América Móvil, AT&T, Bharti Airtel, Deutsche Telekom, Orange, Reliance Jio, Singtel, Telefónica, Telstra, T-Mobile, Verizon and Vodafone join Ericsson to sell network software tools

Global headliners América Móvil, AT&T, Bharti Airtel, Deutsche Telekom, Orange, Reliance Jio, Singtel, Telefónica, Telstra, T-Mobile, Verizon and Vodafone, together with Ericsson have come together to form Live Aid for network APIs. The global telecom companies will form a new joint-venture company “to accelerate adoption and innovation of network APIs” and basically try to work out how to monetise them.

Ericsson will hold 50% of the equity in the new venture while the telco partners will hold 50%. The Swedish vendor’s involvement is unsurprisingly given its $6.2 billion bet on Vonage in 2021, which has since it write down around $4 billion since. Vonage is already working with several of the telcos in the new group but to create an ecosystem APIs are going to need to integrate across many hundreds of telcos.

A new Bridge to Paragon?

The members hope this will catalyse API development spurring new ways to charge for network-based services. Given the size of the telcos involved, this is the most serious attempt to make APIs work to date. For example, Singtel’s involvement is smart given that telco’s work with the Bridge Alliance to create an API Exchange (BAEx) which has now been joined by a 13 operators including Airtel, AIS, China Unicom, CSL, CTM, Globe, Maxis, Mobifone, Optus, Singtel, SK Telecom, Taiwan Mobile and Telkomsel.

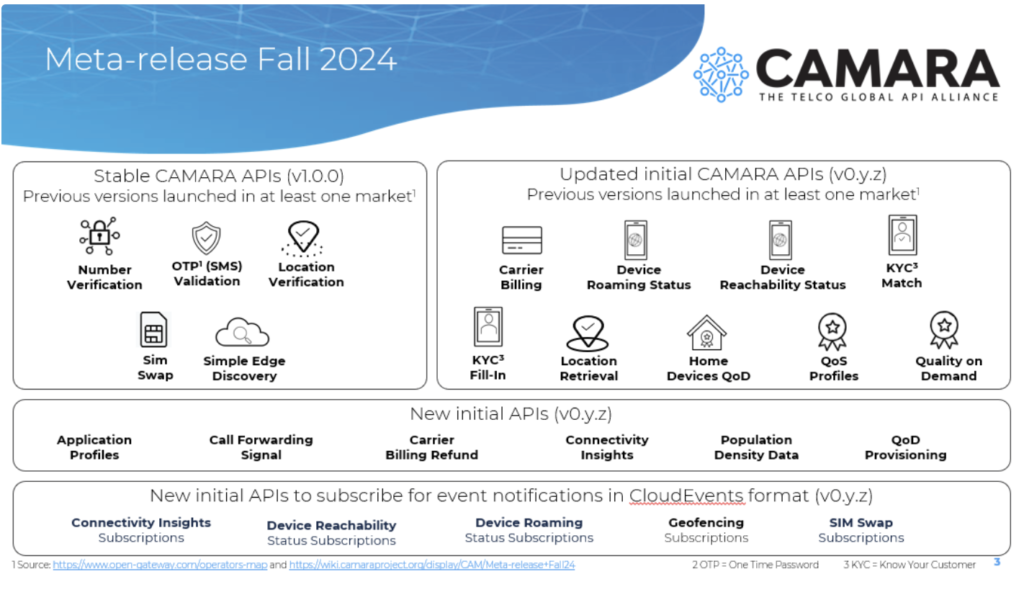

Underlying (BAEx) is Singtel’s Paragon orchestration platform, and the exchange builds on the GSMA’s Open Gateway initiative and Project CAMARA. AEx) is already offering Silent Network Authentication APIs such as Number Verify and SIM Swap and has plans to introduce more APIs like eKYC (electronic know your customer) and QoD (Quality-of-service on Demand).

Singtel also has a technology share agreement with SK Telecom and recently, the South Korean mobile leader signed a deal to collaborate with Korea Telecom and LG Uplus on APIs – so there is a real making an API movement in the works.

Google in the house

Vonage and Google Cloud will partner with the new company, providing access to their ecosystems of millions of developers as well as their partners. The new venture shareholders will bring funding and important assets, including Ericsson’s platform and network expertise, global telecom operator relationships, knowledge of the developer community and each telecom operator’s network APIs, expertise and marketing.

The newly formed company will combine network APIs globally, with a vision that new applications will work anywhere and, on any network, making it easier and quicker for developers to innovate. Google’s involvement is fascinating given that many of the telcos in the new alliance partnered AWS at MWC Barcelona in the hope of creating a new “go-to-market-channel for telcos” using APIs.

