Last week the Latin American operator’s board said that the bid undervalues the company whose shares have risen more than 33% this year

The French billionaire, Xavier Niel, has a made an offer for the stake of operator Millicom he doesn’t already control via his investment vehicle Atlas Investissement. The vehicle is already the largest shareholder with 29%. The move is a few weeks after the billionaire’s investment vehicle, Atlas Investissement, acknowledged it was exploring the possibility of buying out the operator to quell media speculation.

The bid made on 1 July offers $24 per share, valuing the company at more than $4 billion. Last week Millicom’s board last week said this undervalued the operator given its expected financial performance. Its shares have risen more than 33% this year.

Millicom’s shares are traded in the US and Sweden. Atlas Investissement launched its bid in both countries simultaneously. If it goes ahead, it will cost about $2.9 billion.

Under Swedish law, Millicom’s board must either take a position or declare itself neutral regarding the bid and produce an independent assessment.

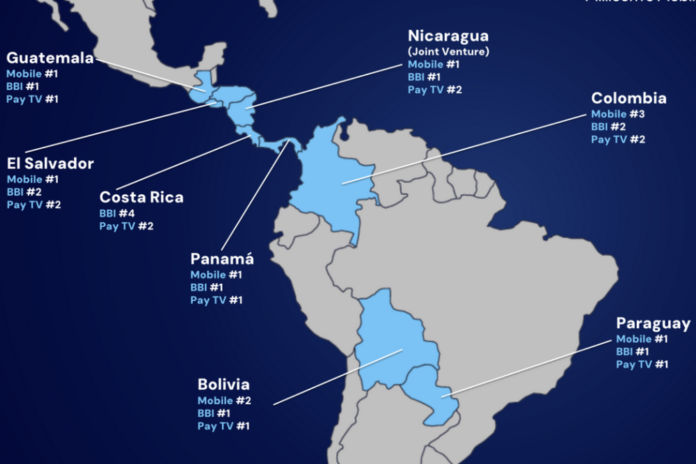

The would-be acquirer says it would continue to execute Millicom’s strategy of expanding the reach and capacity of its networks. The map above shows its Latin American opcos.

The would-be new owner said it would continue to support the operator’s strategic plan and would target “expanding the reach and capacity of Millicom’s networks and distribution capabilities to grow its customer base”.

Niel’s other telecoms enterprises include the Iliad Group, which operates under the Free brand in Italy and France, and Play in Poland.

In February, Freya Investissement has entered into a binding agreement with investment house Kinnevik to acquire its entire shareholding in Tele2 for SEK 13.0 billion (€1.16 billion) in cash. This equates to a stake of about of about 19.8% in Tele2.

Freya Investissement is an investment vehicle jointly owned by Iliad and NJJ Holding.