In a converged multiplay world, service assurance becomes more important than ever before. With a nod towards Hokusai’s “Thirty-six Views of Mount Fuji”, this white paper describes three views of multiplay convergence (revenue, CAPEX and OPEX) and shows how a converged multiplay service assurance solution benefits all three.

Telenor settles Vimpelcom claim

Telenor has called off an arbitration claim, lodged in January 2011, to protect its voting rights in Russian operator Vimpelcom.

The operator has announced that it has bought 234,000,000 VimpelCom preferred shares from Weather Investments II (Weather), for US$374.4 million. Weather is the investment vehicle through which Naguib Sawiris and his family hold their interests in VimpelCom.

Weather gained its shares in Vimpelcom when Vimpelcom acquired WIND Telecom early in 2011. Telenor protested at the time that it would not accept a diminution in its voting rights.

At the time, Telenor held 36% of the voting shares, but saw that fall to 25% after the Vimpelcom/Wind merger. The deal just agreed now bumps Telenor’s voting share to 36.3%, with Alfa Group’s Altimo Telecom holding 25% and Weather’s voting share reduced from 29% to 18%.

The deal is intended to stabilise the ownership and government of the company, and the parties say they have also “entered into certain put and call arrangements regarding the remaining 71,000,000 VimpelCom preferred shares held by Weather”.

“This transaction takes Telenor to approximately the same voting position as a successful outcome of the arbitration process would have achieved, and is therefore a commercial solution we are happy with,” said Jon Fredrik Baksaas, Telenor’s CEO.

“The withdrawal of the arbitration claim will prevent further dilution of the VimpelCom shareholders, and it will enable a more normal corporate governance situation in VimpelCom. We will work to expand the VimpelCom Board to eleven members.”

“I am very happy about this transaction which will allow Weather to participate actively in the Supervisory Board of VimpelCom, will foster improved corporate governance of the company and ensure a better focus of the management on industrial issues in a context in which the existing disputes among the key shareholders have been resolved,” said Naguib Sawiris.

TE Connectivity announces Copenhagen Metro deal

TE Connectivity supplies DAS to underground system

TE Connectivity today announced that its FlexWave Prism Distributed Antenna System (DAS) has been deployed to provide clear and consistent mobile coverage for multiple mobile operators throughout the Copenhagen Metro subway system. The subway system spans 21 km from the island of Amager to Copenhagen City in Denmark. The TE Connectivity DAS covers the underground section of two nine km parallel tracks as well as eight underground stations in the centre of Copenhagen, providing mobile service in the most important part of the metro system and connecting Copenhagen City to the airport. The Metro and DAS services more than 1,000,000 passengers per week.

The FlexWave Prism system replaces a legacy DAS that was having performance and reliability problems. In addition, the older DAS had active elements in train tunnels – it was necessary to maintain these active elements, however access to the tunnels was severely restricted. The FlexWave Prism system eliminated active elements in tunnels and lowered the number of active elements in the system from more than 50 to 13, significantly reducing maintenance costs while improving reliability. In fact, the Prism remote units are virtually maintenance-free. Another significant saving is the removal of the eight local base station locations deployed throughout the Metro with a central base station hotel, which supports multiple operators from one central location, reducing OPEX and improving reliability.

The new DAS is project managed by Niras, supports GSM900, and can be easily upgraded to support DCS, UMTS-HSPA, and LTE services. The all-digital RF transport throughout the DAS ensures consistent power levels and performance everywhere in the system, no matter how far a remote unit is from its base station. This is a significant improvement of the pervious cascaded system, with improved downlink and uplink signal levels, quality and higher data performance.

“With its combination of stations, tunnels, and elevated trackways, the Copenhagen Metro was an ideal candidate for our FlexWave Prism DAS, and we are honoured that the Danish mobile operators selected our solution for this strategic and important infrastructure in Copenhagen,” said Chris Jurasek, vice president and general manager, Wireless and Services at TE. “Our success in Copenhagen follows other major urban street level and subway deployments, demonstrating that our solution scales to meet the needs of any urban transportation system.”

Femto Forum Becomes Small Cell Forum

The Femto Forum today announced it is to be renamed the Small Cell Forum.

The Forum will address all small cells that operate in licensed spectrum, are operator-managed and feature edge-based intelligence – including what have been dubbed femtocells, picocells, microcells and metrocells. It will also support the crossover between small cells and other relevant technologies including: Wi-Fi, cloud RAN (which connects cellular radio to cloud-based intelligence over fibre), Distributed Antenna Systems, as well as macrocells as part of the new heterogeneous network (hetnet) environment.

