It has announced a slew of contracts and collaborations in recent months and is scoring highly in analysts’ reports – it is time for another go at an IPO?

Although Mavenir is considerably smaller than many of its rivals it never lacked ambition and looks to be doing something very right in a tough market. It describes itself as “the cloud-native network infrastructure provider building the future of networks” and seems to be on a roll.

It has the funding…

Mavenir is receiving the backing to achieve its ambitions: at the end of May, announced an injection of up to $75 million (€69.73 million) from an unspecified, existing investor to help it cement that statement.

In May last year its biggest investor, Siris Capital Group, was at the head of a $100 million funding round. Mavenir raised another $155 million in October 2022. It backed away from an initial public offering (IPO) in 2020, during the pandemic, and remains in private hands but is thought to bring in revenues of more than $0.5 billion annually.

Orders so far this year

Earlier this month, Mavenir, Qualcomm and Echostar successfully demonstrated the reduced capability (RedCap) 5G capabilities of its Open virtualized Radio Access Network (Open vRAN) solution on the Boost Mobile Network in the US. RedCap solutions are designed to provide coverage using low power, thereby reducing connectivity costs for use cases that do not neeed full broadband capabilities.

In May, the company signed a five-year strategic collaboration agreement with AWS “set to revolutionize the deployment of telecom workloads running on the AWS,” the publicity said.

The plan is for the companies jointly to architect Mavenir’s technology to streamline the development, testing, integration, and application of cloud-native solutions and AWS’ attributes “to create a new telco-grade deployment model that is set to transform how operators launch 5G, IMS (IP Multimedia Subsystem), RAN and future network technologies.”

In February, at Mobile World Congress, it signed a contract with solutions by stc to launch the first commercial Open RAN in Saudi Arabia this year. Mavenir had already deployed Open RAN 4G/5G NSA infrastructure in partnership with solutions by stc.

In the same month, Mavenir announced it is “in the advanced commercial phase of an Open RAN network pilot deployment for Vodafone Idea Limited (Vi). The deployment now underway, which commenced in September 2023, covers key launch sites and is currently carrying live commercial traffic ahead of a planned large-scale deployment. The pilot marks the first O-RAN-compliant deployment into Vodafone Idea’s network.”

Mavenir’s Open RAN centralised and distributed units are deployed on Vi’s telco cloud which is built on Red Hat’s OpenShift. Vodafone Idea (Vi) might be enduring huge challenges and struggling financially, but it is still the third biggest network provider in the most populous country on Earth, India. As of the end of September 2023, it had a subscriber base of 219.8 million.

Mavenir’s success is recognised too. It cites high scores across diverse categories in recent reports published by reputable analyst houses and other sources. You have to wonder if this is the prelude to another go at an IPO. In the meantime, it makes interesting reading.

Omdia’s verdicts

For example, it achieved the top spot in the new Partner Ecosystem category in Omdia’s Market Landscape: RAN Vendors 2024 report. The category was added this year to reflect the importance of the ecosystem in Open RAN.

Omdia stated that Mavenir (which did not participate in the report last year), “has entered as a major challenger in 2024. Though smaller than many other vendors covered in this report, Mavenir has a competitive portfolio centred on O-RAN solutions and the richest partner ecosystem”. Samsung, Fujitsu, Nokia and Ericsson all trail Mavenir in this category.

In Omdia’s logo metrics – which monitor if a supplier has gained 5G business at the expense of rivals or won greenfield deals – Mavenir emerged in the top three, having gained 20 new ‘logos’, behind Ericsson and Nokia.

Further, highlighting the prevalence of 5G Non-Standalone, Omdia’s report notes, “Winning 5G contracts where a vendor did not already provide LTE is a strong endorsement of its solutions. This shows that an operator is willing to rips and replace an incumbent LTE vendor.”

Mavenir is also listed by Omdia as having the widest portfolio of O-RAN compliant radios, with Nokia, NEC and Samsung.

For the report, Omdia evaluated the business performance and portfolios of 11 RAN vendors, grouping them into three categories: leaders, major challengers, and emerging vendors.

STL Partners highlights partnerships

Next up, a just-published Executive Briefing from STL Partners, highlights the significance of partnerships between network solution vendors and hyperscale cloud providers (such as AWS, Microsoft Azure and Google Cloud) in delivering successful telco transformation at scale – creating the opportunity for both vendors and telcos to fundamentally reimagine established business relationships.

