The GSMA has announced its new Board. A press release from the Association said that the board’s 25 members represented the world’s largest operator groups as well as smaller, independent operators with global representation.

Is that really the case? Looking through the list, it looks like a solid list of companies who are at very least T1 players in their own domain, if not regional or global group operators.

USA: AT&T, Verizon

Europe/global: DT, Orange-FT, Telefonica, TeliaSonera, Telenor, Turk Telecom, Vodafone

India: Bharti Airtel, Tata

China: China Mobile, China Unicom

Japan: NTT DoCoMo, KDDI

Korea: SKT, KT Corp

Middle East: Etisalat, Qtel

Latin America: America Movil

Asia: Axiata Group

Africa: MTN

Russia: Vimpelcom

Australia: Telstra

In fact, looking at that, if you take out the Group operations of the likes of Telefonica, Vodafone and Orange there’s really very little from Latin America or Africa, or even from South East Asia. There’s no T2/T3 presence at all, and precious few “smaller” players.

There has been a view of late, expressed to me by several sources, that the GSMA has become a “big players” club, coalescing around the strategic needs of the big group operators, and that its board and senior management is less diverse than previously.

I wondered if that view, chiefly formed by TIM’s Bernabe and Orange’s Bouverot taking over as Chair/CEO and Director General in 2010, held any water.

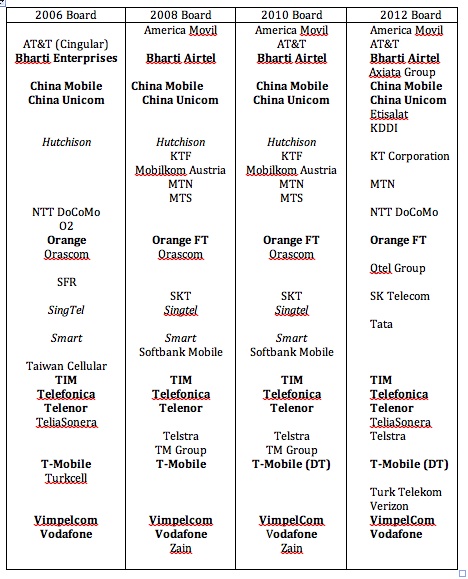

So here, below, are the last four boards.

As you can see, there have been a few ever-presents in that time, with most of those being the traditional group operators from Europe. The ever-presents are: Airtel Bharti, China Mobile, China Unicom, Orange, TIM, Telefonica, Telenor, T-Mobile,Vodafone, Vimpelcom. (Hutchison, SingTel and Smart were on the previous three boards, but not on this year’s.) This Group presence, roughly European in ownership, would appear to be the core board membership, with other operators slipping in and out.

If you looked at the 2006 board, with Smart, TMGroup, SingTel and SFR, you could at a real push argue that those sorts of companies wouldn’t make it on to the board now. But I think it’s going too far to say that the GSMA has become a big players only club. More likely, if you wanted to look for trends, is that fact that those core European group operators, plus the Chinese, have successfully pushed for more executive-level control.

What would that mean, if true? It could mean that the GSMA is more likely to focus on issues and initiatives, like m-payments (not banking), Joyn, VoLTE, and the Connected Living programme that speak to mature market concerns about brand relevance and declining core revenues. It would also advance the cause of these group operations in emerging markets. Certainly the GSMA has been doing that. But it also has initiatives aimed at emerging and developing markets that you couldn’t solely explain in terms of furthering the interests of a clutch of Group operators.

If you want to see the controlling hand of the major group operators through the GSMA, you probably will. If you want to see the GSMA as a body truly representing the interests of all its operator members, globally, then there’s activity and initiatives to support that view too – and areas like mHealth and connected living are just as relevant to these markets as the mature, Western markets.

Does any of this matter? I think it does; the GSMA forms the face of the mobile industry as it interacts with Governments and regulatory bodies, with “OTT” and other partners and competitors, and of course to the supply chain and vendors. It decides what its areas of interest will be, what messages it will relay, where it will lobby and on what.

Perhaps this table (above) presents some initial facts around who, exactly, has been pulling the strings at board level over the past few years.