Ookla analysis looks into how the number of operators in EU and other high-end markets affects outcomes

Ookla has analysed how the number of operators in a market affects network quality and consumer prices across the European Union and other high-income countries in a new report.

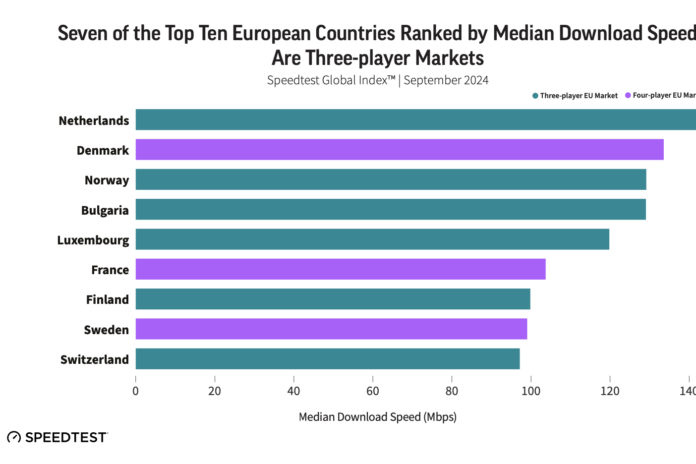

According to Speedtest Intelligence, three-player mobile markets in the EU delivered median download speeds 56% faster than their four-player counterparts in Q2-Q3 2024. (Note: Mobile Europe believes too much emphasis is put on network speed rather than coverage and reliability by regulators and therefore operators – but see more on the apparent importance of speed below.) Further, seven of the 10 fastest European countries were in three-player markets.

There are notable exceptions, including Denmark, Sweden and France, which are four-player markets. However, in these markets, network sharing is more prevalent than typical.

The report also found that the number of operators in a market is not a strong predictor of the availability of 5G. Factors including population density, economic development and the availability of spectrum play a bigger role.

According to Speedtest Intelligence’s data, three- and four-player markets in the European Union showed comparable levels of 4G availability in between Q2 and Q3 this year, at 93.59% and 93.65% respectively.

Faster speed, higher ARPU

Speedtest Intelligence data reveals a positive correlation between download speeds and average revenue per user (ARPU) in four-player markets across the EU, with higher ARPU in markets like Denmark, Sweden and France potentially driving better performance outcomes.

The paper concludes that, “There is no one-size-fits-all concentration profile that uniformly optimises network quality and consumer pricing outcomes in every country.

“Exceptional outcomes in countries such as Denmark — a four-player market with low concentration but very high median download speed — and the Netherlands — a three-player market with high concentration and also high median download speed — suggest a targeted policy toolkit, rather than the blunt instrument of consolidation, is needed to achieve balanced outcomes across a bloc with highly diverse market contexts.”

Download the white paper from here.