Analysts SNS Telecom & IT expects a compound annual growth rate of 42% between this year and 2027; cites reference deployments

Although private LTE networks have been around for more than a decade, they are a niche part of cellular infrastructure. Now private networks based on the 3GPP-defined 5G standard are beginning to move beyond proofs of concept and small-scale deployments to production, according to a new report from SNS Telecom & IT – outside of China, that is.

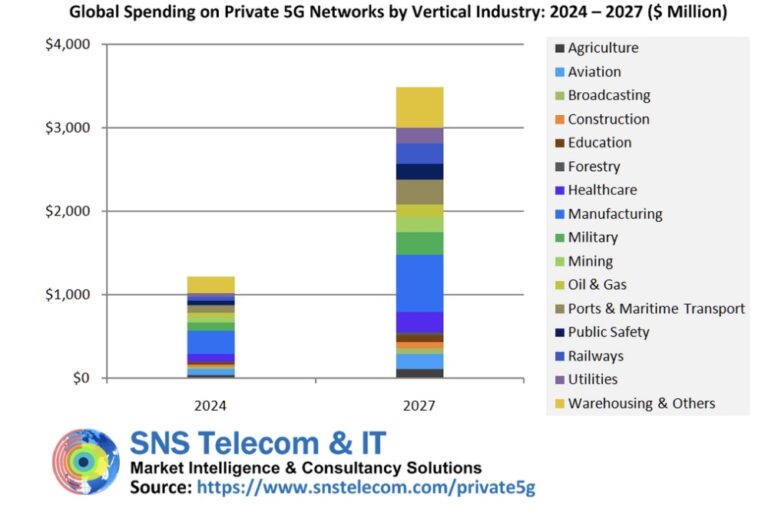

The analyst house estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of about 42% between 2024 and 2027, accounting for nearly $3.5 billion (€3.272 billion) by the end of 2027.

Much of this growth will be driven by highly localised 5G networks covering geographically limited areas for Industry 4.0 applications in manufacturing and process industries. However, sub-1GHz, wide area networks for critical communications (such as public safety, utilities and railway communications) are also expected to begin their transition from LTE, GSM-R and other legacy narrowband technologies to 5G towards the latter half of the forecast period.

Among other features for mission-critical networks, 3GPP Release 18 adds support for 5G NR equipment operating in dedicated spectrum with less than 5MHz of bandwidth, paving the way for private 5G networks operating in sub-500 MHz, 700 MHz, 850 MHz and 900 MHz bands for public safety broadband, smart grid modernisation and Future Railway Mobile Communication System.

China pioneered private 5G

China is the most mature market for 5G private networks due to state-funded directives to accelerate the application of 5G in industry, at scale.

Consequently, it provides good examples of what 5G private networks can do – without the onus of having to prove the business case. The report – Private 5G Networks: 2024-2030 – Opportunities, Challenges, Strategies & Forecasts – says the largest private 5G installations in China can comprise hundreds to even thousands of dedicated RAN nodes. They might be supported by on-premise or edge cloud-based core network functions depending on specific latency, reliability and security requirements.

For example, home appliance manufacturer Midea’s Jingzhou industrial park hosts 2,500 indoor and outdoor 5G NR access points to connect workers, machines, robots and vehicles across an area of about 104 acres. Wuhan Iron & Steel Corporation (WISCO) has installed a dual-layer private 5G network – spanning 85 multi-sector macrocells and 100 small cells – to remotely operate heavy machinery at its plant in Wuhan (Hubei).

Fujian-based manufacturer Wanhua Chemical recently built a wireless network for more than 8,000 5G reduced capability (RedCap) devices, most of which are surveillance cameras and IoT sensors.

Now for the rest of the world

For the rest of the world, SNS Telecom and IT reckons private 5G networks “are laying the foundation for Industry 4.0 and advanced application scenarios” because 5G brings new capabilities to the party such a low latency, network slicing, and superior reliability, availability and the density of connections. Not all applications require all of these attributes. Still, it is the first purpose-designed, wireless alternative for industrial-grade communications between machines, robots and control systems.

In addition, 5G’s new capabilities are seen by the telecoms industry as paving the path 6G networks in the 2030s.

The report found that despite 5G’s relatively higher cost of ownership, “its wider coverage radius per radio node, scalability, determinism, security features and mobility support have stirred strong interest in its potential as a replacement for interference-prone unlicensed wireless technologies in IIoT (Industrial IoT) environments, where the number of connected sensors and other endpoints is expected to increase significantly over the coming years”.

Enterprises in the US, Germany, France, Japan, South Korea, Taiwan and elsewhere are ramping up their digitisation and automation initiatives. Against this backdrop, private 5G networks are being implemented to support use cases as diverse as wirelessly connected machinery for the rapid reconfiguration of production lines, environments that rely on distributed programmable logic controllers, autonomous mobile robots) and automated guided vehicles) for intra-site logistics.