The role of the Small Cell Forum will be to tackle the practical challenges facing deployment. This includes finding appropriate small cell sites; delivering power and backhaul; managing interactions between small cells, macrocells and other wireless technologies; and effective interoperability and network management. This continues the work of the Femto Forum which has been actively working on small cells outside the home for some time, as well as their interactions with other technologies. Examples of this work include integrated Femto/Wi-Fi devices and networks; enterprise multi-femto architectures; public access small cell interference management; standards and management processes which are generic across all small cell types; and LTE small cell standards for all environments.

“Femtocell technology was originally designed for the home but has since extended into enterprise picocells, urban metrocells and modern microcells for all manner of locations. The core technologies developed by members of the Femto Forum – including Systems on a Chip, provisioning systems, standardised gateways, and other related innovations – lower the cost of licensed band solutions and facilitate easy deployments for all small cell products. As such it is the ‘small cell’ banner that now best represents these technologies,” said Simon Saunders, Chairman of the Small Cell Forum.

A new orthodoxy?

Alcatel-Lucent began the week by launching its new CEM portfolio. This might just be the dullest opening sentence to a weekly newsletter ever, but there is some importance to it.

What we are seeing is the major network equipment vendors continue to reposition themselves not as, just that, equipment vendors, but as enablers of Customer Experience Management. The fact that you might buy a few base stations from them is incidental to the most important thing, helping you position yourself as the most proactive, responsive, intelligent goddam service provider out there.

How to do this, or how to be this, is something the NEPs profess enormous knowledge of, although, of course, that’s not new. They have been building up their managed services and consulting capability for years, and all that professional services capability needs something to be professionally serving. Alcatel-Lucent in particular has long had a long suit in BSS. I can remember seeing presentations about its end to end services capability years ago, drawing on convergent charging and billing capabilities, through OSS skills (really network element management), service creation and delivery, through to the actual network equipment itself. NSN bought subscriber data management specialist Apertio in 2008, and built a SDM and now CEM practice on that acquisition, adding it to its existing network data smarts. Ericsson too has had major presence in charging and billing type solutions through the likes of LHS and now it has added Telcordia, which gives it a big boost in OSS stuff like service assurance. All of them, of course, offer those network and systems integration capabilities.

So the vendors realised a while ago that all the data they have churning out of their switches, through their charging and billing systems, through their element management and monitoring systems could, if used in association with more customer-facing data,such as charging and billing info, be very useful stuff to an operator looking for an edge.

The battle is not so much in convincing operators the worth of this. They are on board, and have pushed off from the quayside already. Many operators, for example, have a Chief CEM Officer, or similar, who is in charge of making sure that right across the business, units are thinking about what they do in terms of how it affects the customer experience.

The battle is, why work with the NEPs? This is really about shifting data around business units, or rather making data available to business units in a way that makes sense to that unit. And the NEPS, even if they are accepted as being the sort of companies who could do this are (excepting NSN) late to this game. The major players like Amdocs, Oracle, HP, and a host of companies with more focussed, point solutions, are already out there. There have been some big investments in NEP CEM: they are not all going to pay off.

Now, here’s something that might put a dent in a few power point presentations at Mobile World Congress – evidence from Vodafone that is is seeing the annual doubling in data traffic volume start to look more like an annual 20% growth in volumes. For the second quarter in a row the operator said that it had matched data volumes to data revenues growth, at around 20%. I don’t know how many business cases are being built on projections of continuing “n” times growth in mobile data traffic, but it certainly spans everything from new antenna design to WiFi offload to content optimisation to network optimisation to the perceived need for operators to charge content providers for driving bandwidth demand.

It’s just one operator, of course, and a couple of quarters, and there are still many users out there yet to get on the smartphone train. But it will be interesting to see if a new orthodoxy builds around the view that policy, user controls and traffic management have done their job, and the networks are coping OK, thank you.

Indeed, perhaps we’ll go back to seeing demand for solutions that drive traffic across the network, as the operators look to up their data packages. Guaranteed HD video over mobile as a differentiator, anyone?

Rebtel Surpasses 15 Million Users and 500 Million Calls

Rebtel, the world’s largest mobile VoIP company after Skype (based on revenue), today announces it has hit 15 million users worldwide. Rebtel has made significant strides since its inception in 2006 with a total of 500 million calls ever made and two billion minutes of international calls logged.

