Having led with FWA, it is eyeing a deal to become the anchor tenant of a fledgling joint venture for infrastructure

T-Mobile is in discussions with a Tillman Global Holdings business to become the anchor tenant of a fledgling fixed infrastructure joint venture that intends to provide wholesale FTTP, according to Bloomberg.

There are no further details about the joint venture’s plans, which was announced in August and is between Tillman FiberCo and private equity company Northleaf Capital Partners.

Deutsche Telekom (DT) is the majority shareholder in T-Mobile which was a big contributor to DT becoming first European-headquartered telecoms group to exceed €100 billion market capitalisation in January.

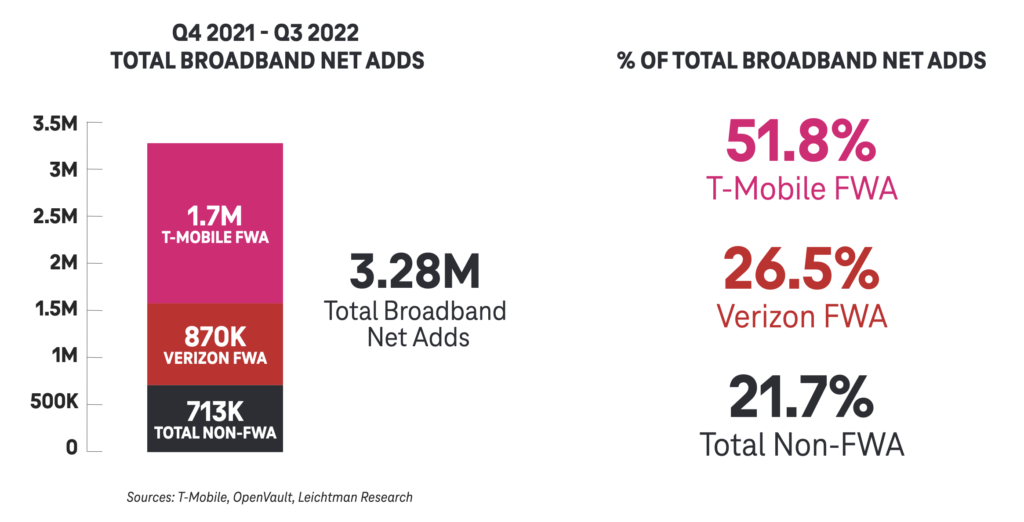

T-Mobile is the US’ second largest mobile operator, after Verizon. Since its merger with Sprint in spring 2020, T-Mobile has benefited from much of the growth in fixed wireless mobile (FWA – see graphic below)

Source: T-Mobile report on The state of fixed wireless access 2022

Bloomberg suggests that going into the fixed broadband market would “put it closer to competing directly with cable providers like Comcast and Charter Communications”. Looks more like putting a toe in the water: $500 million is relatively small amount of money in a market the size of the US, where government grants are being handed out in billions of dollars.

From information on Northleaf’s infrastructure portfolio, it looks like entry into the US fixed broadband market would be something of a departure from its usual activities, while Tillman FiberCo was formed in 2021. Parent company, Tillman Global Holdings, “is focused on investing in and operating telecommunications and energy infrastructure businesses in developed and emerging markets”.