The GSMA’s research also found this diverse region, the least connected in the world, faces many challenges, but suggests remedies

The GSMA has launched its Mobile Economy Sub-Saharan Africa Report, 2024. It addresses opportunities and challenges in the region’s digital landscape.

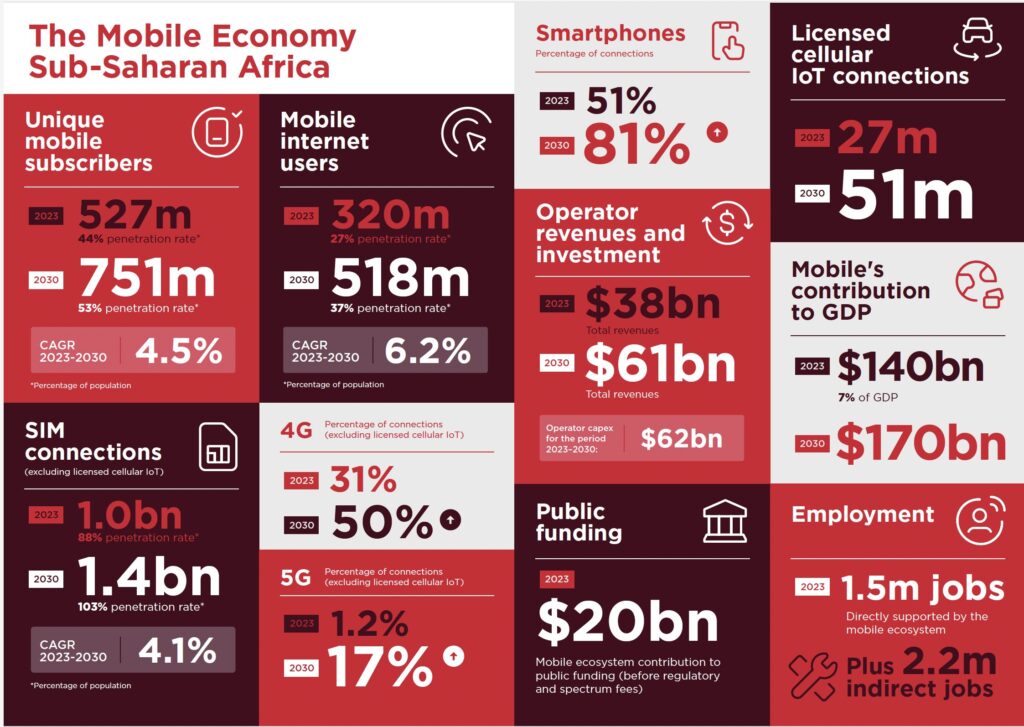

The headline finding is that overcoming key connectivity barriers could unlock $170 billion in GDP for Sub-Saharan Africa by 2030, up from a $140 billion contribution in 2023. The region’s rapid digitalisation and 4G’s expanding coverage is expected to drive a surge in mobile connectivity, accounting for 50% of all connections by 2030.

However, 13% of the Sub-Saharan population will remain without coverage by the end of the period. Further, a 60% “usage gap” could persist: that is, although many people live within coverage areas they struggle to get online due to factors like unaffordable devices, limited digital skills or online safety concerns.

Globally, 3.1 billion people – 39% of the global population – are impacted by the usage gap. Sub-Saharan Africa is the least connected region, with the largest usage gap worldwide, although there is great diversity in this region that covers 48 countries. It is often divided into four main regions: West Africa, stretching from Senegal to Chad; Central Africa, from Cameroon to the Democratic Republic of Congo; East Africa, from Sudan to Tanzania; and Southern Africa, from Angola to South Africa.

Connectivity and usage gaps

Addressing connectivity gaps could unlock $170 billion in gross domestic product for the region while technologies “like generative AI” could contribute up to $1.5 trillion to Africa’s economy by 2030, apparently.

5G promises to be a gamechanger: the region stands gain up to $10 billion economic benefits by 2030, accounting for 6% of the mobile sector’s total economic impact. By 2030, the GSMA expects 5G to account for 17% of total connections primarily in South Africa, Nigeria and Kenya.

In addition to connectivity challenges, the region faces high operating costs, inflationary pressures and volatile energy prices.

GenAI and satellite

The GSMA report is optimistic about the potential of Generative AI and satellite partnerships bridging gaps across sectors. GenAI is expected to contribute up to $1.5 trillion to Africa’s economy by 2030, with mobile operators increasingly using AI for customer engagement and network optimisation. MTN and Vodacom, for instance, are deploying AI-powered initiatives to improve operational efficiency, although the region faces a shortage of skilled AI professionals.

The report emphasises the need for progressive spectrum policies to support long-term growth and equitable digital access. It particularly urges governments to release spectrum in the 6GHz band and to adopt policies that enable mobile networks to expand efficiently and affordably, and in an environmentally sustainable way.

It also calls for costs to be cut – for example with less taxes on the sector, by lowering import duties on handsets and reduced activation fees – to make services more widely accessible.

The report notes that 5G Fixed Wireless Access (FWA) is gaining traction as a primary broadband solution in countries such as Angola, South Africa, Nigeria, Kenya, Zambia, and Zimbabwe.

Fraud, universal service funds

The issue of fraud also needs to be addressed: South Africa became the first country in Sub-Saharan Africa to implement GSMA Open Gateway APIs, focusing on fraud prevention and security with Number Verification and SIM Swap APIs. This initiative is part of broader efforts across the region to improve digital security, particularly within digital banking.

Finally, many universal service funds in Sub-Saharan Africa are underperforming, often hindered by inefficiencies. The report calls for reforms to improve transparency, streamline disbursements, and direct funds toward impactful initiatives, such as digital literacy programmes in underserved areas

“Our findings this year reveal both the extraordinary potential and the challenges facing Sub-Saharan Africa’s mobile ecosystem,” said Angela Wamola, Head of Sub-Saharan Africa, GSMA. “To fully realise the benefits of connectivity, it is essential for operators, policymakers, and stakeholders to address affordability barriers, support infrastructure expansion, and foster collaborations that drive digital inclusion and economic impact.”