The newly formed company will provide network APIs to a broad ecosystem of developer platforms, including hyperscalers, communications platform as a service (CPaaS) providers, system integrators and independent software vendors, based on existing industry-wide CAMARA APIs – the open-source project driven by the GSMA and the Linux Foundation.

Additional telecom operators are encouraged to join the new company, further driving the industry and developer experience, and allowing all participants to tap into a “significant new revenue opportunity”, such as telecom operator Three Sweden (Hi3G Access) which is already in discussions. Closing of the transaction is expected in early 2025, subject to regulatory approvals and other customary conditions. The new venture’s platform and partner ecosystem will remain open and non-discriminatory to maximise value creation across the industry.

What does the wider industry think?

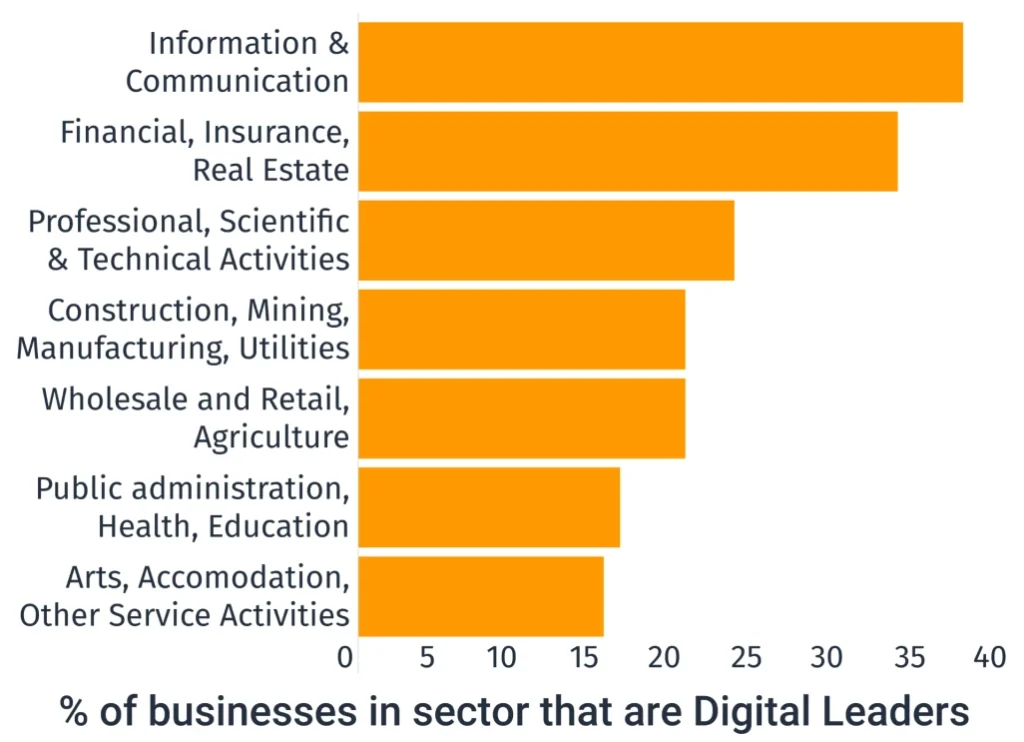

Kester Mann, Director, Consumer and Connectivity at CCS Insight, commented, “Traditionally, telecom operators have largely failed to support developers by providing them with the right tools and opportunities to create new services. This was not such a problem in the 3G and 4G eras, as successful applications like Uber were developed without needing major support from telecom providers.

“With 5G however, a lack of tangible and attractive customer uses — particularly in consumer market — continues to restrict sector growth and unnerve investors seeking a more tangible path to return on investment. To overcome this, operators have been forced to adopt a fresh mind-set of collaboration, flexibility and openness.

“Today’s announcement is an important step in that direction by addressing one of the major challenges for developers seeking to engage with mobile operators – sector fragmentation. In the past, the telecom industry – with many competing players each deploying different strategies for their specific regions – has struggled to present a united and coherent front.”

Mann cautions, “Operators have a dubious track record in collaborating. However, driven by growing urgency to better monetise significant network investments, and now with involvement from major technology partners in the form of Ericsson and Google, there should be fresh optimism that the new company unveiled will enjoy more success than previous failed ventures.”

Telco executives applaud

“This is a critical first step in our innovation journey to fully harness the power of our networks at scale, providing secure access to new on-demand network services and advanced network capabilities. By delivering a common and simple set of network APIs for developers globally, we can unleash this network value for businesses, large and small. This is a definitive gamechanger for businesses, opening up the possibility of a new wave of digital services,” said Orange CEO Christel Heydemann.

“We are very excited to join Ericsson and other key players in our industry in this innovative global platform initiative that will benefit the digital ecosystem as a whole. New API solutions will establish exciting value-added offerings to our customers on the top of our networks’ infrastructure,” said AMX CEO Daniel Hajj.