Rebtel has been profitable since 2010 and its average revenue per user (ARPU) is three times higher than Skype. Skype currently operates an ARPU of around $8 per month; Rebtel’s ARPU is around $24. Rebtel’s figures show it increased revenues by more than 55% in 2011 and hit $60 million in revenue. Its predicted the revenue run rate for December 2012 lies at $95 million. The milestones come at critical time in the company’s history as Rebtel is currently growing at a rate of 500,000 users per month.

The company attributes its success to its dedication to core business values of transparency, honesty and cutting-edge innovation focused on helping people communicate internationally. Its customer loyalty is high with 96% of users stating they would recommend Rebtel to a friend during its customer satisfaction survey in December 2011. Rebtel’s word of mouth recommendations are an integral part of its growth as it drives registrations and accounts for over two-thirds of new user registrations.

Andreas Bernström, CEO at Rebtel, says: “2011 was a great year for us. Our new set of international calling apps with KeepTalking technology were well received; we generated 13 times more downloads in Q4 than Q3 as a result of the launch. We also expanded the our workforce by almost 50% and increased our user base by 50% to 15 million users. 2012 will be more of the same. We are focused on growing our user base, we aim to add up to ten million to our user base this year, as well as maintaining high revenue run rates and ensuring our apps are viral as they can be.”

Counteracting the capacity crunch with active antennas

Whether you believe the capacity crunch is a real ongoing concern for mobile operators or think it something they are increasingly coming to grips with, there’s no doubt that operational and capex pressures will mean that spectral and network efficiency will remain an ongoing concern for operators. Here, in the latest guest post we have selected, Mark Bole, of Mesaplexx, highlights the role of Active Antenna Systems as a potential part of the operator toolbox.

Counteracting the capacity crunch with active antennas

There are a wide variety of potential solutions to the capacity conundrum including: site densification, small cell deployment, new spectrum acquisition, WiFi offloading and data capping. Each has their own pros and cons – some delivering capacity improvements from a few per cent to over fifty per cent compared to what is being achieved today.

Then of course, there is the emergence of LTE and ultimately LTE-A. The next evolutions of the GSM family of technologies will deliver improved network capacity on new frequency bands, but not enough to appease increasingly impatient mobile subscribers on their own. LTE must be deployed in a way that maximises its potential. When implemented with active antenna systems (AAS), LTE capacity can be improved by a further 65 per cent or more.

AAS can achieve these dramatic improvements through accurate and intelligent beam steering techniques. These differ from a traditional fixed beam approach by targeting capacity to where it is specifically needed in the network. Beam steering in this way improves the quality of the radio channel and increases network efficiency. This has been proved by recent trials in the US where a leading operator has used AAS to increase existing cell capacity by as much as 40 per cent across the network and by 200% at cell edges.

Implementing AAS will enable operators to not only shape their networks to meet current capacity demands, but also effectively adapt and respond to demand spikes in the future. AAS, for example, can enable separate tilts for uplink and downlink to deliver significant capacity gains. Furthermore, AAS eliminate significant amounts of signal loss by placing the radios at the top of the site mast, removing the need for expensive coaxial cables. AAS also allows operators to dispense with remote radio heads and tower mounted amplifiers, vastly reducing site costs and power consumption, creating cleaner, greener networks.

So, with all these benefits, why haven’t AAS become the bedrock of operators’ next generation network infrastructure? The truth is that a number of issues have emerged which prevent AAS from performing to their full potential, all linked to one of the technology’s smallest components – the radio filter.

Current active antenna radio filters are eating up capacity. They are causing too much loss, weakening critical signal strength, and generating excessive heat in the process. Since multiple radios and filters are required to make the beam steer, reducing heat has been a real challenge. This extends to delivering multiple technologies on multiple bands as these capabilities again require having multiple radios and filters inside each antenna housing, generating heat that must be dissipated.

The vendor community is rising to the challenge, investing vast sums in R&D to develop a compact, cool running, low loss, high isolation filter that can improve sensitivity and handle much more power. Until such a filter has been developed, AAS will continue to fall short in its attempts to increase network coverage and deliver its 65 per cent capacity gains.

