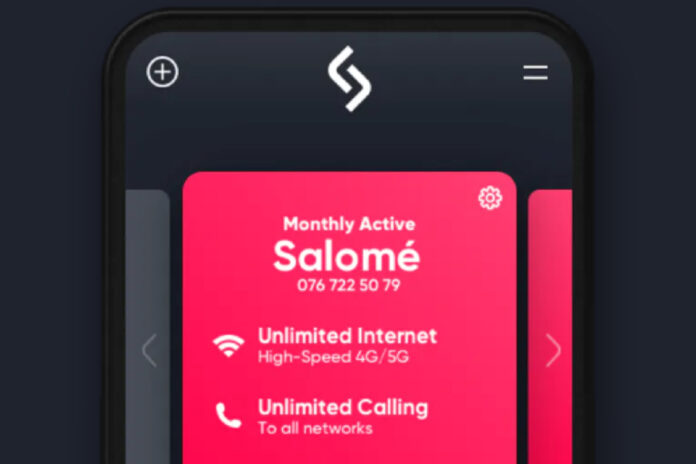

The Swiss operator’s new swype offer relies on eSIM , no contract and flat-rate pricing and data.

Sunrise UPC (the merger of the two was completed at the beginning of the month) says swype is the first Swiss provider to launch a digital eSIM that is downloaded and installed directly on the smartphone or tablet via the swype app – without needing a QR code or any other intermediate procedure.

Flat rate

swype offers a flat rate for calls and internet use in Switzerland and costs CHF 1.50 (€1.34) a day or CHF 25 (€22.66) a month. The first month is free, and the monthly plan can be cancelled at any time.

“Innovation from swype goes on…For our customers this means 100% digital onboarding – completely without paperwork, postal delivery or contact with customer service,” says Christoph Richartz, Chief YOL Officer Sunrise UPC.

Payment is through TWINT or credit card.

International option

Customer who want to use swype in or from other countries can book the additional International option for CHF 3, which includes international calls from Switzerland to 25 countries as well as unlimited roaming with internet use and calls in those countries, listed at the bottom*.

Lack of interest in eSIM

Tom Rebbeck, Partner, Research at Analysys Mason, noted in a briefing in December that the relative lack of interest in eSIM’s potential is surprising: operators have so far failed to counter the terrific success of mobile virtual network operators like 1NCE, EMnify and Twilio. swype is another example.

He pointed out that Deutsche Telekom has a small stake in 1NCE, which since launching has introduced more than 5 million eSIMs into the market, thanks largely to a very simple price plan – connectivity costs €10 for up to ten years – and the ease of buying online.

Rebbeck said, “The main telecoms operators have been a bit slow to react to this… I’m slightly surprised that they haven’t countered it yet and I think probably we’ll see one of the big operators counter it during next year [2021], quite possibly through an acquisition: they could buy out one of these smaller, smaller MVNOs.”

*Austria, Belgium, Bulgaria, Canada, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Spain, Sweden, United Kingdom, United States.