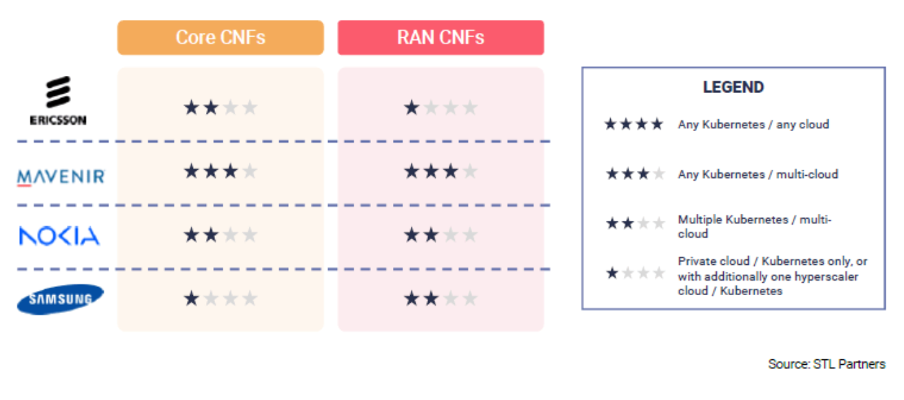

This report stresses Mavenir’s leadership in enabling any-cloud, network-critical Open RAN cloud deployments for telecoms operators a commercial reality. Mavenir leads the charts on cloud-enabled CNFs, ahead of Ericsson, Nokia and Samsung.

ABI Research choosing the right RAN vendor

And ABI Research’s report in April on Selecting the right Open RAN vendor for 5G Mobile Networks gave Mavenir the top individual score in every category: end-to-end hardware and software platforms; sticking to industry standards; and collaborating with major telcos to accelerate the adoption of Open RAN worldwide. Mavenir was also identified as a leading implementer based on pilots and partnerships with operators, cloud providers and chipset vendors, noting its expanding geographical coverage.

As seen on TelecomTV

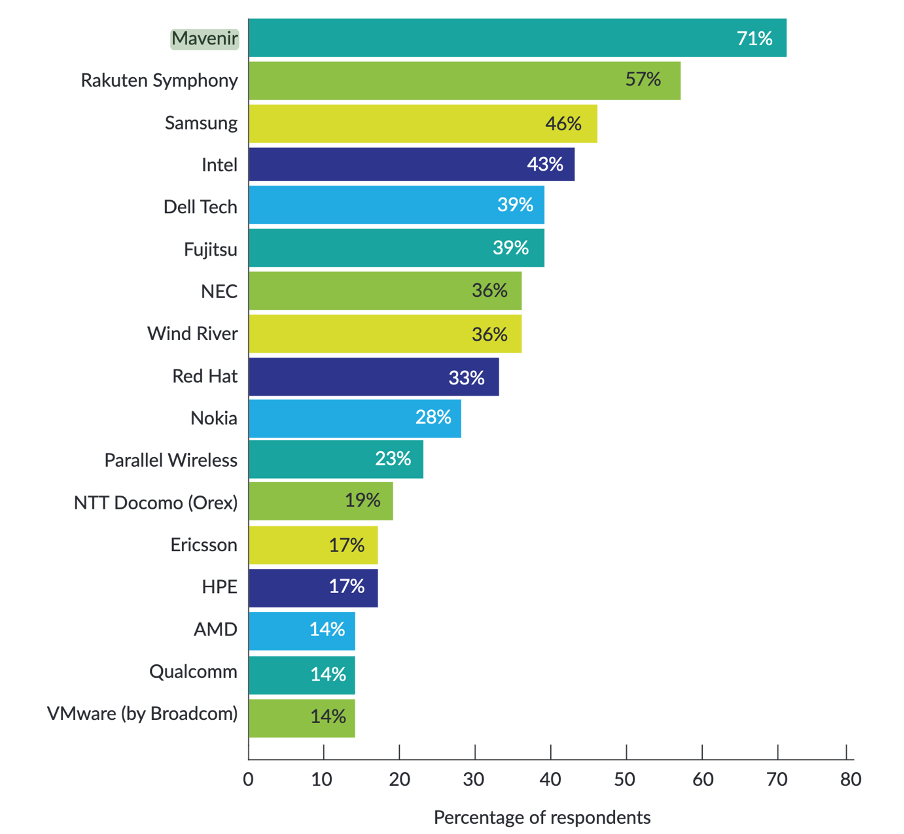

Executives from network operator identified Mavenir as an Open RAN market leader, when responding to a survey conducted by TelecomTV for its Open RAN Market Perception Report which was published in March.

Source: Open RAN Market Perception Report, published by TelecomTV, March 2024