In this highly competitive market, the vendor that is first to market with a multi technology AAS that can deliver its true potential, at the right price point, will reap significant rewards. While the most urgent requirement for capacity is in Western Europe and the US, demand for mobile data services continues to increase at unprecedented levels all around the world. On top of this, the rise of smartphone ownership means that operators have to satisfy higher levels of QoS and service delivery expectations of data-hungry subscribers. With smartphones now used for an increasing number of applications including real-time navigation, videoconferencing, social media updates, gaming and shopping, there is no room for poor quality connectivity.

AAS are not a silver bullet either, but innovations in filter technology can make AAS a real force multiplier for LTE. In addition, AAS are a straightforward way of gaining significant capacity increases from existing sites and infrastructure, and the promise of a 65 per cent capacity improvement is worthy of serious consideration.

Ixia adds VoLTE and VoIP test capabilities

Ixia has introduced a test application to its IxLoad solution to measure voice quality from the radio network through the core network. The application is intended to enable operators to compare voice quality of over-the-top (OTT) service to operator-provided voice services by measuring the mean opinion score (MOS) of voice quality before going live. Additionally, Ixia’s new application tests the functionality, scalability and resiliency of LTE infrastructure components and new IMS networks that support VoLTE-based services.

Ixia’s IxLoad is a unified test solution for testing all aspects of wireless networks, including LTE base stations, core network components and the IMS subsystem. IxLoad supports a broad set of test applications measuring the scalability and capacity of data applications, the quality of rich media services, and the evaluation of security vulnerabilities.

“Mobile VoIP subscribers (Over the Top) growth is predicted to be 386M in 2015, led by Skype and GTalk Mobile, but generating little revenue. Now operators must compete to preserve their $500 billion per year in global business under attack,” said Stéphane Téral, principal analyst at Infonetics Research. “VoLTE is the solution that allows operators to offer a differentiated solution. This important demonstration shows that Ixia can test VoLTE implementations so operators can go to market with confidence.”

“The demand for high-definition voice and other media-rich features is growing with the number of mobile users and devices accessing the Internet. Operators must be sure that their new LTE networks can deliver high quality voice services,” said Joe Zeto, senior manger, market development at Ixia. “Ixia’s new VoLTE test application allows operators to validate their networks under realistic conditions.”

Ixia fact sheet:

- IxLoad measures voice quality by a mean opinion score (MOS) using E-model and perceptual estimation of speech quality (PESQ) algorithms

- IxLoad’s high RTP performance supports more than one million concurrent calls with media per chassis

- IxLoad measures control plane and media latency which can be used to understand call setup latency

VoLTE features include:

- Support of the GSMA IR.92 specification

- Emulation of SIP endpoints to initiate and receive voice calls and SMS texts over eGTP

- Emulation of the IMS network (P-CSCF & MGW)

- AMR and AMR-WB codecs

- AKAv1 & AKAv2 authentication

- Default and dedicated bearers

Don’t mind the gap? Vodafone results

Vodafone’s data revenue growth continued to match its traffic growth in the last three months of 2011 — puncturing the current industry orthodoxy that data traffic growth is running out of control, threatening profitability as a result.

The operator reported data revenue growth in its third quarter (Oct-December 2011) of 22%, and traffic volume growth of 20%.

CEO Vittorio Colao told Mobile Europe on a results call this morning that the operator had achieved parity between revenue and traffic growth by “proactive management”, especially of “ultra high” data users, mainly through more targetted tariff and traffic management. The slowdown in the growth rate of bandwidth demand on the network was also “a little bit the numbers” he said, meaning that previously high rates of growth were bound to slow a little in any case.

Many operators reported a doubling of data volumes year on year from 2008 to 2010 and many industry projections assume this will continue. The recent slowdown in Vodafone’s data volume growth across the group casts some doubt on those forecasts. It is possible that there will be a second wave of growth, however, as smartphone penetration increases, and LTE networks are rolled out.

In fact in the UK, a market with a combination of high smartphone penetration, high data usage (84% of Voda customers have a data tariff) and a competitive market, Vodafone did see a slight gap between data traffic and service revenue growth. Data revenues grew 13% with traffic growing 20%. But across the group Vodafone reiterated its position of the 2nd quarter, that it had closed the gap between data revenue and traffic growth

However, although data revenues are growing, they are only part of the story. Overall, Vodafone saw service revenues rise by just 1.7% in Europe, and Group revenue reduce by 2.3%. The operator said that Mobile Termination Rate cuts in some markets, as well as declining revenues in Southern European markets, were adversely impacting results.

