Finland tops the charts as report finds mobile data usage could be elevated by an increased data-only penetration

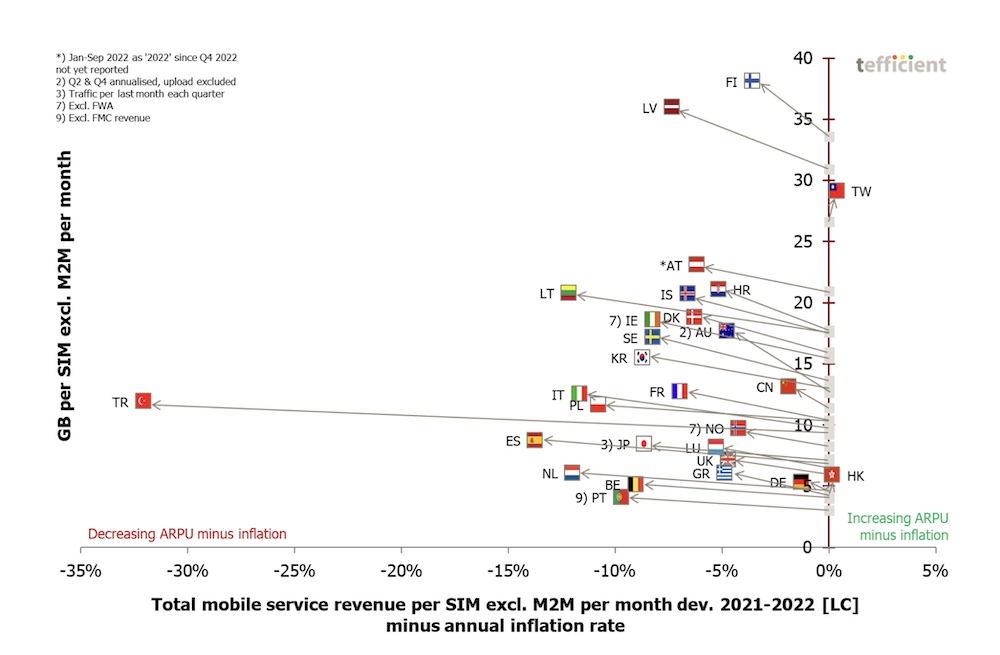

While the majority (71%) of global markets experienced saw mobile ARPU growth from a combination of price increases and data usage growth but when accounting for overall inflation, the ARPU growth is almost always slower than inflation.

This was the sobering finding of Tefficient’s 37th public analysis of mobile data development and drivers, which compares trends across 37 countries worldwide, excluding M2M/IoT. The analysts argue that while CPI-driven price increases have occurred in many markets, it will take more time for ARPU growth to link with inflation, particularly in markets where some operators didn’t implement CPI-driven rises – and users vote with their feet.