They are also being used for: assisted guidance and troubleshooting using augmented reality; vision-based quality control of production processes and machines; wireless software flashing of manufactured vehicles; and remote-controlled cranes. Other applications include: unmanned mining equipment; beyond visual line-of-sight operation of drones, digital twin models of complex industrial systems and automatic train operation.

Private 5G networks support video analytics to improve safety at railway crossings and on train station platforms, plus remote visual inspections of aircraft engine parts, real-time collaboration for flight-line maintenance operations, extended reality for military training and virtual visits enabling parents to see their infants in neonatal intensive care units.

Yet more applications include production for live broadcasts in locations that cannot be accessed by traditional solutions, operations-critical communications during major sporting events, and optimisation of cattle fattening and breeding for Wagyu beef production

The report found that progress is happening, despite long-standing issues like limited non-smartphone devices and high 5G IoT module costs due to low shipment volumes. Other issues that have proved to be stumbling blocks include the lack of experience and expertise in end-user organisations in using cellular wireless systems in this way and, of course, resistance to change.

Still, early adopters are investing in networks built independently using new shared and local area licensed spectrum options, in collaboration with private network specialists or via traditional mobile operators.

Actual deployments

Some private 5G installations have progressed to a stage where practical and tangible benefits – particularly efficiency gains, cost savings and worker safety – are becoming increasingly evident. Notable examples include:

• Tesla’s private 5G implementation on the shop floor of its Gigafactory Berlin-Brandenburg plant in Brandenburg, Germany. It has helped overcome up to 90% of the over-cycle issues for a particular process in the factory’s general assembly shop. Tesla is integrating private 5G network infrastructure to address high-impact use cases in production, intralogistics and quality operations across its global manufacturing facilities.

• John Deere [the agricultural machine maker] is progressing towards its goal of reducing dependency on wired Ethernet connections from 70% to 10% over the next five years by deploying private 5G networks at its industrial facilities in the US, South America and Europe. Meanwhile, IKD which supplies automotive aluminium die-castings has replaced 6 miles of cables connecting 600 pieces of machinery with a private 5G network. The cost of cable maintenance is now almost zero and the product yield rate has risen 10%.

• civil aviation customers no longer need to physically attend servicing sessions at Lufthansa Technik. Instead they can carry out inspections remotely, thanks to Lufthansa’s 5G network at its Hamburg facility. Previous attempts to implement virtual inspections using Wi-Fi proved ineffective, hampered by the large metal structures within the plant.

• The East-West Gate (EWG) Intermodal Terminal at Fényeslitke in Hungary has increased productivity from 23 to 25 containers per hour to 32 to 35 an hour through its private 5G network. It has also reduced the staff operating expenses by 40% and eliminated the risk of crane drivers’ injuries due to remote-controlled operation, with a latency of less than 20 milliseconds.

• The Liverpool 5G Create network in the inner city area of Kensington has shown there are potential savings from digital health, education and social care services. This includes “an astonishing $10,000 [€9,351 or £ 7,908) drop in yearly expenditure per care home resident through a 5G-connected system to prevent falls and a $2,600 reduction in WAN (connectivity charges per General Practitioner’s surgery (that is local doctors’ clinics or offices). This could represent a $220,000 annual saving for the UK’s National Health Service when applied to 86 surgeries in Liverpool.

• CJ Logistics has achieved a 20% productivity increase at its Ichiri centre in Icheon (Gyeonggi), South Korea, after replacing the 300 Wi-Fi access points in the 40,000 square meter warehouse with private 5G for Industry 4.0 applications, which previously experienced repeated outages and coverage issues.

The report’s summary cites many more use cases.

Other developments

Some of the most technically advanced features of 5G Advanced – 5G’s next evolutionarily phase – are also being trialled over private installations. For example, the Chinese automaker Great Wall Motor, is using an indoor 5G Advanced network for time-critical industrial control within a car roof production line. This is part of an effort to prevent wire abrasion in mobile applications which result in average downtime of 60 hours a year.

Geopolitical trade tensions and sanctions have given parties the means to test domestically produced 5G network infrastructure products in controlled environments, prior to large-scale deployments or vendor swaps across national or regional public mobile networks. For instance, Russian industrial groups are trialling private 5G networks in zones within production sites, using indigenously built 5G equipment operating in Band n79 (4.8-4.9 GHz) spectrum.

A number of new alternative suppliers have developed 5G infrastructure offerings tailored to the specific needs of industrial applications. For example, satellite communications company Globalstar has launched a multipoint terrestrial RAN system, that complies with 3GPP Release 16. It is optimised for dense private wireless deployments in Industry 4.0 automation environments. German engineering conglomerate Siemens has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers.

Aspects under investigation

The report presents an assessment of the private 5G network market, including the value chain, market drivers, barriers to uptake, enabling technologies, operational and business models, vertical industries, application scenarios, key trends, future roadmap, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2024 to 2030. The forecasts cover three infrastructure submarkets, 16 vertical industries and five regional markets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 7,000 global private cellular engagements – including more than 2,200 private 5G installations – as of Q2, 2024.