Excepting Turkey, there was a North/South divide in results, with Germany and the UK seeing slight rises in revenues, and Spain and Italy contributing declines of 8.8% and 4.9% respectively.

“We continue to grow revenues, compensating voice decline with data growth and emerging market growth, as well as continued growth in enterprise,” Colao said. Voice revenues declined 4.7% year on year, but still account for 70% of all revenues.

Although there was a small stir around the “revelation” that Vodafone is removing cash from Greece at the end of every day, Colao emphasised that this has been the case for every operating unit in the group for the past ten years. The company operates a centralised treasury, which is “good and normal practice”, he added.

Alcatel-Lucent launches expanded CEM portfolio

Alcatel-Lucent has announced a major Customer Experience Management (CEM) software launch. Bundling existing BSS and OSS software with a variety of new packages, the company is aiming its Motive Customer Experience Solutions (CXS) portfolio squarely at the growing need within operators to reduce churn and increase revenues by improving all aspects of the customer experience.

Greg Owens, Director, Customer Experience Solutions Marketing, Alcatel-Lucent said, “We are launching a brand new portfolio to help service providers define and execute on their CEM strategies.

“We’ve taken our existing assets and brought them into one unified portfolio in the company. We’ve also recognised that we have had gaps and we’ve filled those with some active investments in new technology.”

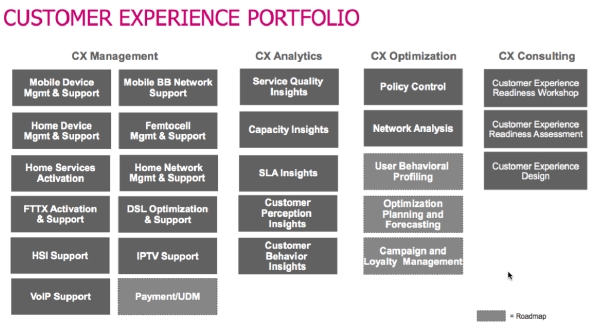

CSX is formed of four main elements, Management, Analytics, Optimisation and Consulting. (See left) Each suite contains existing Al-Lu software and a few new elements.

Owens said that new elements included the mobile device management and mobile broadband network packages within the CX Management suite. The CX Analytics suite also has new its elements: with its Customer Behaviour Insights and Perception Insights being based on “new algorithms” developed by Bell Labs.

Me too from Al-Lu?

So is Al-Lu following the herd with its CEM strategy, or is it attempting something different? NSN is already very active in highlighting the strategic importance of its CEM software both for its customers and for its own business, and Ericsson and Huawei are also expected to make CEM launches before or at MWC.

Owens said, “The way we are going to market is very different to the way NSN and Huawei and Ercisson think of [CEM]. We do think we are unique in this space. We think a lot of companies take a narrow perspective: they want to talk about this in the context of the network, and we say it’s about the customer. They want to talk about in the context of mobile, and we also think it’s about what happens at work and home as well.”

Owens added that this is not a market that Al-Lu has come to lately. “CEM is something that we have always been interested in; we have been in this area for the better part of last 12 years,” he said.

Owens added that operators were at an inflexion point in the market because a “sea change of events” happening at the same time hasmeant that “the things they relied on to compete and win no longer work.”

To respond, operators are recognising they need to move from a growth-based “land grab” to a model that focuses on customer attention and retention. And to do that they need software tools that allow them to analyse their network data, their device and application level data and to make sense of that to different business units within the operator, including marketing, CRM, technical and networks units.

The breadth of Al-Lu’s portfolio will be a key strength, Owens said. Although many operators are creating a CEM advocate or chief CEM officer, responsibile for CEM delivery across the business, all operators have different requirements and start from different places, he added.

“Our portfolio allows us to walk into an executive who is charged with making sure CEM strategies filter through the whole organisation and say that we can collaborate with you to build that vision and strategy. We can go to different business teams with nimble and flexible solutions that we can work into their business processes based on that day’s immediate needs.”

So what does Owens make of operators’ attempts to transform their CEM capabilities to date?

“I think they will all tell you that they are in a great position to own the customer experience and that they want to own it, but they will also say they have lots more options to explore and innovations to make to truly capture the voice of the customer. There’s much more they can do in the context of improving the channels they’ve already established.

“The thing they are struggling with the most is that CEM change requires a broad initiative that impacts every employee in the business, so they have to get around the organisational challenges. But by no means are they sitting back. Our perspective is that this is a crawl, walk, run process and we expect material advances by the end of the year.”