One of Europe’s leading FTTH markets is a test case for what happens when fibre networks overbuild

The acquisition of Digi Spain’s fibre-to-the-home (FTTH) network by Macquarie Capital and partners, abrdn and Arjun Infrastructure Partners, has brought the focus back onto just how overbuilt the Spanish market is with fibre and the inevitable consolidation path the market will follow.

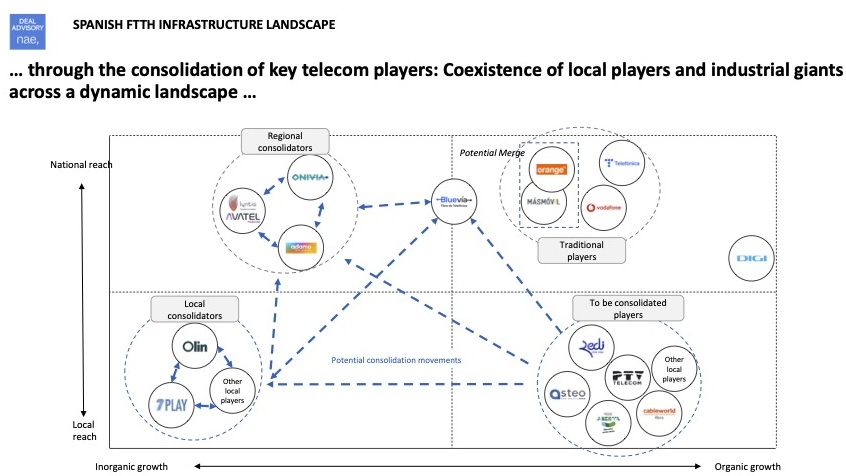

Spanish and Latin America telecom consultancy Nae has been tracking the market closely and have come up with the term consolidation clock to help understand which operators may become the consolidators and which may be looking to exit the market.

Digi’s network will be run by Macquarie’s wholesale fibre company Onivia which, following the acquisition, will increase its coverage to around 10 million Spanish homes, more than a third of homes in the country.

Market leading deployments

Today eight out of every 10 broadband lines in Spain are fibre, a figure that exceeds the data for France, Italy, Germany or the United Kingdom. Spain moved early to establish the appropriate framework for operators to invest in fibre and now enjoys a very high level of coverage. The market is brimming with Tier-1 to alternative and rural FTTH operators it is is also the market that will see consolidation and new fibre models, particularly in the regions, first.

Nae recently carried out a consolidation analysis of the Spanish market and concluded, investors and operators are in for a bumpy ride. Spain is a sophisticated market although it has a major challenge with respect to overbuild due to low deployment costs.

According to Nae, due to this large number of homes passed deployed, Spain is materially overbuilt compared to other European countries by a factor of 3.1 times versus a market like the UK – which is already seeing altnets merge or fail – which is 2.6 times.

Nae director Joaquín Guerrero told Mobile Europe that the consultancy uses network overlap models to work out how good future merged partners may look. New deployments are, in fact focussed in low or no overlapped areas,” he said. “But there are huge exceptions. Digi choose to build a brand-new network directly overlapped with Telefónica and MásOrange. This network is being to be acquired by Onivia that already has building units (formerly from MásMóvil) overlapped with the Digi network.”

Complex wholesale market

The high overbuild ratio in Spain has led operators to open their networks, creating a highly complex wholesale ecosystem with a large number of operators and agreements between them. In the centre in incumbent Telefónica. Tier 2 ISPs run their own agreements, but Guerrero said the potential merger of two of them might bring significant changes to the ecosystem. Most of the major Tier 3 ISPs operate their own infrastructure, whilst simultaneously leveraging their operations on third-party networks to provide nationwide services.

“The overall FTTH ecosystem is already transforming: Telefónica´s BlueVia creation, the brand new MásOrange, the Onivia acquisition of 6 million homes passed from Digi, the sale process of Avatel or the Fi Vodafone contract renegotiation are some examples,” he said. “Not to mention the announced plans of Zegona to create a Netco with the former Vodafone HFC network. Almost every agent is changing their role in the ecosystem. And we think consolidation will be the norm in the future.”

He said high penetration and urban overbuild drive the exploration of opportunities for expanded growth in rural areas but this doesn’t come risk-free. “Rural deployments are harder and more expensive,” he said. “Creating a compelling business case for rural is also harder and you need to be both realistic and optimistic drawing your take-up curve.”

He added: “The bigger risk is, again, overbuild. If your assumptions include to be ‘the only FTTH network in a rural area’ for a long period, your business case will crash if a local overbuilder arrives.”

