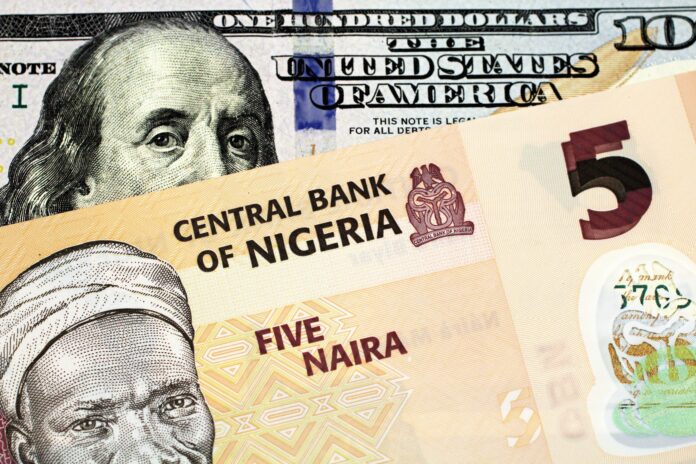

The cost of doing business in the country has soared now its currency is not pegged to the US dollar

MTN Nigeria Communications has posted a loss after tax of N137 billion (about €79 million) for the 2023 financial year, despites its service revenue increasing 22.4% to N2.5 trillion.

Likewise Airtel’s revenue in Nigeria for the nine months ended 31 December 2023 fell 21.96% to $1.24 billion (€1.144 billion) from $1.59 billion although in constant currency, the firm’s revenue grew by 22.7%.

Airtel operates in 14 African countries. Nigeria had been the most profitable, but over the last nine months, its Francophone markets (Niger, Chad, Rwanda Democratic Republic of Congo, Republic of Congo and Gabon) have reported impressive growth of 8.5% overall on the previous year.

The fall is the result of Central Bank of Nigeria’s decision to let the naira trade freely. It had been pegged against the dollar for many years. The naira has fallen 70% against the American dollar since June 2023 meaning the cost of doing business in Nigeria has soared, aggravated by inflation as well as the plunging exchange rate.

Towering costs

MTN is Africa’s biggest mobile services providers by subscribers and Nigeria accounts for about a third of its revenues. An example of how its operating costs have risen is that MTN Nigeria leases almost 16,000 towers from the independent US towerco IHS Towers.

As MTN Nigeria’s tower leases are indexed to the dollar, costs are estimated to have increased by 45-50%. MTN owns 26 per cent of IHS and is at loggerheads with the towerco over governance and is demanding voting rights commensurate with its stake. Last autumn MTN Nigeria announced its intention to switch from IHS to American Tower Corporation for some 2,500 sites.

Karl Toriola, CEO of MTN Nigeria, said in a statement, “This development contributed meaningfully to the upward pressure on the cost of doing business in Nigeria, and for MTN Nigeria in particular, significantly increased the costs in relation to our tower leases.”

MTN group’s annual results are due to be announced on 25 March. Although its Nigerian business has been dealt a severe blow beyond its control, the operator reported a 45% increase in data traffic, and a 49% rise in mobile money transactions.