Sponsor Interview at Mobile Europe’s Business and Technology Summit event in London on 3rd July 2024.

Michelle Donegan speaks with Michael Dakin, UK Managing Director, Connect44.

To learn more, visit www.connect44.com

Sponsor Interview at Mobile Europe’s Business and Technology Summit event in London on 3rd July 2024.

Michelle Donegan speaks with Michael Dakin, UK Managing Director, Connect44.

To learn more, visit www.connect44.com

VEON has said its wholly owned subsidiary, Kyivstar, continues to invest in resilient connectivity for Ukraine. It plans to deploy an additional 848 industrial generators and 61,766 batteries for service continuity during the extended blackouts caused by attacks on Ukraine’s energy infrastructure.

Since the war started, resilience has been part of Kyivstar’s strategy to maintain crucial communication services and safeguard digital operations. The operator has deployed 2,322 generators and 115,000 four-hour duration batteries at base stations to provide backup power during blackouts.

Kyivstar now plans to deploy 848 more stationary industrial generators and 61,766 new batteries to support business continuity of the network. The systems will be deployed throughout the country, including at critical facilities that require at least three days’ generating capacity in a major outage

VEON and Kyivstar announced their commitment to invest $1 billion in Ukraine from from 2023 to 2027 at the Ukraine Recovery Conference in Belin. Kyivstar was named as Ukraine’s largest foreign investor in 2022 and 2023 by Forbes Ukraine. It was also recognised at MWC 2024 with the GSMA’s Global Mobile Award for Best Mobile Innovation Supporting Emergency or Humanitarian Situations for its Network Resilience Project.

Oleksandr Komarov, CEO of Kyivstar, commented, “Energy resilience and preparedness against blackouts have been at the centre of our investment priorities since the end of 2022. Consistent and significant investment of over $24 million over the last two years has helped us improve energy resilience.

“However, the changing nature of threats to Ukraine’s energy infrastructure and extended blackouts now necessitate a reinforcement in our strategy. This second wave of focus on energy resilience will enable Kyivstar to support critical connectivity with even further resources dedicated to energy resilience.”

As communication service providers (CSPs) adjust to the evolving digital landscape, leaders are looking beyond traditional business models for growth. While many are consumed by today’s tactical challenges, they could be missing out on capturing opportunities, especially 5G. APIs are the key to unlocking the sector’s ability to capitalise on its investments and a new era of growth.

The industry gathered for TM Forum’s DTW conference in Copenhagen in June after a series of announcements about alliances and aggregators’ agreements with operators to collaborate on network APIs. For instance, Vonage’s partnership with Telstra.

It was encouraging to see CSPs share the stage with ecosystem partners, collectively bringing the whole product. A great example of this was the launch of Glide API, with leaders from Google Cloud, Telefonica, Orange and the GSMA presenting with the startup. This industry has a history of successful collaboration on technology innovation through fora such as 3GPP, GSMA, TM Forum and others. It has been less successful at collaborating on impactful innovations for business models. We must get that right this time.

People are already engaging with the ecosystem economy like in-app purchases and juggling many accounts. We have the technology to optimise underlying tech, like 5G standalone cores and network slicing, for connectivity. Developers want to innovate by leveraging great networks around the world (see Kearney’s recent developer study on 5G APIs). In other words, the industry is primed for change.

Driving innovation with 5G APIs

APIs are tools used for communication and interaction between different software applications and systems. In the context of 5G and other network standards, APIs provide developers with standardised interfaces to provision access to and leverage networks’ capabilities. A developer could, for example, embed network functionality in their apps supporting ID verification and assuring optimal network experience for the service. This creates an opportunity to make money not only for the CSPs, aggregators and marketplaces that facilitate the exposure, but also for the developers and companies embedding this functionality in their solutions.

APIs are not new. They are successful across sectors like banking, logistics and even telecommunications, accelerating speed to market and enabling innovation across a much broader developer community. In telecom, we have seen the birth of the Communication Platform-as-a-Service (CPaaS), where companies like Twilio moved monolithic services into the cloud age, most notably for SMSs.

Now emerging network APIs allow us to put the end user front and centre, so developers can create amazing experiences taking advantage of the latest network features.

Industry readiness

Despite the clear benefits and potential new revenue streams, whether telecoms can capitalise on this opportunity remains in question. According to a report from GSA in May, only 49 operators globally (fewer than 10%) have invested in 5G Standalone cores which are required for the highest value features such as network slicing.

