been put to shareholders, not just taken by the board. Also negotiations regarding Sparkle, the international fixed infrastructure division which was to have been included in the KKR deal are not concluded.

From 1 December, the remainder of Telecom Italia, its mobile and enterprise businesses, will have about 17,500 staff.

Unions within TIM had also threatened industrial action.

An evolving trend

If these potential hurdles are all overcome, Telecom Italia will be the first Tier #1 European operator to split into a NetCo and ServCo. O2 Czech Republic (part of the PPF Group that just trades under the O2 brand) was the first to split into two, back in 2014, followed by Denmark’s TDC Group (the former incumbent) in 2019, under Allison Kirkby’s leadership before she left to head up Sweden’s Telia.

In 2020, PPF announced it would divide operators in Bulgaria, Hungary and Serbia – all former Telenor opcos in which PPF gained a majority stake in 2018 for €2.8 billion – into retail and infrastructure divisions in a newly created CETIN Group.