Canalys reports that the region, excluding Turkey, surged in 2024, with sales of 48.4 million handsets, although growth slowed in Q4

Canalys, now part of Omdia, reports that the Middle East (excluding Turkey) smartphone market surged in 2024, recording a 14% annual growth, nearly double the global recovery rate of 7%.

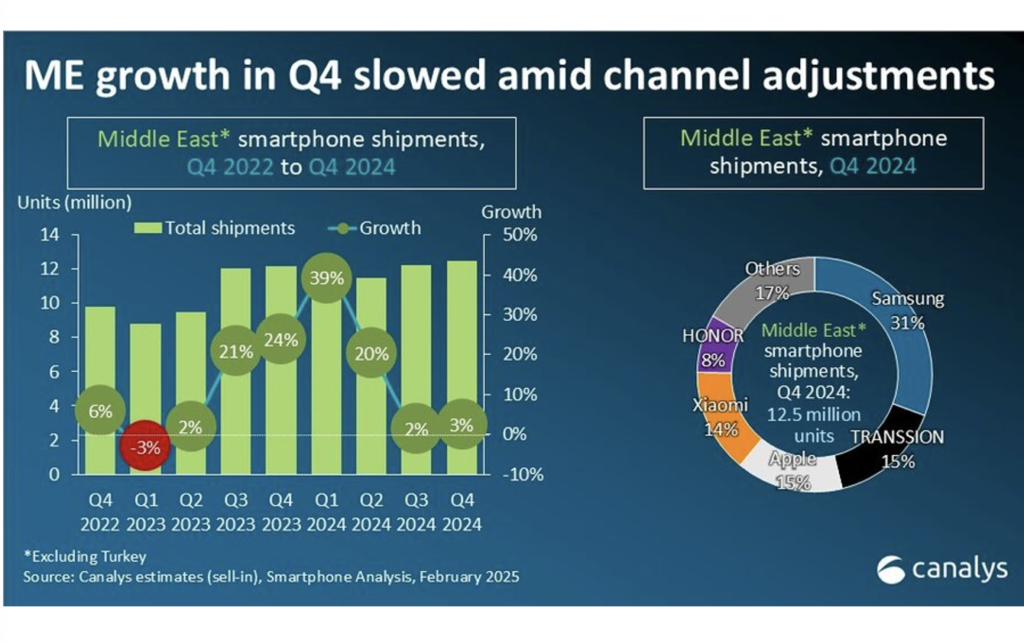

A total of 48.4 million smartphones were shipped in the Middle East during the year. Canalys said this was fuelled by vendors’ market expansion and rising demand for premium devices. However, growth slowed in Q4 2024, with shipments rising just 3% year on year to 12.5 million units, after a 29% surge in the first half of the year.

This slowdown was driven by the build up of inventory in the channel in the first half of the year, the analyst house says, and by “macroeconomic challenges”. They include inflationary pressures and shifting consumer spending patterns. Looking ahead, Canalys predicts the stroog demand for premium devices will continue but, as in many other places, replacement cycles are longer and “in 2025 will pose challenges for brands as consumers adopt a more cautious approach to upgrades”.

Canalys’ Senior Analyst, Manish Pravinkumar, commented, “The Middle East smartphone market is set for cautious single-digit growth in 2025, driven by shifting retail dynamics and consumer behaviour. Non-oil economic expansion and strategic fiscal policies are fostering market diversification, while AI-driven devices, BNPL [buy now, pay later] services and social commerce through platforms like Instagram and TikTok are reshaping purchasing patterns across the region.”

He added, “Retailers in key markets like Saudi Arabia and the UAE are driving new initiatives through hyperlocal strategies and immersive technologies, setting benchmarks for engagement. The region’s mobile-first approach continues to accelerate ecommerce, self-checkout innovations and seamless payments.

“Upcoming product launches will emphasize gaming, AI integration and ecosystem-based offerings while improving trade-in programs to make upgrades more accessible. To unlock new growth in 2025 and beyond, smartphone vendors must prioritize value, innovation and convenience, aligning with progressing consumer expectations.”

Read more here.