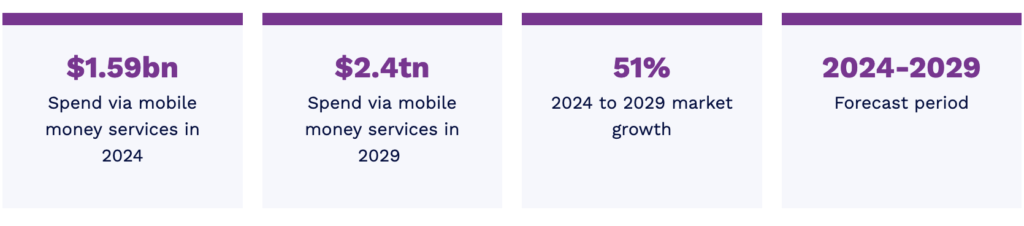

That’s a 51% increase from this year, driven by a move towards higher margin merchant payments and international remittances

A new study from Juniper Research found mobile money spend in emerging markets will reach $2.37 trillion by 2029 (€2.17 trillion) in 2029, up from $1.58 trillion in 2024.

It predicts this 51% growth will be driven by operators expanding their portfolios to include higher-margin, more advanced services, such as enabling merchant payments in-store or via eCommerce, and providing international remittances.

Key findings

Source: Juniper Research, Mobile Money in Emerging Markets

This will allow providers of mobile financial services (MFS) to lessen their reliance on revenue from person-to-person transactions but they will also have to build new capabilities.

Juniper thinks the providers will face major challenges in offering these more advanced services at scale. For example, the complexity of shifting from basic Unstructured Supplementary Service Data (USSD) services to offering app-based experiences.

Also, the research house suggests partnerships with digital wallet platform providers will be critical in helping mobile money service providers increase their reach across different access channels.

The report’s co-author, Mélissa Amouny, explained, “As banks struggle with the distribution of financial services in emerging markets and mobile money services have excellent reach via their agent networks, partnerships between banks and mobile money services are a strong fit.

“MFS providers must strike partnerships with banks to offer the capabilities needed, and with platform providers to improve their technical infrastructures, to best address the advanced services opportunity.”