Ultimately, this is not about technology though. Collaboration within the ecosystem is critical to establish channels to vibrant developer communities. We need a multi-channel marketplace where CSPs, marketplaces, aggregators and other platform players co-exist, collectively solving the supply of and demand for network services. They share the responsibility for making it effortless for developers to integrate network APIs.

There is a clear demand from developers for using network APIs to enhance their end users’ experiences. Kearney’s 5G API Developer Study revealed that 60% of surveyed developers would integrate 5G APIs within a year if given the opportunity, with 63% recognising the value 5G connectivity could bring to their projects.

This demonstrates strong market potential, contingent on CSPs’ effectively engaging with and supporting the developer community to make it actual.

Strategies for API adoption

CSPs’ teams are typically organised around consumers and enterprises – now they must deal with developers too. The developer often decides which API-based services to select and incorporate – and there is an estimated almost 26 million developers globally, so this segment requires real attention.

Creating a culture of collaboration and knowledge-sharing between CSPs and developers is essential. In Kearney’s interviews with developers for its developer study, many expressed a reluctance to collaborate with CSPs due to a perceived lack of transparency and alignment with their objectives.

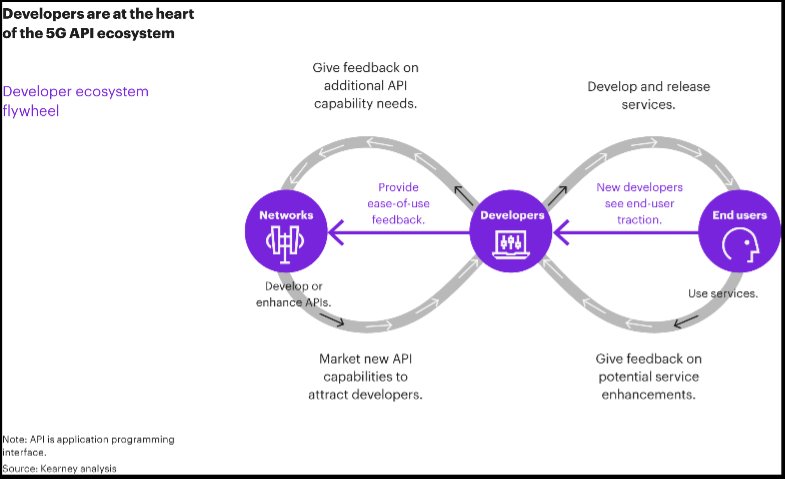

CSPs can address this by actively engaging in developer communities, understanding developers’ concerns, ensuring their APIs are widely available and evangelising the benefits of the services. We often talk about a developer flywheel effect (see figure 1), where the close dialogue with the developer community not only propels growth through word-of-mouth recommendations, but also improves the offered services based on feedback from the community. Now, let’s get this flywheel spinning.

Figure 1. Developer Ecosystem Flywheel

Download Kearney’s developer study on 5G APIs here.

Download Kearney’s latest annual 5G readiness report here.

Vodafone Business and its partner RingCentral are offering the operator’s cloud-based, unified communications-as-a-Service (UCaaS) platform. It combines voice calling, video conferencing and instant messaging. The services will be offered initially in 20 countries globally with plans to extend to more than 30 in early 2025.

In addition, Vodafone Business is adding Contact Centre-as-a-Service (CCaaS) to its unified communications (UC) portfolio, based on RingCentral’s RingCX contact centre solution.

The advantage to multinational businesses is they can more easily connect new locations and employees using these services, and adopt hybrid working models worldwide according to Vodafone Business, which will be their a single point of contact.

Vodafone Business also says the new offers “provides customers with one of the largest global UCaaS footprints, and Vodafone Business will also work with them to cover additional countries if specified”.

Unified comms

The Vodafone Business UC with RingCentral can replace traditional switchboards, cables, and IT systems with a secure and scaled cloud-based platform, according to the press release.

Customers can combine and customise messaging, video meetings, file sharing and virtual phone systems via a single user interface accessible on any internet-enabled device, mobile or fixed. The package comprises PSTN (voice) calling, numbering, UC devices, meetings and collaboration tools. It allows employees, regardless of location and device, can be set up quickly and given access to the same set of services, regardless of whether they work in an office, at home or in the field.

