More than 60% of telcos aim to reach Level 3 autonomy by 2028 and yet only one in five has a comprehensive strategy in place

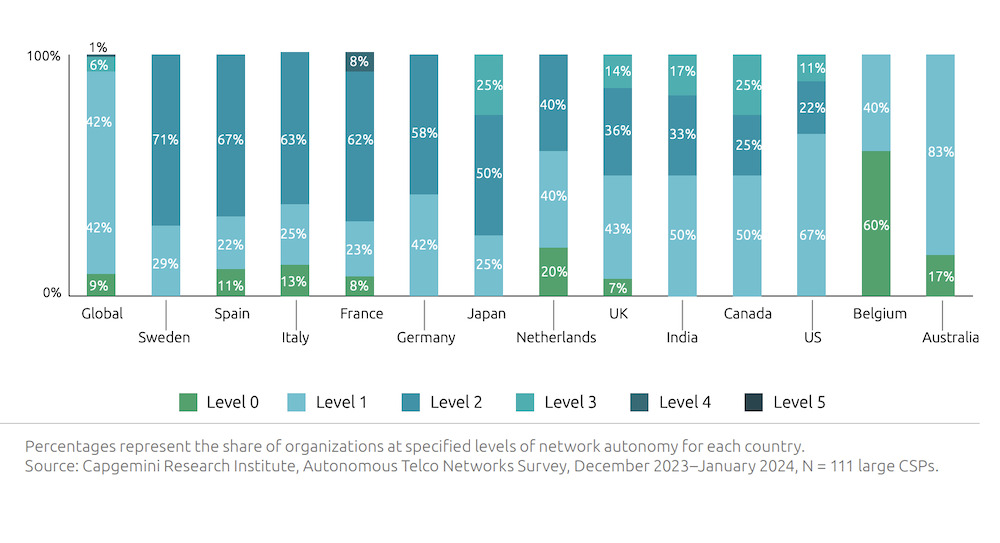

While most telcos (84%) currently reside at Level 1 or Level 2 autonomy as per the TMF definition – for their overall networks, aspirations for higher levels of automation remain optimistic. More than 60% of operatorsU aim to reach Level 3 autonomy or higher by 2028. Level 3 means the system can sense real-time environmental changes, and, in certain network domains, optimise and adjust its operation to the external environment to enable intent-based closed-loop management.

However, the path to full autonomy is fraught with challenges, both technological and organisational. Only 1% expect to attain Level 5 [full autonomy] and 16% to attain Level 4 overall (including operations). Telcos aiming to reach Level 4 and 5 believe technology will mature in the next five years, as more autonomous network use cases are implemented across network domains.

“We have a three-year and a fiveyear network-transformation plan to have an intelligent network that’s intent-based, using AI/ML. The design aims to minimize build and run cost per bit to mitigate traffic growth and the rise in input costs, in particular labour and energy. We aim to reach Level 4 in five years,” said Virgin Media O2 director of network strategy and engineering Paul Kells.

“Our ambition to reach Level 4 network autonomy (for some workloads as of 2025) plays a crucial role in the Group’s strategic plan – ‘Lead the future’ which was announced in February 2023. Through enhanced use of data and AI at Level 4 autonomy, our network will be, more agile, more effective, more resilient, and higher performing,” said Laurent Leboucher, CTO at Orange and SVP of Orange Innovation Networks.

Nearly two-thirds of telcos in Sweden, Spain, Italy, and France have attained Level 2 autonomy. One-third of telcos (33%) in the US have moved to either Level 2 or Level 3 autonomy.

According to a new Capgemini Research Institute report “Networks with intelligence: Why and how the telecom sector should accelerate its autonomous networks journeys”, some of the biggest obstacles hindering progress toward autonomy are the mindset of employees, integration issues, and regulatory concerns around data sovereignty.

