The mobile sector has a target of net zero for greenhouse gas emissions by 2050 – and to halve them by 2030

The mobile sector has a target of net zero for greenhouse gas emissions by 2050, and to halve them by 2030

The mobile industry’s net zero goals are ambitious, but recent progress shows it’s achievable. In Europe network operators collectively cut their own emissions by 50% between 2019 and 2022, driven by energy efficiency improvements and a switch to powering networks using renewable energy.

But energy use is relatively easy to address. If mobile network operators are to hit the 2030 milestone, then we must reach beyond areas that are within our direct control.

Linear to circular supply chains

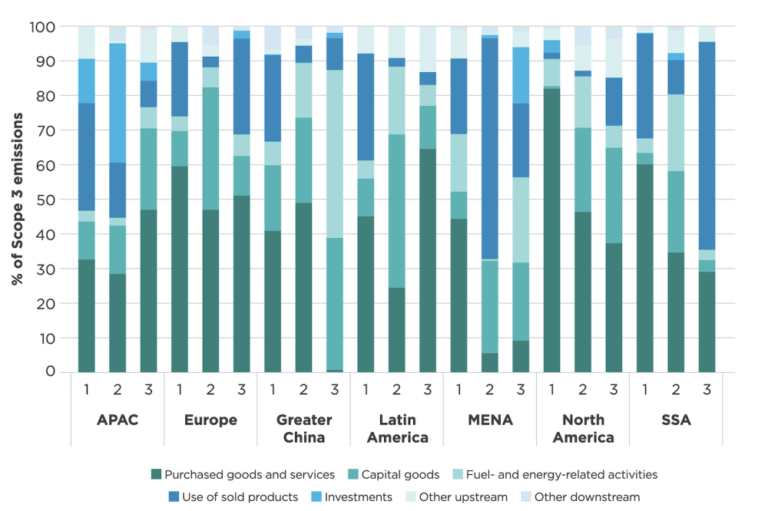

One of the biggest opportunities to reduce emissions comes from our supply chain (known as Scope 3 – the graph above shows Scope 3 emissions by category for select operators, by region, taken from GSMA’s Mobile Net Zero Report.

It represents the largest share of a telecommunication network operator’s carbon footprint: around three-quarters of the mobile industry’s emissions, with the majority coming from the manufacturing of devices and network equipment, that is, Scope 3.

The manufacturing of network equipment, including materials extraction and processing, and the construction of network sites and mobile masts accounts for more than 30 million tonnes CO2e per year. That’s the same as manufacturing a billion phones.

Talking phones

Likewise, over 50 different materials can be found in an average smartphone, including gold, cobalt, rare earths, copper and silicon. Mining for these materials can cause negative environmental and social impacts. Some 80% of a phone’s environment impact comes before it’s even been used.

And with more than 5 billion discarded mobile phones lying idle around the world, it’s clear that more needs to be done to extend their life, whether through repair and re-use or by recycling precious materials.

The GSMA estimates that if properly recycled into a more environmentally friendly “circular” supply chain, these 5 billion mobile phones could release $8 billion worth of gold, palladium, silver, copper, rare earth elements, and other critical minerals, and enough cobalt for 10 million electric car batteries.

As things stand of the 1.4 billion mobile phones sold annually, 85% of them are not formally recycled, creating an unsustainable model of mining, making, using and storing or disposing of devices and equipment.

By extending the lifetime of all smartphones in the world by one year we could potentially save around 20 million tonnes of CO2 emissions annually by 2030, equal to taking around 5 million cars off the road.

There is real progress in certain parts of the industry towards a circular economy but there’s a lot more to do.

A circular mobile industry

Working with our members, the GSMA has set out a vision for change in the sector. It’s a vision where refurbishment and repair extends the lifetime of devices and network equipment. An industry where equipment and devices are made with 100% recyclable and recycled content, where we use 100% renewable energy and where no device ends up as waste.

With this in mind the GSMA, alongside industry partners, has launched two major initiatives in the past year to help accelerate change.

The first is the GSMA Equipment Marketplace, a global digital marketplace to source, reuse, resell, and recycle pre-owned telecommunications network equipment. It gives operators and equipment manufacturers a platform to achieve financial and environmental sustainability.

Early adopters, such as Vodafone, have successfully used the platform providing them with new revenue and cost savings, while also helping reduce their carbon footprint. The service was launched in February 2024 and we already have eight operators using GSMA Equipment Marketplace.

Our second initiative is in the area of mobile device circularity where we have set two new targets. Sixteen operators representing over 1 billion mobile connections have signed up to reduce their environmental impact by increasing the take-back of mobile phones and ensuring they are reused or responsibly recycled.

The future is [like] Orange

Operators taking the lead on circularity like Orange are already seeing benefits. Through its ‘Re’ initiative, Orange has responded to customers’ demands for more repair options, refurbished phones, easier returns for trade-ins and simple ways to recycle, including ensuring all data is wiped from phones. Since 2010 they have collected 21 million used phones.

These initiatives and others across the industry are a great start, but we need more telecom operators and equipment manufacturers to adopt circular economy business models to achieve the carbon savings needed in the coming years.

Governments must also play their part through better customs procedures to make it logistically simpler to import and export re-usable network equipment and devices. Likewise online device resellers can reduce transport emissions by checking the ownership status and trade-in value of a re-usable device before shipping it to a new customer.

With telecoms operators supporting initiatives like these, now is the time to integrate climate requirements into procurement plans. Given the short amount of time we have to avoid environmental disaster, collaboration on circularity gives us a tangible tool to address these challenges and reap the business rewards.