Marika Auramo, Chief Executive Officer, Vodafone Business, said: “Our expanding portfolio of unified communications services is ideal for customers looking to expand geographically whilst maintaining agile and sustainable hybrid working models.

“By switching to the cloud from rigid fixed systems, customers can add services when required, paying only for what they need. We estimate this will save many of them up to 30% in operating costs by reducing administrative costs and IT operational expenses whilst boosting productivity and collaboration.”

Contact centre too

The CCaaS, Vodafone Business Contact Centre with RingCentral, is designed to make it simpler for companies to establish and operate contact centres by equipping agents with AI. This includes call summaries, transcripts, automated scorecards, conversational insights and coaching.

Vodafone Business Contact Centre with RingCentral offers data insights plus voice and more than 20 digital channels including web, messaging and social media channels. Roll out will start in the UK, followed by Germany later this year, then progressively to other markets.

“With Vodafone Business Contact Centre with RingCentral, we’re empowering businesses with an all-inclusive contact centre solution that is simple to deploy, easy to use and manage, and comes with robust AI capabilities,” said Homayoun Razavi, EVP, Chief Business Development Officer, RingCentral. “Our comprehensive feature set ensures businesses can meet their customers wherever they are in their journey, while also driving operational efficiency to best position their business for success in today’s digital-first world.”

Africa represents 2.5% of today’s global AI market, but emerging applications could boost the continent’s economic growth by $2.9 trillion by 2030 according to AI4D Africa.

A new GSMA report AI for Africa: Use cases delivering impact, developed from existing research and interviews with leaders across civil society, non-government organisations, academia and the private sector, identifies over 90 AI use case applications in frontrunning technology markets (Kenya, Nigeria, and South Africa) that can drive socio-economic and climate impact.

Naturally, turning potential into actual AI involves overcoming barriers from the limited availability of data centres to big tech investments. The report reckons that by addressing the digital skills gaps and scarcity of smartphones, mobile-based AI solutions could offer a practical way to circumvent limitations and tap into AI’s potential across the continent.

Today, most African AI use cases are related to agriculture (49%), climate action (26%) and energy (24%).

Agriculture dominates

Agriculture employs 52% of the African working population and contributes 17% on average to GDP. In Sub-Saharan Africa, up to 80% of food is produced by smallholder farmers who often use traditional techniques and lack access to information that would help improve yields.

The GSMA finds that most AI use cases are digital advisory services enabled by machine learning, typically accessed by farmers via mobile devices.

Affordable, reliable energy services

The region faces serious challenges in access to electricity and a reliable supply: half Africa’s population has no access to electricity. AI-enabled solutions in Africa are improving on-grid infrastructure and off-grid systems through applications like predictive maintenance, smart energy management, assessing access to energy and ‘productive use’ financing to monitor and extend services where energy is scarce.

Improving access to energy and greater efficiency in this sector is vital, in the GSMA’s estimation, because it creates a virtuous cycle: greater access to and use of connectivity and data are the fuel needed for AI.

Supporting climate action

Despite contributing less than 3% of global energy-related CO2 emissions, Africans disproportionately suffer from climate change; without intervention, climate-related emergencies could reduce African GDP by 8% by 2050.

The GSMA finds that the increasing availability of remote sensing technologies and satellite imagery has supported the development of uses cases for natural resources management, where AI is being used for biodiversity monitoring and wildlife protection.

Early warning systems that offer predictive analytics and real-time assessment of disasters, including climate emergencies, are also improving through ML models, providing better forecasting in areas where data is scarce.

Most (98%) of AI use cases in Africa are predictive AI applications, reliant on ML, as historical datasets are available, simpler applications and lower computation requirements compared with Generative AI (GenAI) models. The GSMA says more nascent use cases and GenAI are key to driving long-term socio-economic benefits.

Unlocking AI capabilities

Effective training of AI models needs extensive, diverse and representative data that reflect the complexities and nuances of African markets rather than mimic data from the Global North. For instance, there is a dearth of local-language data cross Africa, hindering AI’s development and scale.

AI development also requires robust infrastructure and computing power. As AI applications expand, the energy demands of data centres and the cost of hardware and software will rise. The continent already faces a shortage of data centres and, in countries such as South Africa and Kenya, the cost of a graphics processing unit (GPU) is prohibitively high, representing 22% and 75% of GDP per capita, respectively. This make running AI applications much more expensive than in rich countries.