Despite these – and other – challenges, there is no denying that autonomous networks offer significant benefits to telcos. Over the past two years, operators have already realised a 20% improvement in operational efficiency and an 18% reduction in network opex through autonomous networks initiatives. Additionally, 71% of operators have reduced energy consumption during this period, while they expect to lower greenhouse gas emissions by 30% over the next five years.

According to the report, telcos anticipate investing an average of $87m in autonomous networks over the next five years, with estimated opex savings for a mid-sized telco of $150m-300m per organisation during this period. Furthermore, the return on investment (ROI) of autonomous networks initiatives ranges from 1.7x to 3.4x, with a payback period of between 2.9 to 1.5 years in conservative and optimistic scenarios, respectively.

Where’s the plan?

Capgemini found that only 17% of telcos adopt a comprehensive autonomous network transformation strategy, complete with well-defined goals and target timelines. Over half (51%) of operators have a roadmap that covers only the next one to two years, leaving them with limited visibility into the future.

Such a strategy also needs a leader but only 15% of organizations have already made this appointment, while a further 31% are in the process of finding the right person.

But autonomous network implementation is a complex, systematic transformation involving many ecosystem partners and implementing solutions across different layers is challenging. Respondents suggested employee mindsets and behaviour are as big a problem as technology integration. Possibly because employees can see the writing on the wall.

A recent Harvard study found that willingness to support enterprise change collapsed to just 43% in 2022, compared with 74% in 2016. In 2022, the average employee experienced 10 planned enterprise changes – such as a restructure to achieve efficiencies, a culture transformation to unlock new ways of working, or the replacement of a legacy tech system – up from two in 2016.

“To transform to Level 4 network autonomy, it’s not only us who have to change. Our ecosystem, including vendors, system integrators, hyperscalers, and software providers, will have to reskill or upskill people to drive this change forward,” said Juan Luis Mulas, head of telco cloud, OSS and automation at Orange Spain.

Large organizations must also grapple with their legacy systems. Significant capital investment and employee training are required to switch over to new autonomous infrastructure. Hence, Capgemini also saw CSPs initially focusing on automating their existing procedures, rather than overhauling entire operations.

What do autonomous leaders look like?

Capgemini found the telcos operating at Levels 2–3 have reported notable reductions in operational costs, faster time-to-market for new services, and increased overall efficiency. Telcos with partial or conditional autonomy (Level 2–3), utilizing data, AI capabilities, and real-time insights to enable intent-based closed-loop management in certain network domains, have achieved an 11% improvement on average in operational efficiency.

Conversely, those with no or minimal autonomy (Level 0–1) have realized a modest 4% improvement on average in operational efficiency. Likewise, telcos with higher network autonomy are also saving more, with 16% reduction on average in network opex.

“We also analyzed the potential savings from reduced network opex for telcos over the next 5 years as they progress each level of network autonomy. With each advancement, significant savings are anticipated at high ROI. Telcos planning to move from Level 1 to Level 2 within the next five years expect an average savings of about $202 million at an ROI of 2x, while those transitioning to Level 3 anticipate an additional $203 million in savings. Further progression to Level 4 is estimated to bring an additional $300 million in total savings at an ROI of 4x, revealing that gains gather speed as telcos move to Level 4.

Most telcos (60%) prefer to lead the transformation of the network core themselves, but are much more open to their partners’ leading the transformation of other domains – hyperscalers in transport (53%) and hyperscalers (43%), and software vendors (49%) in services.

Head of autonomous networks, Juan Manue Caro, outlined Telefónica’s priorities for its transformation: “We’re fairly advanced in terms of autonomous use cases for transport, followed by RAN. And Assurance is by far the process where we have advanced more until now. For Core, we have just implemented the first AI closed loop use case, although we are being cautious with the level of autonomy there. It is important to gain trust before going farther due to the high impact of any potential problem of this domain.”

The report is based on the findings of an industry survey of 435 senior executives (director level and above) from telcos, network equipment providers, and hyperscalers. All organisations had annual revenue above $1 billion. About 51% of executives were from network; 24% from data/AI and IT; 15% from top management; and 10% from engineering.