ABI Research’s ‘first-of-its-kind’ study examines the neutral host model, quantifies network costs, cost and energy savings by modelling deployments in Rome and New York

New research shows that Neutral Host Networks (NHNs) are 38% greener and up to 47% more cost-effective than traditional standalone 5G deployments. Neutral Host Networks: A Solution to Greener and Cost-Effective Deployments was researched and written by ABI Research, commissioned by Boldyn Networks which is a neutral host operator.

ABI modelled NHNs against 5G Standalone (5G SA) deployments across New York City and Rome (pictured), which the research house claims is “first-of-its-kind” research. Dimitris Mavrakis, Senior Research Director at ABI Research, stated, “No such project has taken place in the industry so far to quantify and understand the benefits of neutral hosts in a tangible and realistic manner in a commercial environment”.

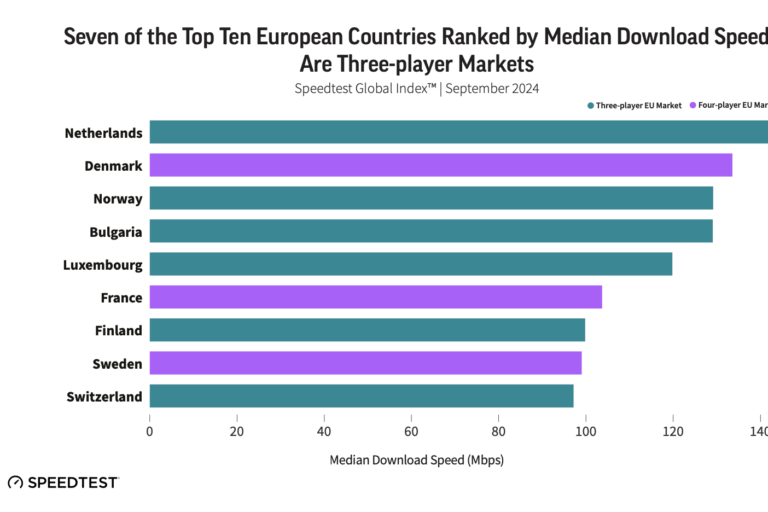

He continued, “Why are we doing this now? Many 5G networks are reaching congestion, especially in the urban locations, very highly populated locations. The next step in the deployment model of these operators is to densify their networks, particularly in areas where fixed wireless access is deployed and is…congesting these networks.

“From the other from the other side of the equation, we see carbon efficiency and energy savings being a very important driver in network deployments now, and as well, as you know, TCO and financial conditions.

“Last but not least, there is a lot of overlap…in centralising processing for network, for example, through a network neutral host deployment model to be used in future technologies like AI and Gen AI. So that’s the scope of our projects

Rising demand for network capacity and 5G’s higher frequencies result in greater densification of base station sites which incur higher costs from building and maintaining new 5G sites, plus a negative impact on national power grids.

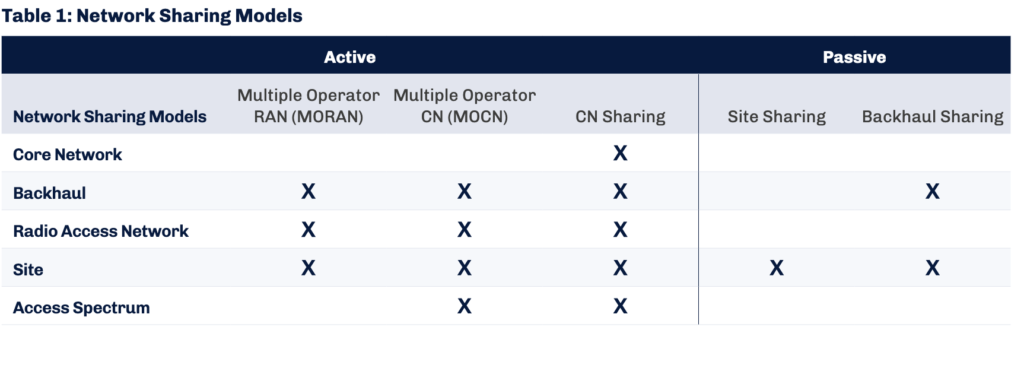

By delving deeper into network sharing models (see below), ABI Research aimed to understand the benefits that such models bring to operators and to the planet.