As local compute ecosystems grow, countries can leverage mobile-first markets to develop distributed or hyperlocal edge computing, running tasks on devices including phones and laptops to reduce reliance on high-powered data centres. After foundational models are trained on large datasets, they can be transferred to smartphones for fine tuning.

Current smartphone penetration is at 51% and expected to reach 88% by 2030, boosting mobile-based edge computing which will be central to expanding the proliferation and capabilities of AI in Africa.

Better skills all round

Max Cuvellier Giacomelli, Head of Mobile for Development at the GSMA, said, “To harness the transformative potential of AI across Africa, there needs to be a strong focus on increasing skills for both AI builders and users, especially among underserved populations. Better training programmes are essential, particularly in the face of a global brain drain on AI talent.

“To ensure Africa doesn’t get left behind, strong partnerships are required across a broad ecosystem of partners including ‘big tech’, NGOs, governments, and mobile operators. Policies must also evolve to address inequality, ethics, and human rights concerns in AI deployment.

“As African countries shape their own unique AI strategies, active engagement in global forums will be pivotal in defining regulatory frameworks that promote ethical AI development and safeguard societal interests, moving toward sustainable solutions that benefit all African communities.”

The board of operator group Millicom, which operates in Latin America, has formally reiterated its view that the $4.1 billion takeover bid by Atlas Investissement is too low and rejected it. Atlas already holds a 29% stake in Millicom, the financial vehicle which belongs to the founder and owner of France’s Iliad operator group, Xavier Niel.

The board rejected the offer on the grounds that the bid undervalues the group (at $24 a share) and published a detailed explanation of its conclusion. It is advising shareholders to decline the offer.

It seems likely that Niel will make an improved offer, but he’s chasing a rising star. On Monday, as the news of the rejection broke, Milicom’s share price went up another 1.6% on the Nasdaq.

In the last year, the group’s share price has risen by more than a third, from $16.72 per share to $25.81 at the time of writing.

it is reported that Alphabet’s negotiations to buy cybersecurity start-up Wiz are progressing although have not reached the point of no return. In addition, anti-trust regulators might take a dim view of a leviathan like Alphabet snapping up a potential new leader in a sector. Alphabet acquired cybersecurity firm Mandiant for $5.4 billion in 2022.

According to Reuters, Wiz started life in Israel and now has headquarters in New York. It is one of the fastest-growing software startups globally, providing cloud-based cybersecurity solutions with real-time threat detection and responses powered by artificial intelligence. Wiz works with 40% of Fortune 100 companies, its website says.

Since Wiz was founded in 2020, it has raised about $2 billion in funding since from the likes of Sequoia Capital. It was recently valued at $12 billion and is led by former Microsoft exec Assaf Rappaport.

Liquid C2, a subsidiary of Cassava-owned Liquid Intelligent Technologies (LIT), has announced the expansion of its Cloudmania business into the Egyptian channel partner ecosystem. Cloudmania is Liquid C2’s distribution business unit for cloud and cyber security solutions with operations in 35 countries across the Middle East and Africa.

Cloudmania’s strategic partnership with Microsoft has allowed it to equip numerous partners with cloud and cyber security services and solutions, including Microsoft 365 and Azure solutions, within a fully supported ecosystem. Services supported include Microsoft 365 Enterprise, Microsoft Dynamics 365 and the AI companion Microsoft Copilot. In addition – although not across its entire footprint – Liquid C2 supports OneVoice for Operator Connect

“Extending Cloudmania’s reach to Egypt reflects our confidence in the Egyptian economy following the launch of Liquid C2 in Egypt a year ago, said Liquid C2 VP operations Sherif Shaltout. “We see Egypt as the anchor country of our expansion into the Middle East and North Africa and we look forward to playing our role in realizing the government’s Egypt Vision 2030 strategy, supported by its ‘Digital Egypt’ initiative.”

“Partnering with local businesses will help in developing digital infrastructure, promoting digital skills development, creating opportunities for entrepreneurship and economic growth, all while tapping into Egypt’s wealth of local tech talent,” he added.

“Cloudmania’s growth over the last year from 100 partners to over 750 demonstrates how our value proposition resonates with channel partners across these regions. Being named the Microsoft Partner of the Year in Ethiopia and Côte d’Ivoire in 2022 and 2023 respectively, reflects our commitment to delivering solutions that propel cloud adoption and partner growth, accelerating digital transformation for businesses in Africa,” said Liquid C2 chief commercial officer Vinay Hiralall.

