Point Topic comments on Ofcom’s wholesale fixed broadband market reviews since 2018 and how they have changed the landscape.

In March 2021, the UK’s telecoms regulator Ofcom will publish its Wholesale Fixed Telecoms Market Review (WFTMR) 2021-26, which will see regulations put into place for Physical Infrastructure Access (PIA) Dark Fibre Access (DFA) and Dark Fibre Inter-Exchange Connectivity (DFX), with the aim being the accelerated deployment of FTTP networks nationwide, especially in the remaining rural and hard to reach areas, over the next five years.

Since 2018, Ofcom has carried out several wholesale market reviews aimed at lowering barriers to next-generation access network investment and expansion. They have attempted to give communications providers multiple ways of rolling out services, to have maximum flexibility to respond to individual local market conditions, and to be accessible to both large and small players alike.

Progressive approach

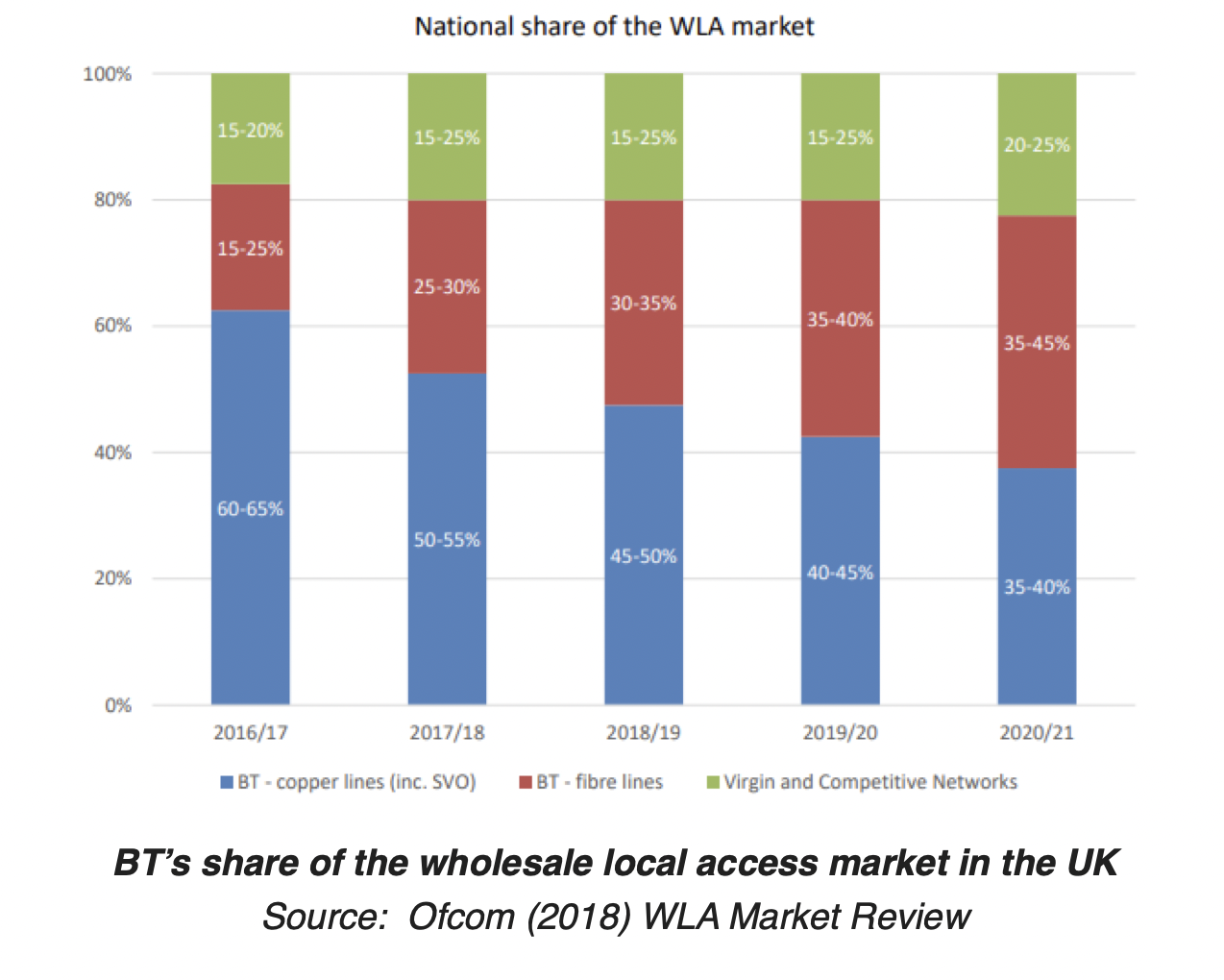

Ofcom has previously adopted a more progressive approach to regulation of the fixed sector which saw the introduction of policies advancing FTTP deployment across the UK. In 2018, the regulator published their highly anticipated reviews of wholesale competition in their statements on Wholesale Local Access (WLA) and Wholesale Broadband Access (WBA) markets. Considered radical at the time, the WLA review marked a fundamental shift within the sector as service providers of any size could begin to develop their own offerings using BT’s infrastructure.

This step-change ultimately required BT to develop a more robust set of Passive Infrastructure Access (PIA) products which could allow alternative network operators to significantly reduce their FTTP deployment costs by sharing BT’s ducts and poles. Furthermore, it required BT to make investments to improve the provisioning and availability of these services, removing the restrictions which Ofcom had imposed on the uses of these products, along with significant reductions in the rental costs payable by other operators.

Gaining momentum

Momentum has greatly increased in terms of ultrafast full fibre networks expansion and the UK is seeing a relative coming-of-age with FTTP coverage going from only 3 per cent (840,000 premises passed) in December 2017 to 18 per cent (5.1 million premises covered) at the end of 2020. Openreach remain on target to reach 4.5 million premises by March 2021, Virgin Media aims to complete its DOCSIS 3.1 network upgrade to deliver gigabit-capable broadband to around 15 million homes and businesses by the close of the year and in early 2020 CityFibre increased their FTTP target from 5 to 8 million premises by 2025 with their total network build coming in at just over 500,000 homes and businesses at the start of 2021.

Since May 2020, KCOM, which remains the incumbent in East Yorkshire around Hull, has focused its main strategic goal on developing a wholesale-focused business based on full-fibre services serving the Hull Area and surrounding locations. The move will maximise network utilisation while delivering increased service provider choices for consumers, something that has been lacking in the area for many years.

Independent service providers have been growing in significance over the last several years as they have started to deploy their own fibre networks across the country and cover an estimated 1.2 million premises at the close of 2019. These include vertically integrated fibre providers Gigaclear whose network covers more than 22 counties across the South West, the Midlands and South East, along with Hyperoptic, who has a presence in 43 towns and cities nationwide.

At the end of January 2021, the number of unbundled lines stands at 9.22 million. There are 4.21 million Wholesale Line Rental (WLR) lines and the number of telephone numbers using a carrier pre-selection (CPS) service is 2.09 million. There are now more than over registered 100 communication providers offering various levels of broadband services.

Read more of the report here.