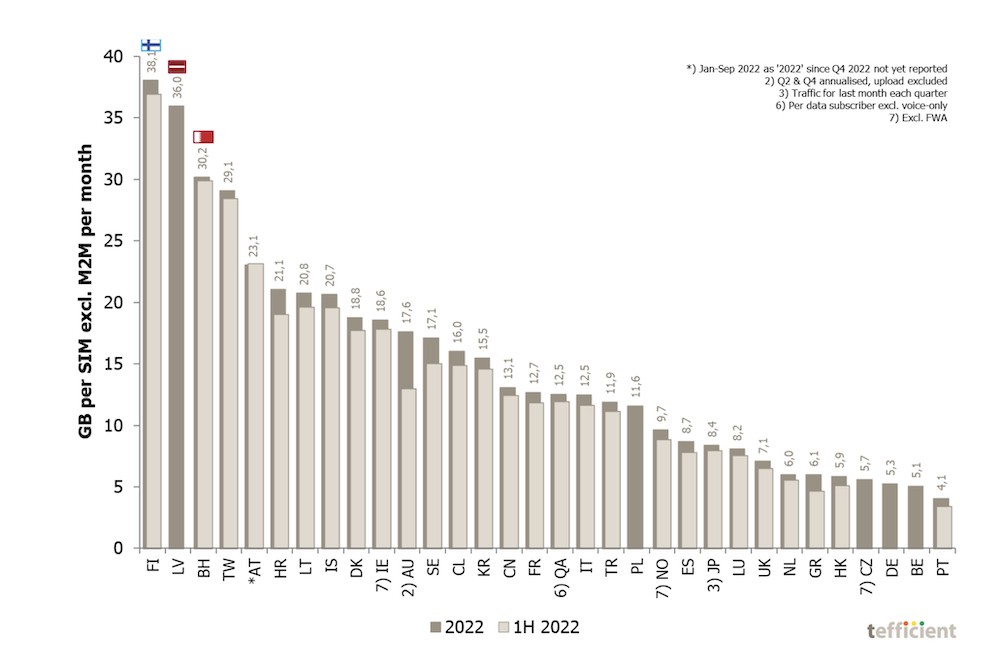

The surge in mobile data usage caused by the pandemic is waning with growth in most markets slowing down. In 2022, Czechia experienced the highest growth rate in mobile data usage, reaching 59%. At the other end of the spectrum, Qatar and Taiwan had relatively lower increases, both below 9%.

Data-only subscriptions continue to dominate average mobile data usage, although their market share remains limited. In 2022, Latvia‘s average data-only subscription reached 138GB per month. In the FWA-only category, Australia recorded 286GB, while Sweden reached 250GB.

Overall, the report found that mobile data revenue once again reached its lowest level, although the erosion in revenue per gigabyte has slowed compared to previous analyses. Greece experienced the fastest erosion rate at 30%, while Turkey witnessed an increase.

Finland tops the usage charts – with 38.1GB per average SIM (excl. M2M) per month in 2022 (+4.5GB vs 2021). Latvia is the runner-up and is approaching Finland. Bahrain is third-ranked after having overtaken Taiwan in 2022. Austria is fifth-ranked.

But despite 84% of non-M2M SIMs being unlimited and three 5G networks covering 80% of the population in December 2022, the data usage growth rate was slow in Finland to 13%. Usage in Czechia grew 59%. But in absolute terms, the data usage grew 4.5GB in Finland and just 2.1GB in Czechia.

The average Latvian non-M2M SIM carried 36.0 GB per month (+5.1 GB vs. 2021). Unlimited is offered as a premium option in regular mobile in Latvia but the high usage is to a large extent explained by data-only subscriptions.

The countries with the lowest data usage were Portugal, Belgium, Germany, Czechia, Hong Kong, Greece and the Netherlands. Albeit in the lower usage range, Germany and Norway had quite modest usage growth in 2022.

Data-only powerhouses

Tefficient’s analysis showed a strong correlation between the data-only share of a country’s SIM base and the average data usage. Five countries – Finland, Lithuania, Austria, Bahrain and Latvia – are the data-only powerhouses of the world. Official Finnish statistics show that mobile networks carried 49% of the total data traffic in the second half of 2022.

Unsurprisingly, 5G was found to be driving data usage in countries where operators have rolled out much 5G on dedicated frequency bands, like South Korea. The data consumption per 5G subscription was 28.8 GB per month in March 2023 – about 3.6 times that of the average 4G subscription.

In December 2022, 23% of the SIM non-M2M base in Finland was data-only. In Lithuania and Austria, data-only represented 18% of the bases and the usage was lower than in Finland. Bahrain had an almost as high data-only share of base, 17%. Poland almost had 17% too, but much lower overall usage. Latvia was on 16%.

“We…conclude that data-only penetration is a significant driver of the average mobile data usage,” writes Tefficient. “The easiest way for low-usage countries to grow data usage and expand the mobile market would be to start addressing and monetising the data-only segment. This seems to be effective particularly in markets where fast fixed broadband networks (FTTH, FTTB or HFC) aren’t already available to a substantial share of the households.”

