Passing off dynamic spectrum sharing as ‘proper 5G’ can disappoint customers when their experience does not improve – and there is too much emphasis on speed alone

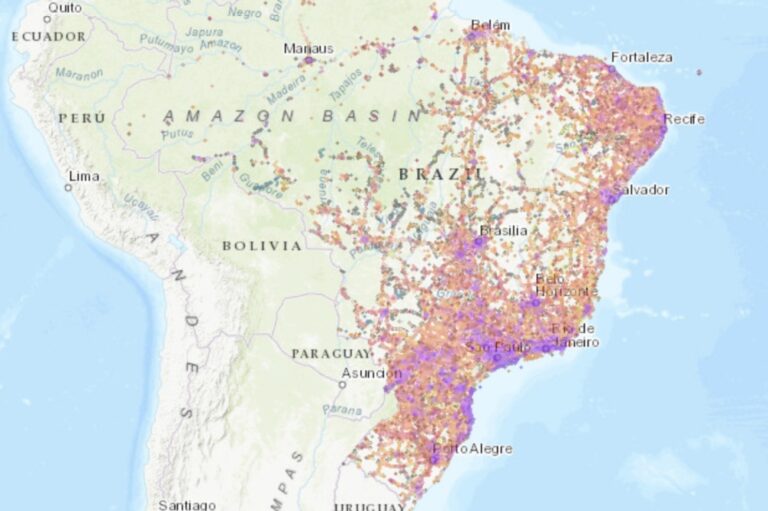

MedUX tests and monitors the quality of experience for internet connections provided by operators across the globe. Now it has produced a report that evaluates 5G connectivity across 10 prominent cities in Europe, including Berlin, London, Lisbon, Porto and Milan. Collectively they are home to about 25 million people.

We interviewed its CMO, Rafael Gonzalez Galaretta, about the report. Refreshingly, MedUx seems more interested in digging into results rather than simply looking at alleged speeds and crowdsourced data. London was at the bottom of the rankings and Berlin at the top – faster than the other cities by between 5% and 25%. The German capital also offers the highest quality of service.

Gonzalez Galaretta explains, “We focus on quality of experience, which is a synthetic indicator, aggregating many other factors beyond speed.

“I think these are very valuable insights, not only for operators, but also for governments, most importantly, in the current heated discussions on what to do and how to achieve the intended targets, which is 100% 5G coverage by 2030 and 100% of Gigabit connectivity by 2030. Those big targets are very difficult to achieve.”

Misleading figures

As we all know, figures about network coverage and speed can be very misleading. As Gonzalez Galaretta adds, “We wanted to convey that not all 5G networks are created equal.”

He acknowledges that producing an overall picture for the 10 cities might be unfair on certain operators or give a distorted picture of the country. For instance, EE’s network in London was superior to that of the other three mobile network operators – Three UK, Virgin Media O2 and Vodafone UK. This resulted in the average downlink speed in the UK’s capital being 125Mbps whereas the cities of Lisbon and Porto, for instance, at about 450Mbps and 415Mbps respectively are almost four times faster.

Yet EE ranked in the top third of all the operators across Europe involved in this study “which is good news for certain users in London, which is an important message here,” he says. It is worth noting, though, that in August, Ookla found that, for example, 5G download speeds were faster in Birmingham and Manchester than in London – and that the Three UK network was fastest in all three cases.

‘Fake’ 5G

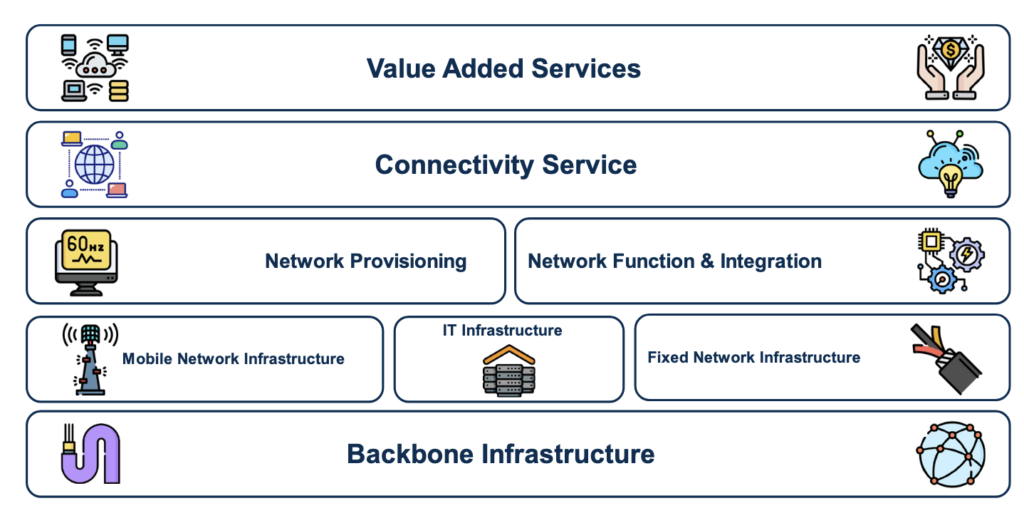

He is more concerned though about instances where an operator might be using dynamic spectrum sharing for 5G Non-standalone with “only a tiny part of the spectrum used for 5G”, he explains. The rest of which is used by 4G, “So you have two degraded networks in parallel. This is what many operators in Europe have been doing so that they can say they have 5G.

