The number of private networks is set to rise tenfold over the next five years, according to analyst Berg Insight – presenting a vast opportunity for operators, writes Kate O’Flaherty.

This includes new revenue streams and the chance to recoup spectrum investments as 5G opens up exciting use cases. As the market develops, RAN vendors such as Ericsson, Nokia and Huawei are also expected to play significant roles in private networks.

The private network market is being fuelled by technology advances, with many European countries looking to set aside 5G mobile spectrum for private licensing. Currently there are 1,000 private networks – defined by Berg Insight as a 3GPP-based private LTE/5G network built for the sole use of one organisation. The analyst says this number will reach 13,500 by 2026.

For the enterprises that use them, private networks offer benefits including increased security and efficiency. 5G is set to revolutionise the market by opening up a plethora of use cases, but there are challenges to overcome before they can become more widespread.

Firstly, there are security and regulatory issues to be resolved. At the same time, the ecosystem enabling private networks is at a very early stage and needs to evolve before mobile operators’ role becomes clear.

The current market

Today, the private mobile networks market is mainly based around 4G. “There’s not much in 5G yet,” says Richard Webb, Director of Network Infrastructure at analyst firm CCS Insight. “Wi-Fi is still playing a very active role in industrial settings, and some of the wired networks currently in place need to be untethered to add the flexibility that mobility offers. Change is happening, but it’s not rapid – it’s an evolution, not a revolution.”

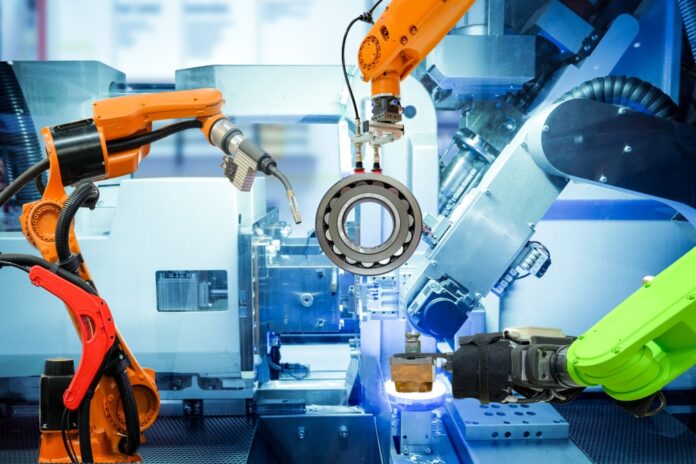

Private 5G network deployments, which are currently limited at 200 to 300, are mostly in trial phase. Yet 5G offers vast potential in large scale environments that need low latency, high reliability and security, such as ports, utilities, and manufacturing “where there are lots of logistical moving parts and machinery and intricate systems and processes”, Webb says. “These not only require the scale of mobility and flexibility of being unwired, but they also need lots of different types of connectivity.”

There are a number of exciting use cases for private networks including integrated mobility, healthcare, and manufacturing, says Maria Lema, Co–founder of Weaver Labs, a software platform provider working with Transport for Greater Manchester to create a private network that serves multiple smart city use cases. “Private networks have been a catalyst for innovation in the area: not only technical innovation but also around business models and commercial sustainability of public sector-owned assets,” Lema explains.

Private networks offer multiple benefits to enterprises, including better use of data, improved security, more efficient and faster operations and less waste, says Ann Heyse, Telco Solutions Manager at BICS. “Compared to using public mobile networks, private networks can be secured in a way that is customised to the specific needs of the enterprise. They offer greater control and deliver targeted high-capacity coverage.”

Crucially, at a challenging time for mobile operators, private networks offer the ability to create new revenue streams. As part of this, says Heyse: “It offers the chance to recoup some of the significant investment in 5G spectrum and infrastructure.”

5G benefits

It’s early days, but 5G could be transformative for private networks. Some organisations, particularly those engaged in manufacturing, healthcare, and shipping ports, are reluctant to share network spectrum with other companies due to security concerns. Private 5G networks solve this by enabling firms to isolate business-critical data from the public network, says Eric Van Vliet, Head of Telecom Business Development, EMEA at Dell Technologies. “This gives them absolute control over security, the use of their resources and the applications they want to prioritise. It also allows organisations to build bespoke networks to meet specific requirements, improving cost efficiencies.”

A convergence of connectivity solutions powered by 5G is allowing businesses to design their own use cases for private wireless networks which can be tailored to meet their specific requirements, says Marc Overton, Managing Director, Division X, BT. He says BT is “starting to see those use cases become a reality” after a surge in demand for running specific business requirements over hyperscale integrated and unified networks.

“This gets really interesting when we start to think about bringing the promise of IoT and smart spaces to life,” Overton adds.

As they realise the potential of private networks, operators such as Vodafone, Orange and Telefonica are partnering with enterprises to develop solutions using various deployment models to address a particular business need, says Sylwia Kechiche, Principal Analyst, Enterprise at Ookla. “These include network slicing and customised technical capabilities specific to manufacturing businesses.”

Private network challenges

They certainly offer potential, but private networks pose challenges for both enterprises that use them and mobile operators helping to enable them. As the reality of 5G draws closer, these include integration with legacy technology, privacy and security, and cost, says Kechiche. “Integration is key as, in reality, only a minority of 5G private networks will be greenfield: most will have to integrate and interoperate with existing legacy technologies.”

At the same time, while many enterprises are aware they need private networks, there’s “a sizeable knowledge gap” around the technical requirements and use cases associated with them, says Stephane Daeuble, Head of Enterprise Solutions Marketing at Nokia. “Most businesses have high-level knowledge, often drawn from the experience of private wireless deployments and emerging standards, but there’s a lack of understanding about the ecosystem and interdependencies that underscore this technology.”

Another big challenge is regulation and access to spectrum, says Heyse. “The competition for spectrum and demand from verticals must be balanced with the need to provide operators with spectrum for consumer 5G. It’s only a matter of time before access to spectrum is opened up to private companies on a global scale, through cost-reduction and legislation changes.”

There are multiple predictions for growth and a host of possible use cases, but 5G private networks are still in their early stages. “It is early days, especially with 5G, and operators need time to evolve the business model and their own skill sets, as well as to work out the commercials,” says Webb.