Fixed-line substitution

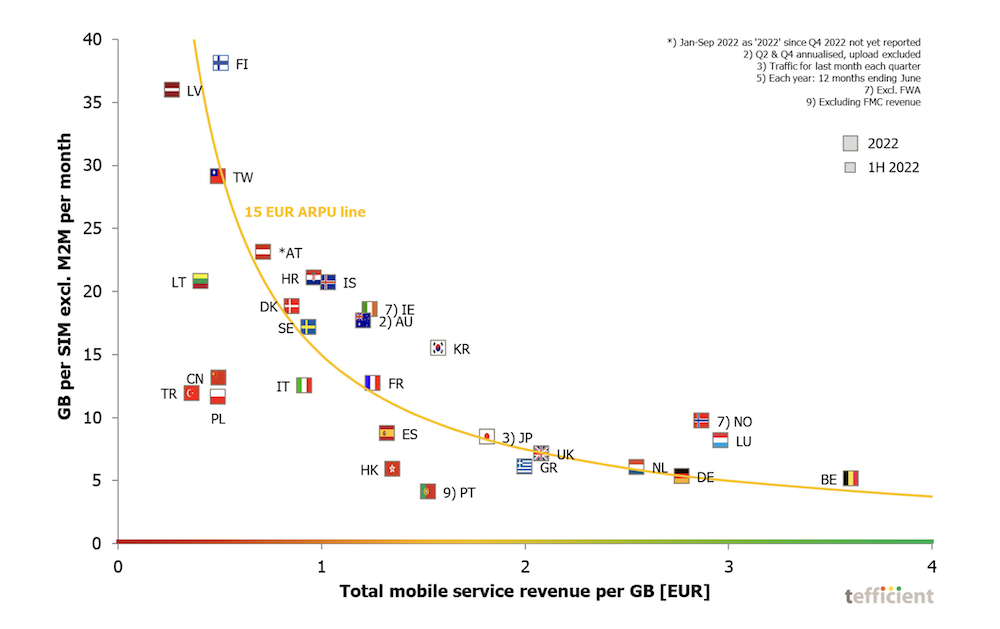

Regardless of technology, Tefficient argued that data usage could be elevated by an increased data-only penetration through fixed-line substitution. But a prerequisite for this – and for high data usage in general – is that the total revenue per gigabyte is low. This is the case in Latvia, Turkey, Lithuania, Taiwan, Poland, China and Finland.

Low usage doesn’t necessarily mean low ARPU, though. Market ARPU is uncorrelated with usage. Norway for example, has, alongside South Korea and Luxembourg, much higher ARPU than other countries without having high usage.

After having eliminated M2M, the analysts concluded that 20 of 28 markets could grow ARPU on the back the data usage growth. But when inflation was taken into account, ARPU growth was slower than the inflation in 26 of 28 markets.

A gigabyte has never been cheaper

Tefficient acknowledged that the horse had bolted on monetising voice and SMS based on usage with operators left with only one lever to pull which was using data volume as a price-defining parameter, based in tiers.

Belgium has the position where operators collectively earn the highest total service revenue per consumed mobile GB. There is a cluster of countries with high revenue per GB without being as extreme as Belgium, including Luxembourg, Norway, Germany and the Netherlands.

Markets where operators get the lowest revenue per consumed gigabyte include Latvia, Turkey, Lithuania, Taiwan, Poland, China and Finland.

“The key explanation to high mobile data usage is low effective revenue per gigabyte: Bigger data buckets lead to lower revenue per GB – which, on the other hand, increases usage,” writes Tefficient.

“But we also said that a gigabyte has never been cheaper. More correctly put is that operators never had lower total service revenue per gigabyte than what they currently have – which is true for all markets except Turkey [which suffered hyperinflation making it an outlier].

Greece had the fastest revenue erosion, 30%. Spain and Portugal both had 28%, Australia 27%, the Netherlands 26% and Hong Kong 25%. Markets with a slow erosion in the revenue per GB are Latvia, Taiwan, Austria, Poland, Lithuania and Finland.