They even notify end users with a 5G symbol on their smartphones but they are not really technically connected to 5G. This is why we use active testing robots, which is on our own hardware and software architecture.” His team spent a week in each city in the report, with the robots taking measurements all the time, and seeing how service degraded in busy places like shopping streets and where there are clusters of eateries. He says, “It’s about capacity and congestion might degrade experience for end user because the network is not adequately dimensioned.”

Gonzalez Galaretta continues, “We have not used crowdsourcing because that would indicate 5G in many more places because people just collect the upper layer indicator they see on their phones.

“What really matters is not a 5G notification on my phone but do people get the better quality when they see that 5G? They might have 5G NSA in the 700 or 800MHz where just 20MHz of spectrum is for 5G. Then there is no difference in terms of speed in comparison with 4G because the operator is doing the same carrier aggregation that it might be doing with 4G.

“So only if the operator has, let’s say, the mid band 3.5GHZ 5G, that’s what might be considered the real 5G but that is still an issue because 5G Standalone (SA) has not arrived in many places.”

Gonzalez Galaretta says, “I’m not sure that we will have a meaningful quality everywhere. This is our concern. We will see differences in rural and remote areas because the operators are not in a position, at least with the current regulatory framework, instruments and mechanisms to make a huge investment in a huge investment in the mid-band [3.3GHZ to 3.8GHz}. I appreciate the European Commission setting those targets, but I don’t see mid band being everywhere in all rural and remote areas because that’s very costly.”

Other factors

He suggests other factors that could account for London’s laggard status could be deployment strategy, the lack of a business case or budget, 5G not being seen as a priority or something that would impact a company’s financial reporting figures. Also, whether there is governmental support at local, regional or national level which “is very important in terms of 5G infrastructure because operators need special licences to deploy the technology,” he states.

He notes that as the UK is no longer part of the European Union, it is not bound by the EU’s targets outlined above, but set its own targets in 2023 for complete coverage of 5G Standalone by 2030. [Editor’s note: The UK government has a poor record of ensuring its telecoms strategy is implemented.] Gonzalez Galaretta says the Standalone element in this is very important as it avoids poor, quasi-5G being passed off as the ‘real thing’.

Not that big a need for speed

Gonzalez Galaretta stresses that his company looks at the many parameters that contribute to quality of experience, “which is a synthetic indicator, aggregating many other factors beyond speed, although it has an important weight in the overall scoring”. He notes that speed, rather than say reliability or coverage, tends to be how mobile operators promote and “commercialise” their networks.

It remains a key criterion concerning how people choose a service provider for both fixed and mobile connectivity, but, “We’re saying there is a world beyond mere speed beyond a certain threshold. Most end users are more sensitive to interruptions to the service or if they are unable to properly connect to a service because it takes too long. It’s about the time to content,” he says.

MedUx’s found that “Any speed above 100Mbps is not really valued by clients for mobile,” Gonzalez Galaretta states. This is back up by Netflix, which recommends the minimum speed for streaming its content is 3Mbps for standard definition (SD) video quality, at least 5Mbps for HD quality and 15Mbps for Ultra HD or 4K quality. This is assuming there is no contention for bandwidth.

reviews.org added, “We recommend grabbing at least 50 Mbps download speeds if it’s just you and maybe one other person using the internet. As for families, we think 100 Mbps or more download speed is better.”

Gonzalez Galaretta continues, “That’s why, in our quality of experience core, speed is only a part of it. The rest is about reliability – that’s a very important part. How consistent is the service in all the internet sessions that you have on a daily basis, and on various services and application? So what’s your experience when doing streaming, web browsing? When you’re visiting social media or using cloud storage, or gaming, etc. That’s the rest of our scorecard.”

It’s also about perception which relies on factors beyond the network itself: In February 2024, the UK regulator Ofcom reported that Virgin Mobile was the most complained-about mobile provider. It also said the MVNO, Tesco Mobile, was the least complained-about pay-monthly mobile provider – although like Virgin Mobile it runs on the O2 network owned by Virgin Mobile’s parent companies (Liberty Global and Telefonica).

Food for thought

“This is why we did the report, to offer insights to the industry and some food for thought that there is a world beyond speed, first thing. Second, that there are many flavours of 5G, and third, that coverage, is all about signal quality.” And the desperate need for “a favourable investment environment” if Europe wants to see “prosperity, competitiveness and resilience in our networks, and achieve the digital transformation the region needs to be world class in the technology field.

“We are lagging behind in many [areas] – quantum computing, artificial intelligence, digital transformation, that public service level in terms of for small businesses…If you don’t have the technology as an enabler for this digital transformation, you will be lagging behind as a country and as a region.”