What’s the deal?

Resellers that partner with Cloudmania receive access to a suite of solutions tailored, unsurprisingly, to suit their customers’ needs. Cloudmania said it aims to help channel partners better manage their business by creating a single-pane view via an always-on platform that assists with billing and subscription management services. In addition to providing partners with programmes that drive sales enablement, they also have access to Cloudmania’s marketing and technical support. Cloudmania is happy to run the backend operations, enabling partners to focus on their core business.

While Cloudmania’s website is awash with all-things-Microsoft, in June Liquid C2 took a big step to addressing hybrid clouds – which is the currently preferred flavour of cloud enterprises are opting for.

The company became what it claims was the first Google Cloud Interconnect provider on the continent. The move came soon after Google announced it was partnering C2’s parent LIT to build the terrestrial section of its new Umoja cable that will link Africa to Australia for the first time.

That strategic partnership with Google Cloud added significant capacity to the cloud solutions that Liquid C2 already offers its customers across Africa through its Cloud Connect portfolio. The two companies signed their first MoU in November 2023 around cybersecurity and cloud offerings and in March Liquid C2 announced collaborations with Google Cloud and Anthropic to deliver advanced cloud and generative AI capabilities to African businesses across the continent.

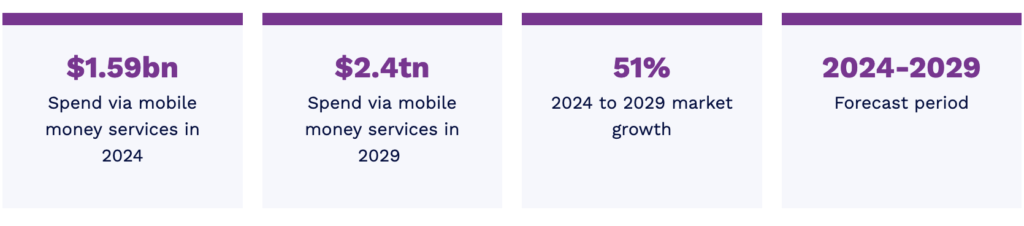

A new study from Juniper Research found mobile money spend in emerging markets will reach $2.37 trillion by 2029 (€2.17 trillion) in 2029, up from $1.58 trillion in 2024.

It predicts this 51% growth will be driven by operators expanding their portfolios to include higher-margin, more advanced services, such as enabling merchant payments in-store or via eCommerce, and providing international remittances.

Key findings

Source: Juniper Research, Mobile Money in Emerging Markets

This will allow providers of mobile financial services (MFS) to lessen their reliance on revenue from person-to-person transactions but they will also have to build new capabilities.

Juniper thinks the providers will face major challenges in offering these more advanced services at scale. For example, the complexity of shifting from basic Unstructured Supplementary Service Data (USSD) services to offering app-based experiences.

Also, the research house suggests partnerships with digital wallet platform providers will be critical in helping mobile money service providers increase their reach across different access channels.

The report’s co-author, Mélissa Amouny, explained, “As banks struggle with the distribution of financial services in emerging markets and mobile money services have excellent reach via their agent networks, partnerships between banks and mobile money services are a strong fit.

“MFS providers must strike partnerships with banks to offer the capabilities needed, and with platform providers to improve their technical infrastructures, to best address the advanced services opportunity.”

The telecoms industry can become preoccupied by new technologies, forgetting that, like money, they only matter because of what we can achieve with them. This event was designed to look at how technology fuels telcos’ businesses – or not.

Direct links to video of all the sessions are on the agenda page here.

We heard great insights from an outstanding cast of speakers on a diverse subjects ranging from:

• aspects of AI

• the ongoing journey to cloud (the picture above shows Scott Petty, CTO of Vodafone Group, in full flow in our thought-provoking, keynote session)

• the green telecoms planet

• open infrastructure and why it matters

• how to deliver digital services to

• successfully financing fibre

• the progress of 5G Advanced and

• why reliability and resilience trump speed.

Mobile Europe would like to thank our sponsors for making this event possible and for their excellent contributions to the various sessions.

Knowledge Partner – Redis

www.redis.io

Gold Sponsor – Red Hat

www.redhat.com

Silver Sponsors – Comarch, nVent, Connect44, Gigabyte

www.comarch.com

www.nvent.com

www.connect44.com

www.gigabyte.com