STL Partners has released research, conducted through its Telco2.0 intiative, that warned the telco industry it is in for a “brutal” time over the next 5-8 years.

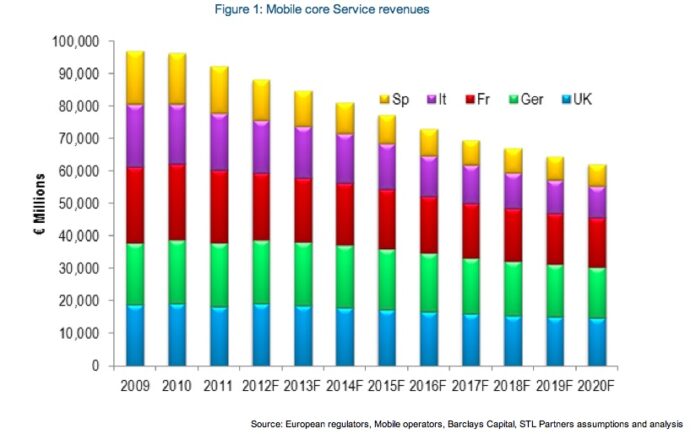

Operators in the big five EU economies (UK, France, Germany, Spain and Italy) will see combined revenues from voice, messaging and data services drop by nearly €20Bn, or 4% per year, by 2016, and by $30 billion by 2020, STL said.

Rubbing it in, the analyst said, “This is much bleaker than most current industry forecasts that typically predict a mild decline of c.1-2% per annum.”

STL said that the main cause of the decline, outside of macro economic issues hitting Spain in particular, is that:

“Competition from Internet-based services, such as Facebook, Apple’s iMessage, WhatsApp and Skype, is making an increasing impact. In essence, users are starting to get cheap calls and new forms of communication from other providers.”

Here’s the picture STL painted:

"Taking together the five largest European mobile markets, despite the rise of smartphones and dongles, overall quarterly mobile revenues are down 10% on their peak from Q3 2009; falling from 24.7bn to 22.2bn in Q1 2012. Even accounting for seasonality, this is significant (a 10bn annualised shortfall) – and early results suggest the fall accelerated in Q2 2012, as economic and competitive factors bit deeper into sales, with recessions in several countries and new entrants such as Free in France.

Worse, if we just look at voice revenues, the market is now down 25% from its peak in Q2 2009, and that fall seems to be accelerating. While declining voice ARPU is not a huge surprise, the failure of other services to take up the slack is disappointing, especially as the source of new business – basic data connectivity – also is the most capex-hungry in terms of extra costs of new spectrum and 3G/4G build-out."

Today, Ovum added its own voice, saying that in its opinion the entire industry will “lose” 54 billion in messaging revenues by 2016, to that same roster of social media messaging providers.

Strategy Analytics is another predicting a steep drop off in messaging revenues, no matter that SMS volumes continue to rise. it forecasts operator revenue from traditional mobile messaging to peak this year at over $105 billion and decline at a 2.5% CAGR until 2017.

STL said that margin management and cost cutting can only be a part of attempts to arrest or combat this decline. Innovation is critical.

“The good news is that there are opportunities for telcos to create a new future. These opportunities lie in business-to-business services that re-utilise telco assets, including mobile commerce, cloud services, machine-to-machine (M2M), and digital entertainment as well as better business-to-consumer offerings,” STL’s Barraclough said.

Meanwhile, Ovum thinks that operators must partner with the handset manufacturers if they want to remain relevant and competitive in messaging. It also recommends that operators need to launch their own operator-branded IP messaging services, and “innovative pricing strategies”, while it waits for collaboration opportunities to arrive from the implementation of RCS platforms from 2014.

“In order to take advantage of RCS when the time comes, operators will have to have a strong market presence. This means that they need to move to social messaging now in order to make sure OTT players are not in a better position to take advantage of future opportunities,” said Ovum’s Neha Dharia, consumer telecoms analyst.

In any case, RCS is only a small part of the answer, Strategy Analaytics’ Nitesh Patel said.

“While RCS/ RCS-e enables mobile operators both to evolve mobile messaging beyond SMS and MMS and keep operators relevant in mobile messaging, it will not mitigate the current decline in messaging revenue. Strategy Analytics’ latest mobile messaging forecast indicates that by 2017 293 million users of RCS/ RCS-e based services will generate $370 million revenue for mobile operators.”

Messaging infrastructure provider Acision said that there is consumer appetite for operator-led messaging services. It said its own messaging research amongst 1250 smartphone users indicated that there is “a clear appetite for a rich, ubiquitous messaging service provided from operators”.

Acision’s respondents were asked about the attractiveness of a new operator-based service that provided SMS/MMS/IM/group chat and file/video sharing that reaches all mobile users. Over half of Smartphone users questioned (52%) stated they would use such a service, with just 5% stating they would not use it at all. Even in the younger age bracket of 18-34 years, where OTT apps are prevalent – 60% of Smartphone owners stated they were highly interested in such a service from their mobile operator.

Marco Wanders, EVP Product Division at Acision, said:

“Our research clearly demonstrates that key user requirements are a need for universal reach with the uncompromised Quality of Service they expect from their operator, as well as the rich features, such as file share and group chat. With this in mind, many operators are well positioned to carve out a clear role in the new mobile messaging ecosystem, as they compete with internet players to serve user demand. To remain the messaging provider of choice, operators can provide a one-stop-shop, which offers the rich features of IP messaging, combined with the reliability and ubiquity that consumers have grown to appreciate in SMS.”

Acision said that price was the number one requirement for adoption of a new rich messaging service. Other requirements all relate to Quality of Service, and corresponded to strengths of SMS including reliability and reach.

The list of requirements in terms of what the survey respondents found desireable in a messaging service was as follows:

63% – Price lower than existing service

50% – Reliability

45% – Instant delivery

42% – Reach

35% – Suport for multiple devices

32% – Content sharing

24% – Is-typing indication

24% – Conversational view

18% – Group Chat