The long running saga of MTN’s dissatisfaction with the towerco’s governance seems to have drawn to an end

Following the announcement last week that IHS Towers and MTN Group had renewed and extended communications infrastructure deals in Nigeria, as well as completing the renewal of all contracts across IHS Towers-MTN markets recently, the companies have announced that, with the commercial relationship now firmly established for the next decade, they will now work constructively to find a mutually agreeable resolution to governance issues previously raised.

Wind back a year and IHS was embroiled in dissent from the towerco’s largest investors including MTN, Wendel and Blackwells over governance and a lack of transparency. MTN’s issues stemmed from IHS Towers’ decision to reportedly cap MTN’s voting rights at 20%. The telco had said that it could not sell its non-voting shares and wanted its stake in the company to be reflected in its voting power. In 2022, the tower company acquired 5,701 towers from MTN. However, MTN owns 26% of IHS Towers through its subsidiary Mobile Telephone Networks (Netherlands).

The spat culminated in MTN awarding competitor American Tower the chance to take over 2,500 of its network sites from IHS Towers’ local subsidiary starting in 2025. In December, IHS has offered improved commercial terms to MTN Nigeria to stop the transaction in its tracks and hold onto the contract.

On 7 August 2024, the companies announced an agreement to renew and extend all Nigerian tower Master Lease Agreements until December 2032. The contracts include new financial terms that provide what the parties believe to be a “more sustainable split between local and foreign currency”. With this deal, IHS Towers and MTN Group have now completed the renewal of approximately 26,000 MTN tenancies on IHS Towers infrastructure across six African markets – Nigeria, Rwanda, Côte d’Ivoire, Cameroon, Zambia and South Africa.

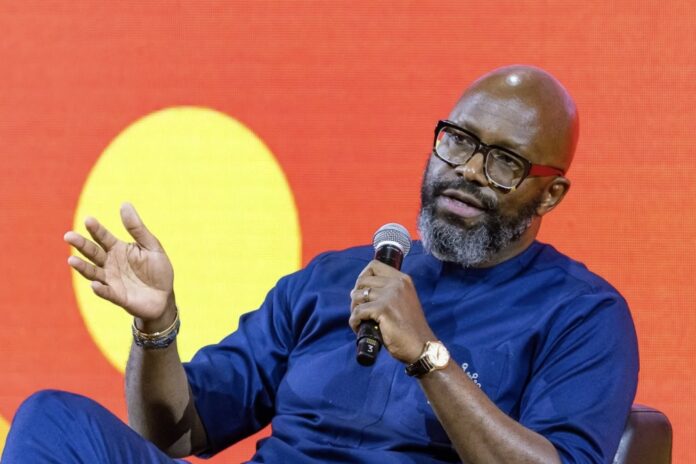

“The renewal of the various contracts across our markets into the next decade put MTN operations in the respective markets onto a more sustainable footing. We remain focused on ensuring our networks are well invested, have high availability and have the headroom to meet the growing and structural demand for data going into the future,” said MTN Group president and CEO Ralph Mupita (above). “These renewals are key to those priorities. We look forward to working constructively with IHS on the outstanding governance issues now that commercial arrangements have been concluded.”

“As our largest customer and longest serving partner, we are proud to have completed the renewal of all tenancies with MTN Group in our African markets,” said IHS Towers chairman and CEO Sam Darwish. “Today, we reinforce our strategic relationship and commit to increased operational stability, by securing our revenue streams into the next decade, and leveraging our shared innovation to deliver critical connectivity and support digital inclusion across the African continent.”

He added: “We are excited by the next phase of our commercial partnership and welcome the opportunity to work constructively for the benefit of the end user.”

Nigerian deal details

Last week, IHS in Nigeria, a subsidiary of IHS Towers and MTN Nigeria announced an agreement to renew and extend all Nigerian tower Master Lease Agreements until December 2032, covering approximately 13,500 tenancy contracts. With regards to the approximately 2,500 MTN Nigeria tenancies that had been due to expire at the end of 2024 and in 2025, under the new terms IHS Towers will renew 1,430 tenancies (including new colocations). MTN is Nigeria’s largest mobile network operator, with approximately 79 million subscribers.

Under the new terms, there is a US dollar component that will continue to benefit from annual escalators linked to US Consumer Price Index, a NGN component that will benefit from escalators linked to Nigerian Consumer Price Index, and a new component indexed to the cost of providing diesel power, introduced to act as a hedge against diesel prices and FX fluctuations.