Based on preliminary stats, overall webscalers ended 2020 with just over $1.7 trillion (€1.44 trillion) in revenues, up from $1.45 trillion in 2019.

While the growth is due to several factors – including acquisitions, a strong digital advertising market and increased cloud spending across verticals during the pandemic – MTN comments, “Webscalers have been attacking the telco vertical for several years. Since the close of 4Q20, over the last three months the webscale sector’s efforts to engage telcos have picked up steam.

“A number of telcos have recently announced new deals with webscalers in the areas of edge computing, service development, digital transformation, and workload shift.

“At the same time, more traditional suppliers to telcos (such as Nokia) have expanded their own collaboration with the cloud providers who dominate the webscale market.

“These deals aim to differentiate [between] traditional telco vendors, prevent webscalers growing too fast in the market, and save costs for telcos.”

Key developments in Q1

Telefonica engaged IBM to act as a systems integrator for an open RAN trial in Argentina.

TIM Brasil announced it migrate all its on-premises workloads to the cloud, using Oracle Cloud Infrastructure (OCI) and Microsoft Azure, including mission-critical applications. The idea is to optimise and simplify the management of its IT infrastructure while improving scalability and agility.

In March, Liberty Global’s Belgium unit, Telenet chose Ericsson, Nokia and Google Cloud for 5G deployment.

Nokia in the clouds

Nokia was by far the most active of telco-focused vendors in 1Q21, announcing several collaborations with the webscale sector.

In January, Nokia announced partnerships with Google Cloud Platform (GCP) to develop cloud-native 5G core solutions. Nokia is supplying its voice core, cloud packet core, network exposure function, data management, and 5G core, while GCP’s Anthos for Telecom platform will be used t deploy applications.

In March, Nokia expanded its work with GCP, announcing it would also partner to develop cloud-based 5G radio solutions. The collaboration leverages Nokia’s RAN, Open RAN, Cloud vRAN and edge cloud technologies with GCP’s edge computing platform and application ecosystem.

Initial efforts centre around Cloud RAN and aim at integrating Nokia’s 5G virtualized distributed unit and virtualized centralized unit with Google’s edge computing platform running on Anthos. Nokia aims to certify its AirFrame Open Edge hardware with Anthos.

At the same time as the March GCP announcement, Nokia announced deals with Microsoft and Amazon.

Playing the field

The Microsoft agreement is intended to develop “new market-ready 4G and 5G private wireless use cases designed for enterprises”, combing Nokia’s Cloud RAN, Open RAN, radio access controller, and multi-access edge cloud technologies with the Azure Private Edge Zone.

With Amazon Web Services, Nokia and AWS will conduct joint R&D into enabling Nokia’s RAN, Open RAN, Cloud RAN, and edge solutions to operate “seamlessly” with AWS Outposts. The goal is to develop new customer-focused 5G solutions.

Per Nokia, “operators will be able to simplify the network virtualization and platform layers for the Core and RAN network functions by leveraging the agility and scalability of cloud.” Ultimately Nokia will be able to leverage Amazon services like EC2, EKS, Local Zones and others to help automate network functions and deploy end customer applications.

Intel attacks

MTN points out that Intel, which has attacked the telco market aggressively over the last few quarters, signed a deal with GCP in February to develop “reference architectures and integrated solutions” for telcos to enable 5G and edge network solutions.

The collaboration involves three main aspects: virtualised RAN and open RAN solution development; a network functions validation lab; and service delivery to the edge.

Israeli telco vendor Radcom announced the integration of its 5G assurance solution (ACE) with Microsoft Azure. Radcom says that the integration of ACE with Azure “enables operators to assure the quality of 5G services by leveraging AI and machine learning-driven assurance and automation” ACE runs as a cloud native function over the Azure Kubernetes Service.

MTN reckons that vendors’ collaborations with webscalers will continue throughout 2021, no doubt.

Mavenir’s SVP for Business Development, John Baker, addressed this trend indirectly in a January interview with SDx Central: “I really do believe the hyperscalers are going to become the new telecom providers going forward…Apart from the physical radio that goes on a tower, everything we’re doing now follows the data center model, and these guys know how to manage data centers, software, and applications.”

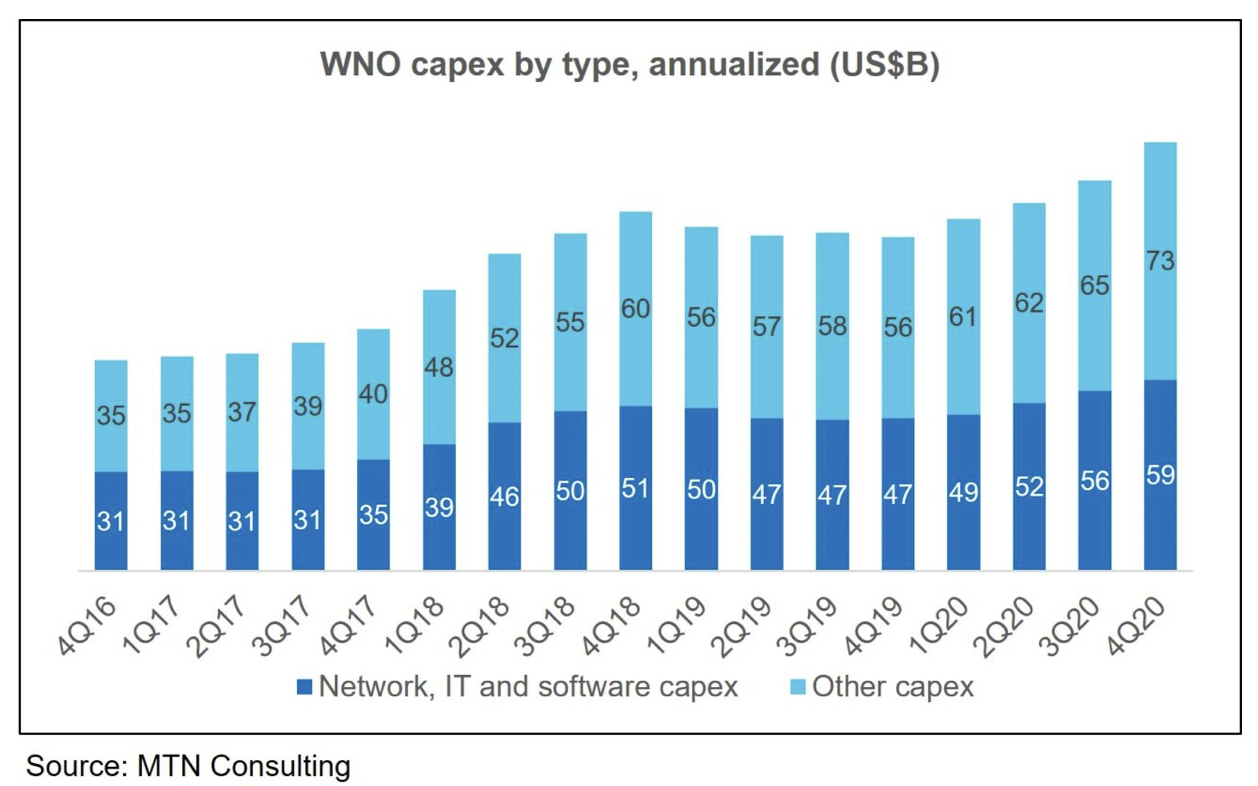

For webscale operators to support all these new activities requires heavy investment in network infrastructure. The figure below shows CapEx by type, on an annualized basis, for the total webscale network operator market since 2016.