The 5G&Beyond Observatory of the Politecnico di Milano investigates if it’s possible to foresee future scenarios and what the processes would be behind their identification?

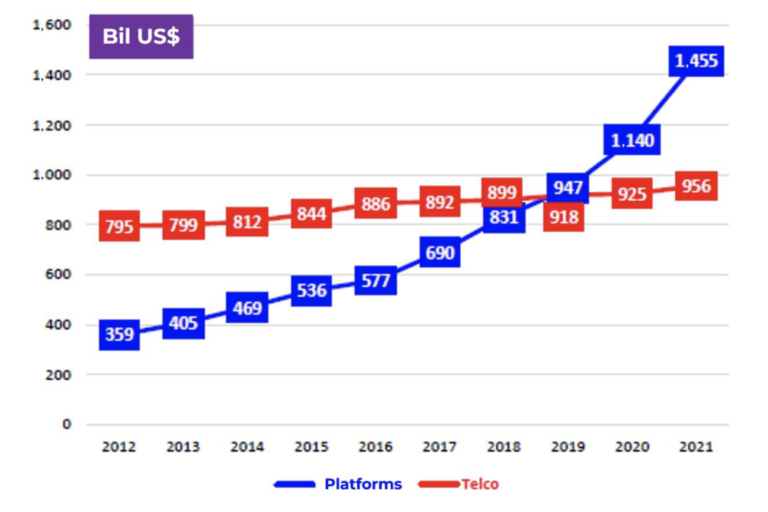

The telecoms industry ‘s decades-old stability is being disrupted by technological paradigms, such as 5G, open RAN and edge-cloud, as well as economic challenges. As digital’s influence and significance grows across industries (see graph above, taken from white paper discussed below), the demand for high-performance network infrastructure and services rises. The infrastructures and services must meet the specific needs of different verticals and support the digital transformation of companies that rely on connectivity.

Many questions remain about the future ‘value network’ in telecoms. The landscape will be shaped by: the strategic decisions and innovation capabilities of industry players; regulatory and legislative industrial policies; changes at national and European levels; and being able to attract investment from stakeholders, including other supply chains.

In the long term, profound changes are expected to:

• the different layers of the current value network

• the roles and positions of existing players

• the nature of the players in the sector, and

• the relationships between companies within the ecosystem and their end customers, including consumers, businesses and the public sector.

Can we predict the future?

Is it possible to foresee future scenarios and what would the processes be behind their identification? Numerous researchers have tried to define a clear and comprehensive methodology to predict and possible and preferable scenarios using different approaches. Yet it is unclear whether the methodologies are reliable and which are the most suitable for analysing different industries. The challenge is not only to create forecasting tools but to validate their effectiveness and specificity in various contexts.

With this in mind, the 5G&Beyond Observatory of the Politecnico di Milano initiated a two-year project within the RESTART foundation program. Funded by the European Union*, since mid March 2022, the program has received a total investment of €116 million. This makes it the most significant public R&D initiative ever undertaken in Italy’s telecoms sector. The program involves 25 partners, including universities, research centres and private companies. It consists of seven missions and 19 grand challenges.

Evolutionary scenarios

The primary objective of this project is to explore potential evolutionary scenarios for the European telecoms ecosystem taking advantage of the large RESTART community of experts and their international relations. By identifying the factors and decisions that could influence its development, the project aims to support market players in navigating this transformation and assist decision-makers in taking informed choices.

The project addresses the Grand Challenge #0 – Envision the Future Evolution of the Telecommunications Ecosystem in Italy and internationally. The research team includes management engineers and a scientific director with a telecoms background.

The project’s first output , the whitepaper, A Techno-Economic View of the Future of Telecommunications, was published on the RESTART foundation website on 16 April. It was presented at the 5G&Co international conference, organized by the Interuniversity Consortium for Telecommunications CNIT. The paper has been translated into English to encourage European collaboration among similar projects and facilitate discussions on the future of the telecoms ecosystem.

It delves into the current structure of the telecoms ecosystem, aiming to establish an initial model representing the players and their value-creating activities. The document provides preliminary insights and will serve as the foundation for further research and devloping potential evolutionary scenarios.

