Initial market growth will not take away from low-power wide area network (LPWAN) sector, but competition will become hostile in the later part of the forecast period.

A new forecast from ReThink Technology Research predicts the global market for IoT-focused satellite services will grow to $5.9 billion (€5.23 billion) in 2025, taking into account end-device connectivity hardware and the annual connectivity fees, once the sector starts to expand 2021 to 2022.

Incumbent satellite providers will be pressured by a new wave of startups that leverage advances in smaller, cheaper satellite technologies, which include launch technologies and miniaturisation of the satellites themselves. Some low Earth orbit (LEO) designs now weigh 10kg and are about the size of two shoeboxes.

Even so, many new entrants will be struck out or be absorbed by their larger and entrenched rivals.

LEO networks are able to provide lower power consumption for end devices, and they can be deployed in a modular fashion, expanding as more customers or funding becomes available.

Competition for LPWANs?

While terrestrial LPWAN networks have taken hold, they have not achieved the sorts of footprints first promised by the most enthusiastic marketeers, and the same applies to the hype around nanosatellites.

Nevertheless, there are vast swathes of the Earth without LPWAN coverage that could make use of these low-cost satellite networks.

For the incumbent satellite providers, IoT customers could be a good way to improve margins, especially in the increasingly cut-throat broadband and broadcast satellite market.

There are potentially hugely lucrative opportunities for the nanosatellite startups that can avoid the immense capex burdens that the incumbent satellite network operators are saddled with.

Still, this market is around three times smaller than the terrestrial LPWAN market, despite higher hardware and connectivity revenues per device.

Some overlap

While some of the industries overlap with LPWAN installations, these nanosatellites will not often compete directly with LPWAN deployments as their use cases have much better tolerances and allowances for the power consumption of end devices.

Connectivity is often said to be between 10% and 20% of the total cost of ownership for an application, which means higher value applications are likely to drift towards satellite or non-LPWAN cellular options, as these applications will be able to justify or settle for having to replace batteries when needed.

The unlicensed spectrum LPWAN (U-LPWAN) markets also need to solve the global roaming problem quickly if they are to counter the marketing narrative from the satellite community – that satellite is the only way to get truly global coverage.

Major leap forward in 2021

While there are an estimated 2.5 million satellite IoT devices deployed currently, ReThink expects that 2021 will see a major jump in deployed devices, as the first few startups begin launching their constellations and supporting live customers.

When viewed on a graph, this presents as an initial bump that slows the next year, before a period of prolonged growth settles in. Due to the scalability of nanosatellites, more units can be added to a constellation to support more devices when maximum throughput thresholds are met.

However, there will be some wasted resources, as many of these startups will be competing directly with each other.

Should a startup fail, they will be adding to the cloud of space junk orbiting the Earth – as it is not clear how easily another operator could take over these communications assets, in the wake of a bankruptcy.

40% annual growth by 2025

By 2025, ReThink expects there to be some 30.3 million satellite IoT devices deployed globally, growing at a compound annual growth rate of just under 40%.

The company thinks this growth to begin to flatten off in around 2027, due in part to the spread of terrestrial rivals for satellite IoT connectivity, and improvements in fixed and local networks that can be used as alternatives for the global satellite ones. In terms of usage.

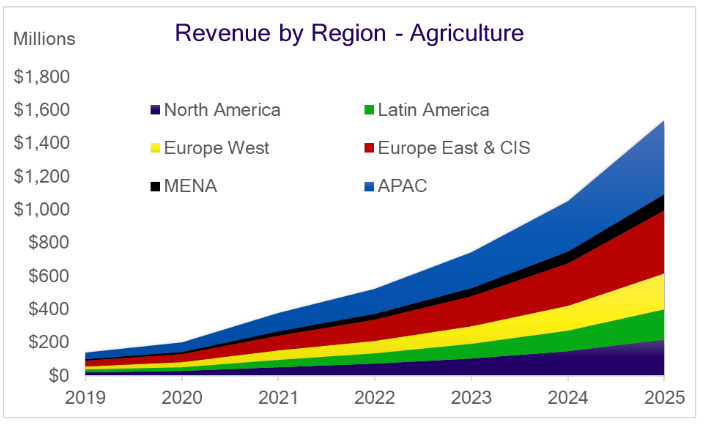

It has identified key use cases within the three main elements of the global economy – agriculture (see graph below), industry and services.