While challenges remain, many are being addressed and other ‘facts’ about the tech – for example, that total cost of ownership is key – turned out to be wrong

A new report, Open RAN looks a real-life deployments and proofs of concept from Rakuten Mobile, Germany’s 1&1, Vodafone, Telenor Group, DISH Wireless and more, as well as next steps. The report – Open RAN, evolving to fulfil its promise, commissioned and published by Mobile Europe – starts by setting out what open RAN is, and what it is not, as there is considerable confusion in the industry about this.

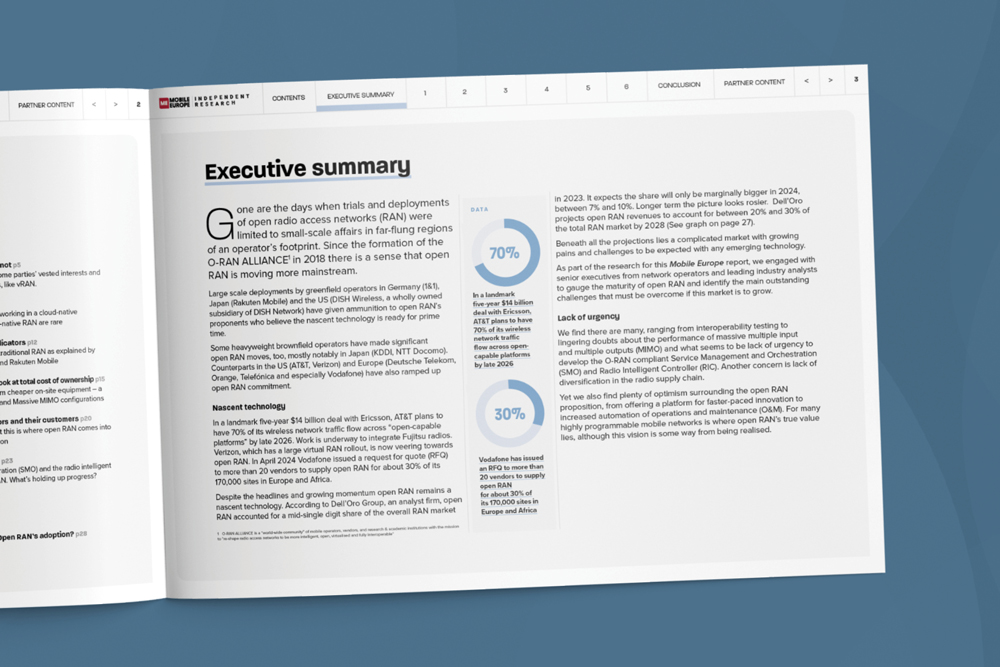

As part of the research, carried out by Ken Wielend who also wrote the report, we guaged the maturity of the tech from interviews with senior executives from network operators and leading industry analysts to gauge the maturity of open RAN and associated technologies, including virtual RAN (which is not the same as open RAN) and open cloud RAN (still in its infancy).

We found the main challenges range from the costly duplication of interoperability testing to lingering doubts about the performance of massive multiple input and multiple outputs (MIMO) and what seems to be lack of urgency to develop the O-RAN compliant Service Management and Orchestration (SMO) and Radio Intelligent Controller (RIC). Another concern is lack of diversification in the radio supply chain.

In the meantime, all parties need to be careful of comparing open RAN with traditional RAN, based on wrong preconceptions and inappropriate metrics. As Terje Jensen, Head of Network and Cloud Technology Strategy at Norway-headquartered Telenor Group, says, simpler open RAN radio configurations (4T/4R) are already “in the ballpark” with traditional RAN equipment when it comes to coverage, capacity, efficiency and stability. The trajectory, he says, is to be “on a par” with kit from several suppliers by the end of the year.

Nonetheless, he warns that generalised statements about open RAN’s performance compared with traditional RAN in the macro network can be misleading, as performance metrics among traditional RAN suppliers are markedly different. “One thing is to do theoretical and lab comparisons,” he says, “but the more accurate benchmarking will likely come from larger-scale, live network deployments.”

Yet we also find plenty of optimism surrounding the open RAN proposition, from offering a platform for faster-paced innovation to increased automation of operations and maintenance (O&M). For many highly programmable mobile networks is where open RAN’s true value lies, although this vision is some way from being realised.