There are another kinds of deployments right now, he added, around densification. “Trying to connect small pools of homes in urban or semi urban areas left unconnected by the first deployments (municipalities licences, landlords, hard geotype and so on,” he said.

Nae’s research has mapped out the distribution of each operator’s infrastructure network, segmented by urban (3.3x overbuild), semi-urban (2.1x overbuild), semi-rural (1.7x overbuild) and rural footprints (1.2x overbuild). As a result, nuances in strategy emerge. “Telefónica has carved out its rural network in BlueVia but has the wider national coverage. The brand new MásOrange has also a very wide footprint combining the urban deployment of Orange and the more rural of MásMóvil,” he said. “Digi has specialised in very dense urban areas vs Adamo very focussed in rural areas.”

The market has ended up with urban giants, rural pioneers, and an abundance of small-regional operators like Avatel/Lyntia leading several municipalities. “The presence of “other” builders [outside the biggest FTTH providers] is very important – comprising rural (19%) and in semirural (23%),” he said. “And this “others” [category] is a full-scale ecosystem with, literally hundreds of players of very different sizes and strategies!”

He added: “We have identified at least 300 municipalities where the “incumbent” operator is a local one.” In urban areas he pointed out that Digi uniquely makes up the “others” in urban areas.

Consolidation time

Nae found that the main FTTH operators show high overlap levels while 60% of the challengers, due to their regional approaches have a low overlap level. “We are envisioning a multistep consolidation process, and these local operators will be included from the very beginning. This is the role of companies like Avatel, Excom or 7Play,” he said.

Using the figure above, Guerrero calls this process the consolidation clock. “In some way many of the small local players (in D quadrant) will migrate to C quadrant as they will be consolidated by local consolidators, and this will be integrated by regionals (A) who eventually will move to B or be acquired by major players,” he said.

“But this process is not going to be so smooth,” he added. “Maybe the prices to be paid does not fit with the current expectations of sellers? Or may be some networks are just left. How much time it will take is hard to say, but the announcement from Onivia and Digi is a symptom that things moving forward quickly.”

ServCo and InfraCo

These consolidation movements also lead us into new business models by splitting a traditional operator into infrastructure and services organisations – changing the current ecosystem. Under these new ecosystem rules, Nae believes an oligopoly scenario could appear where two or three InfraCo players own all the networks.

“In the Spanish market we have already three big “neutral” FTTH networks: Onivia, Elanta (Lyntia) and BlueVia,” he said. “All the local consolidators have also developed (or are developing) a wholesale offer. Nevertheless, the bigger part of the final fixed broadband market is owned by vertically integrated players (Telefónica and, now the leader, MásOrange) so we are very far from a perfectly “delayered” solution, and may be, we will never get there.”

“So, we foresee a consolidation process around the networks of the two vertically integrated operators (MásOrange and Telefónica),” he said. “Is there place for a third, more urban, network? This is the hardest question!”

The functional or even structural splits will cause other ructions. “Will Telefónica and MásOrange do some form of carveout in their networks? Very likely in a medium timeframe,” he said. “And for sure high interest rates are not good for telco infrastructure investments!”

Guerrero said regulating this type of markets is going to be a nightmare for European regulators. And this chapter is yet to be written. “All the major FTTH networks are already open and there [is] wholesale competence (Fi is currently renegotiating their contract with Vodafone for instance),” he said.

“The point here is the level of infra competence we need as industry or society. Is two [InfraCos] enough? How much is three is better? We need to find the answer,” he said. “Personally, I would find more ‘vibrant’ a scenario with three more specialised players, but we need to match this with a predictable, big enough, cash-flow generation machine.”

Onivia the consolidator

Commenting on the Digi transaction Onivia CEO Jose Antonio Vázquez Blanco said “With this acquisition, Onivia confirms its position as largest neutral and independent player, enhancing the value-added proposal for our telco customers, increasing coverage, and offering latest XGS-PON technology. It is also a fantastic step towards our national end-to-end telco proposal for other market segments such as utilities and alarms.”

The network acquired currently comprises approximately 4,250,000 homes passed with the rest of the network, covering up to 1,750,000 homes passed, to be deployed over an estimated period of three years. This would see the network reach a total of 6 million homes passed, covering 12 provinces across the regions of Madrid, Segovia, Avila, Castilla-La Mancha, Comunidad Valenciana and Murcia.

The transaction also provides the consortium with the option to acquire any future fibre rollouts from Digi in those provinces, subject to certain conditions. Digi will continue to use the FTTH network to serve its own customers and remain as anchor client, with the network made available to all other Onivia customers.