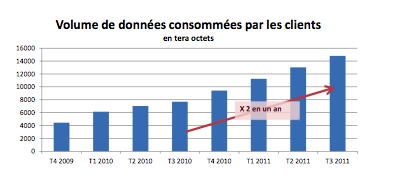

French mobile operators saw overall service revenues decrease for the second quarter in a row in 3Q 2011, according to regulator ARCEP, despite a 40% jump in SMS usage and a doubling of mobile data volumes year on year (see chart: left).

ARCEP claimed SMS usage jumped 42% year on year, with 35.7 billion SMS sent during Q3 2011 — 10.5 billion more than the previous year. An increased number of tariffs that include unlimited texts and/or calls were responsible for the SMS growth, ARCEP said. The regulator added that its efforts to decrease SMS termination rates had also led to an increase in SMS traffic. However, the regulator neglected to reference its earlier work that showed that SMS volume growth in fact levelled off throughout 2011. Much of the gain in messaging volume was made in Q42012 and Q12011, before numbers levelled off in the latter quarters.

ARCEP was understandably keen to portray the usage growth as a result of actions it had taken as operator to cut prices for consumers.

In that light, the regulator also stated that termination rates had led to a quadrupling of VoIP calls being made from fixed VoIP connections to mobile phones, in just a year. Successive decreases in mobile call termination charges ordered by ARCEP – down to €0.02 on 1st July 2011, then to €0.015 on 1st January 2012 – made it possible to extend high-volume offers to fixed-to-mobile calls.

An Arcep statement said, “This has had a profound impact on users’ calling habits: the amount of calls being made to mobile networks practically quadrupled compared to the previous year. As a result, the percentage of fixed-to-mobile calling minutes initiating on VoBB lines equalled the volume of national calls in Q3 2011, accounting for two thirds (64%) of calling minutes originating on fixed lines.”

Despite this growth in usage, revenue generated by mobile services (€4.8 billion) was down by 3.4% compared to Q3 2010. ARCEP said this was due in part to the change in the VAT rate applied to audiovisual services starting on 1st February 2011 and to a decrease in prices. Because mobile operators chose not to carry the increase in the VAT rate (which went from 5.5% to 19.6%) over to their retail prices (incl. VAT), their before-tax income for 2011 has been cut by several million euros. In addition, the introduction several months back of mobile plans that do not include a handset – which was in fact one of ARCEP’s recommendations in support of consumers – has directly influenced customer’s monthly invoices and so operators’ income as well.

Other data from ARCEP on French mobile market.

- The number of mobile service customers (calculated by SIM cards in service) stood at 67 million in September 2011, which translates into a penetration rate of 103.3% or a six-point increase over the previous year (+4 million cards).

- Mobile virtual network operators (MVNO) are becoming a stronger presence: their market share stood at 10.7% (12.6% in the residential segment) in September 2011, which marks a 1.4 point increase in a single quarter. They also account for 90% of new customers during the quarter.

- Minimum expenditure is rising. Increased 7.6% in 2010. The price of mobile services has decreased steadily throughout the period, however: by an average of 2.9% annually, or by a total 11.2% in four years, and accelerating to 3.4% in 2010.

- The heaviest users are the prime beneficiaries of these price decreases (-12.4% in 2010) whereas more modest consumers saw a much smaller decrease in the price of their services (-2.3% for the smallest consumers and +0.3% for mid-level consumers). Consumers are choosing services that are more in line with their actual needs, as the gap between theoretical minimum and the actual invoice is shrinking.