It highlights issues such as declining market revenues, competitive dynamics and emerging technology trends. Based on a review of the academic literature on business models, value networks, and the definition of the telecommunications industry’s boundaries, a new definition of the telecommunications ecosystem perimeter is proposed, identifying 16 categories of different telco player archetypes.

A comprehensive model

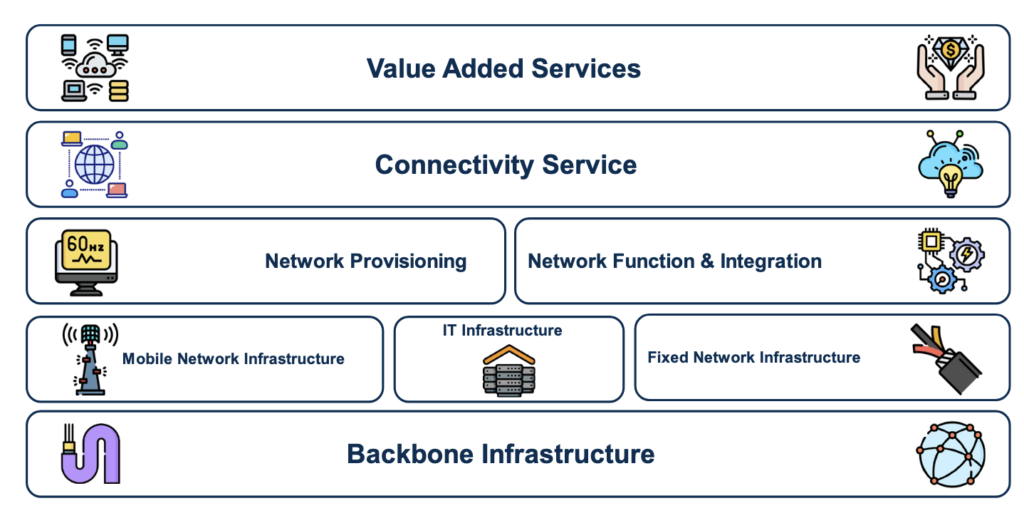

The paper introduces a comprehensive model that will map relationships between various players, focusing on value creation and capture, and the evolving business models within the industry. This model outlines the architecture of telecomms ecosystem across five layers, from macro infrastructure components to service delivery.

Recommended value network architecture layers from the white paper

The first two layers deal with the physical infrastructure and have been divided into backbone infrastructure and mobile, fixed line and IT. Within these layers are the activities performed by infrastructure providers such as laying submarine cables, design and construction of mobile and fixed line infrastructure, and IT infrastructure like Internet Exchange Point (IXPs) and data centres.

Next is the layer related to network deployment in terms of functionality and networking, involving activities like spectrum provisioning and implementation of core and RAN functions. The final two layers deal with connectivity service delivery and value-added services. They are services that can extend to other supply chains and are not only related to connectivity solutions.

Value-added services has two sub-layers. The first is related to the commercialisation of general-purpose ICT services for the B2B, B2C and public sectors. The second one concerns consultancy and implementation services for specific vertical use cases for private companies and the public sector. A typical example is consulting and project integration for private mobile networks where the offer is the technology infrastructure and the enabling application.

Future configurations

Lastly, the white paper presents initial thoughts on the future configuration of the telecoms value network, derived from secondary sources and expert interviews. These insights are categorised into market structure, technology transformations and digital market roles. They emphasise trends like mergers and acquisitions, network softwarisation, and the increasing importance of AI, cloud and cybersecurity.

This provides the basis for mapping the mega-trend of the telco industry and start to define possible scenarios. Next we will identify the next steps of the research into future scenarios to evaluate each one qualitatively and define the overall value network.

The telecoms industry is at a critical juncture. The RESTART foundation program, spearheaded by the 5G&Beyond Observatory, represents an important step towards understanding and shaping the future of its ecosystem. By fostering collaboration and innovation, this initiative aims to provide a roadmap for industry stakeholders and policymakers, ensuring a resilient and adaptive telecom sector capable of meeting the demands of an increasingly digital world.

* NextGenerationEU as part of the NRRP – M4C2, Investment 1.3, Call n. 341

About the author

Edoardo Meraviglia is an analyst with the Osservatori Digital Innovation in Milan, Italy