Main findings re capex and opex reductions

- Costs and energy savings are driven by the consolidation of telecom equipment and the sharing of site installation costs, including but not limited to small cell radios, fibre and power trenching, site maintenance, and site leases

- Small cell equipment needs are significantly reduced in NHN environments, ranging from 40% fewer small cells deployed in dense urban areas, to 47% fewer in suburban areas

- Total savings increase in Greenfield deployment scenarios over Brownfield is significant and primarily driven by the consolidation of capex costs to deploy fibre backhaul and power equipment.

The research simulated two real-world environments where 5G NHNs are being deployed. Based on ABI Research’s understanding of the NHN market, the model assumes an average tenancy rate of 2.4 large operators through to 2028 and a Multi-Operator Core Network (MOCN) sharing model as the preferred mode of network sharing.

Additional parameters including network traffic dimensioning, network architecture comparison and accounting for both Greenfield and existing Brownfield sites were factored in to ensure a realistic simulation of real-world circumstances.

—————————————————————————————————————–

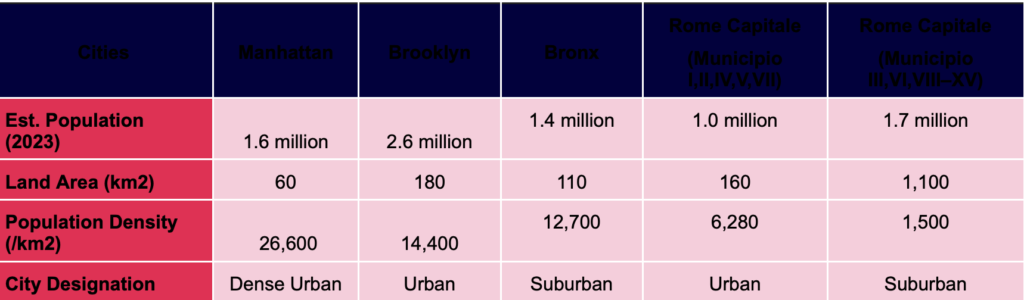

ABI’s model focused on simulating real-world environments where 5G NHNs via small cells are being deployed. This includes:

- New York, which has begun the construction of Link5G towers to support multi-operator tenancy and extend 5G coverage across the city.

- Rome, which has made plans to introduce a shared 5G network across the city via a NHN to provide underlay 5G coverage to consumers and support smart city applications.

The modelled city parameters include:

—————————————————————————————————————–

Significant benefits

“ABI Research’s industry proven network model indicates that there are significant cost, energy and efficiency benefits when considering a neutral host over a traditional network deployment,” said Mavrakis of ABI Research. “Network modelling in New York and Rome shows costs and energy savings as high as 40%, providing a substantial improvement to [operators’ efforts to expand] 5G…ABI Research expects neutral host operators, such as Boldyn, will play an increasing role in network densification efforts in the next few years.”

“As an industry we have the responsibility to roll out new networks in a way that is both cost-effective and sustainable,” said Brendan O’Reilly, Group Chief Operating Officer at Boldyn Networks. “The neutral host model is an elegant, practical solution to reducing capital and operating expenditure for [mobile network operators]. It is also critical to accelerating the adoption of 5G and ensuring the delivery of transformative connectivity services for businesses, people and communities worldwide.

“If the telecoms industry is to truly deliver on the promise of a sustainable, inclusive, interconnected future then mobile operators must consider neutral host a real alternative to delivering future networks.”

To read the full report, Neutral Host Networks: A Solution to Greener and Cost-Effective Deployments, visit this LINK.