“At AT&T, we’ve been creating API tools to empower developers for well over a decade. Now, with a broad-based, interoperable API platform, we’re giving innovators a new global toolbox where the world’s best app developers can create exciting user experiences at scale. This high-performance mobile ecosystem will usher in a new era of greater possibility for customers and mobile users around the world,” said AT&T CTO Jeremy Legg.

“Today marks a defining moment as the industry comes together to form a unified platform that will allow more developers and businesses to utilise our networks and explore API opportunities through open gateway principles,” said Bharti Airtel managing director and CEO Gopal Vittal. “This move will enhance network monetisation opportunities. Airtel is delighted to partner in this initiative that will help enable the telecom sector to drive growth and innovation across the ecosystem.”

“The new company accelerates our leading work with MagentaBusiness APIs to expose our network capabilities for customers and developers. We believe that this company will open up new monetisation opportunities for the industry,” said Deutsche Telekom CEO Tim Höttges. “We encourage and look forward to more telecom operators joining us to expand and develop this ecosystem.”

“Today is a defining moment for the industry and milestone in our strategy to open up the network for increased monetisation opportunities,” said Ericsson president and CEO Börje Ekholm (above). “A global platform built on Ericsson’s deep technical capabilities and with a comprehensive ecosystem, that provides millions of developers with a single connection, will enable the telecom industry to invest deeper into the network API opportunity, driving growth and innovation for everyone.”

“We spearheaded the transformation of both mobile and fixed home broadband by delivering affordable, high-quality broadband to everyone, across India. As we rapidly adopt an AI and API-driven technology ecosystem—by collaborating with global leaders, Jio is thrilled to offer a suite of innovative and transformative APIs to enterprises and developers worldwide,” said Reliance Jio president Mathew Oommen. “Together, we are not just building networks; we are laying the foundation for a smarter, more connected, and inclusive world in the AI era.”

“This unified platform and global eco-system will enable even more developers and businesses to leverage 5G quality networks to exploit API opportunities using GSMA’s open gateway principles,” said Singtel Group CEO Yuen Kuan Moon. “We look forward to helping even more enterprises and organisations in Asia to use network API solutions to drive growth and innovation through this timely collaboration.”

“This collaboration will drive the GSMA Open Gateway initiative and provide customers with a consistent set of Camara APIs,” said Telefónica chairman and CEO José María Álvarez-Pallete. “Our belief is that this industry movement, which will be open to all networks, can set the stage for unprecedented innovation and value creation for the sector, by unlocking the potential of network capabilities.”

“This new global venture will create an ecosystem that provides developers, partners and customers with access to programmable, advanced network capabilities that will unleash a new wave of innovation in digital services and further unlocks the benefits of our 5G network,” said Telstra CEO Vicki Brady. “We’ve been making good progress locally with Ericsson and other partners, and we look forward to further accelerating digital transformation for our Australian customers and bringing value and simplicity to application developers around the world.”

“At T-Mobile, we’ve always been laser focused on championing change across the industry to create the best customer experiences, while fueling growth and innovation across the entire wireless ecosystem,” said T-Mobile president of technology Ulf Ewaldsson. “That level of transformation takes unprecedented collaboration and expertise. We are excited about the possibilities this venture will create for developers and wireless customers around the world.”

“The depth and value of the services and data insights accessible through Verizon’s renowned 5G network are practically boundless,” said Verizon EVP and president, global network and technology Joe Russo. “Verizon has been at the forefront of developing various network APIs to assist developers in enhancing customer security, reducing pain points in customer interactions, and enabling the creation of novel experiences. This exciting collaboration with global partners will broaden the availability of these services and accelerate adoption of APIs worldwide.”

“Network APIs are reshaping our industry. This pioneering partnership will enable businesses and developers to use the collective strength of our global networks to develop applications that drive growth, create jobs, and improve public services,” said Vodafone Group chief executive Margherita Della Valle. “Just as 4G and smartphones made apps integral to our everyday life, the power of our 5G network will stimulate the next wave of digital services.”

“We understand the power of an open platform and ecosystem in driving innovation. We are proud to participate in this important partnership in the telco industry to create value for our global customers via network APIs – and ultimately deliver on the promise of the public cloud,” said Google Cloud CEO Thomas Kurian.

“This groundbreaking, open industry collaboration effectively removes the single largest barrier for developers to leverage mobile networks to their full potential,” said Vonage CEO Niklas Heuveldop. “Developers across the world’s leading developer platforms will benefit from accessing advanced network capabilities in partner networks globally through common APIs, accelerating the digital transformation of businesses and the public sector.”

“As one of the leading developer platforms, we look forward to engaging our developer community as we grow the network API business,” he added.