This is part of Deutsche Telekom’s plan for an O-RAN-based deployment for networks in Europe

In a blog on the Red Hat website, the authors explain that Deutsche Telekom’s (DT) goal is to establish multi-vendor O-RAN as a solution for high-power, large-scale macro network deployment as part of its network modernisation activities in Europe.

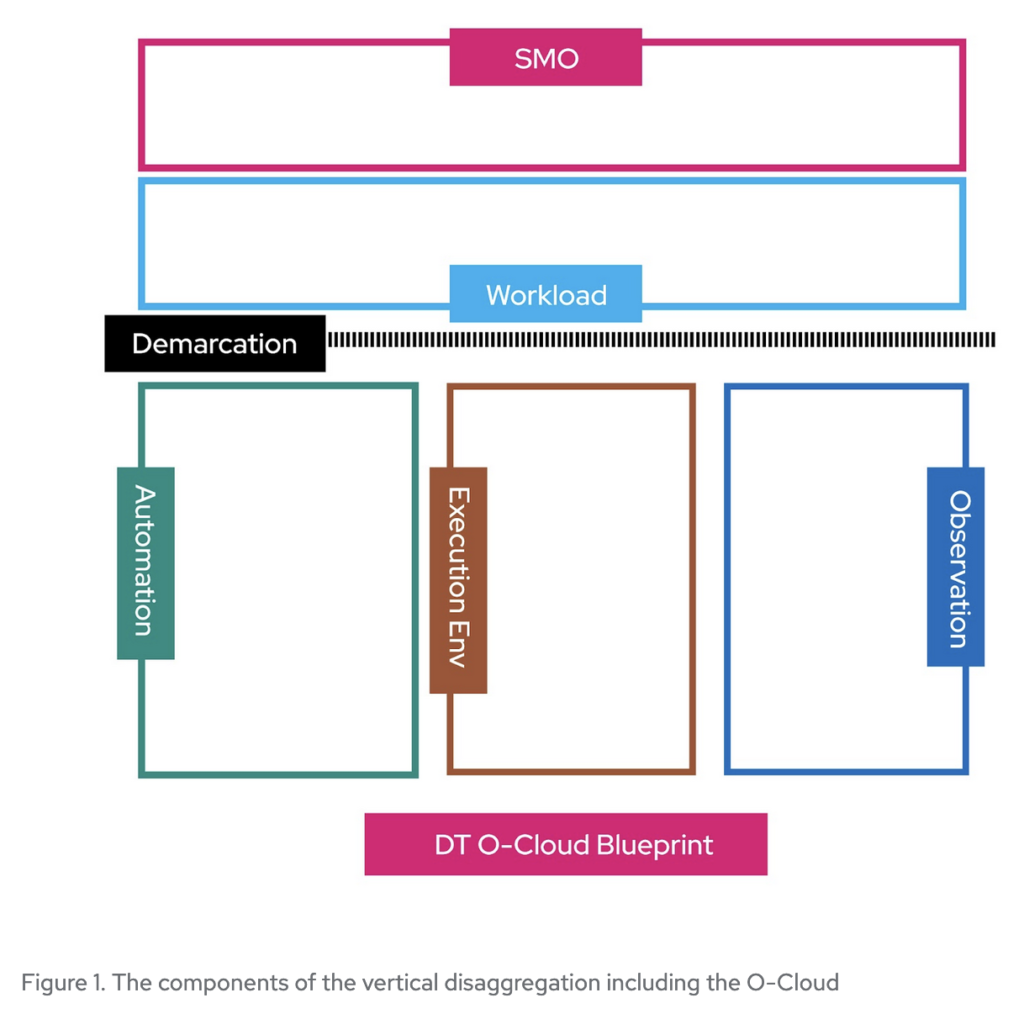

The blog says DT has defined three key pillars in its O-RAN approach to support more options and flexible deployments and advanced automation:

• Open fronthaul to implement and enable RAN disaggregation;

• cloud-based modular workloads with hardware and software separation, via Deutsche Telekom’s O-Cloud blueprint; and

• vendor-independent service management and orchestration (SMO) for consistent, unified control.

Ecosystem collaboration

To these ends, DT is cultivating close industry partnerships and has multiple activities in play both in the lab and live in the field. For example, working with Red Hat and IBM, DT has successfully completed its independent O-Cloud proof of concept (PoC) for RAN.

IBM Consulting helped DT kick off the project in March 2024, aligning the scope alignment with DT’s goals and managing the project, solution design and implementation of essential features of the O-Cloud. They include automation and monitoring of hardware and system integration to achieve integrated, zero-touch provisioning (ZTP). IBM supported the rapid deployment of the solution in DT’s O-Cloud Lab.

Red Hat OpenShift provides the underlying application platform serving as the operating system and container-as-a-service (CaaS) layer. This enables DT to integrate cloud-native network functions (CNFs) from multiple vendors.

DT also used Red Hat’s Advanced Cluster Management, OpenShift GitOps, Topology-Aware Lifecycle Manager and integrated observability to manage and control fleets of workload clusters, in a streamlined way, across their lifecycle.

Red Hat’s Ansible Automation Platform support zero-touch hardware provisioning to speed up DT’s deployment and simplify management. Red Hat’s OpenShift has integral security features such as network and container isolation, and controlled access to application data across the entire software lifecycle.

The trial was completed as planned within six months, demo’ing automated lifecycle management and observability capabilities.

Benefits so far

DT proved that the independent O-Cloud is a robust foundation for its open RAN solution. The PoC fulfilled automation and monitoring requirements for rapid provisioning and deployment with minimal human intervention. The platform integrated hardware and software using open interfaces. The multi-vendor infrastructure gives DT the permanent option of picking the best performing solutions.

Also, the parties gained a shared understanding of what is needed to build out a full cloud RAN stack adhering to DT’s blueprint (see schematic above) with O-Cloud as its target, end-to-end platform for countries in Europe. Ongoing open RAN development is focused on automating onboarding of the centralised unit (CU) and distributed unit (DU), and optimising operational aspects.