We dug even deeper than Nokia’s published survey results to find out which sectors look to benefit the most and specifically where return on investment is coming from

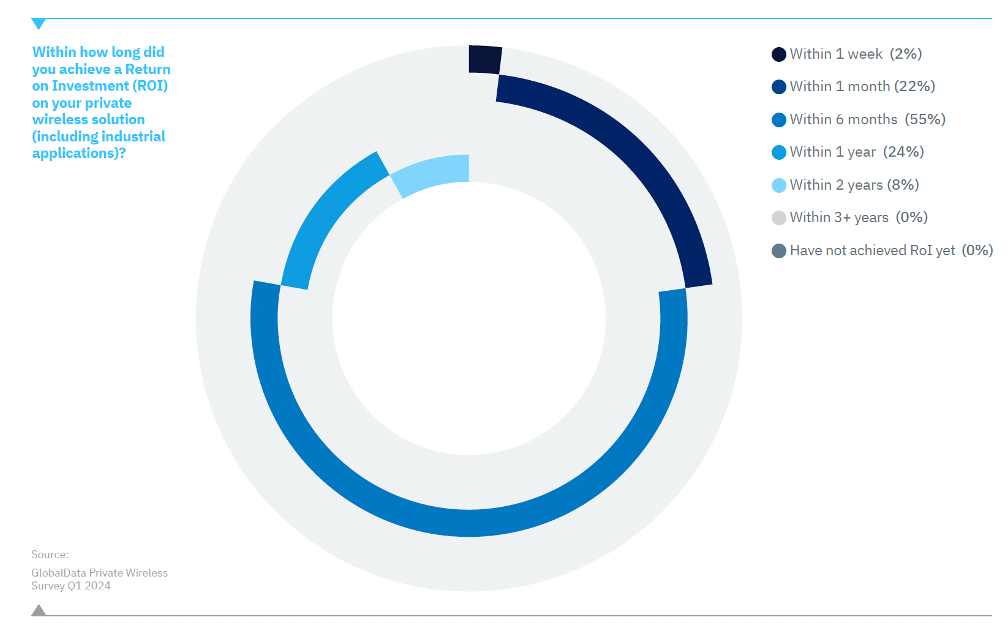

Nokia first partnered GlobalData in 2022 to investigate the private wireless network market. It published Private Wireless Networks Market Opportunity Forecast in December 2022.The stated that 79% of respondents achieved a return on their investment (ROI) in fewer than six months. More than 50% had already seen the total cost of ownership (TCO) fall by 6% or more and 29% had experienced a reduction of more than 10%.

These were interesting findings as the received wisdom at the time was that ROI was perhaps the biggest inhibitor to enterprises adopting private networks.

The report also suggested that the size of the global private mobile market would grown by 49% by the end of 2024, compared to 2022, and almost double by 2027 to be worth close to $8 billion (€7.326 billion) in equipment sales. This is a compound annual growth rate (CAGR) of 23.3%.

Taking a second look

Some 18 months later, Nokia again commissioned GlobalData to undertake research into how the market is progressing. GlobalData conducted surveys and interviews with execs in more than 100 enterprises in industries like manufacturing, transport and logistics, mining, oil and gas, and energy, who have deployed private networks. The companies were headquartered in Australia, France, Japan, UK and US, with 80% operating in two or more countries and 90% have more than 500 employees; about 60% of them have more than 1,000.

The second report found the technology continues to deliver business benefits and returns on investment, as outlined to Global Data’s 2024 Industrial digitalization report: Private wireless, edge infrastructure and applications published in June.

Not all the companies interviewed by GlobalData are Nokia’s customers. Some of the qualifying questions were, “Do you deploy a private wireless network? Do you deploy an industrial edge”. Hence the respondents are referred to as “early adopters” that are “scaling and clear about the business benefits”.

One good thing leads to another

One of the most interesting developments identified in the second report is that enterprises are quickly scaling up deployments once they’ve experienced success. Is this music to the ears of telcos who have failed to monetise 5G through enterprise deployments? In our interview, Carlijn Williams, Head of Marketing for Nokia’s Enterprise Solutions business, was quick to point out that neither Nokia’s deployments nor the research are limited to 5G, but also include 4G and Wi-Fi, and that the Gs and Wi-Fi can complement each other.

Indeed, in May, Nokia launched MX Boost which aggregates mobile and Wi-Fi, which means they can be used as together to provide redundancy and boost each other, including in terms of capacity.

That said, Williams adds that Nokia is seeing “more and more 5G networks because the device ecosystem is also maturing” in its existing deployments – Nokia now has 760 private network customers, up from 730 at the end of Q1. She adds, “What I also see with our existing customer base is most of them are deploying multiple [private] networks and in multiple locations, and going from one use case to multiple use cases.”

Who makes the decisions?

The proliferation includes more than one location within the same country as well as spreading to other markets. For example, one customer first deployed in Brazil and now is implementing a private network in China. Another deployed in multiple sites initially and for the moment does not appear to be looking at deployments elsewhere.

Also, decisions seem to happen at various layers within organisations. Williams notes, “You have to still convince the local management teams every time”. She added that in Global Data’s research, 20% of the respondents were C-level, 37%, Vice President, Director or Senior Manager level. Then 43% were head of team or department. She adds, “I don’t think you can conclude looking at that that it’s only the top execs who have control over multiple countries, because there’s plenty of heads of department/site facility.

“On the other hand, there’s a lot of VPs and C-level [among respondents] and they are all scaling into multiple use cases and multiple regions. So it helps to have that top management commitment to it.”

Has the RIO profile changed?

Williams says, “I think the big ROI comes from business continuity. Before many of our customers might have experienced connectivity issues with applications…for example, AGVs [automated guided vehicles] AMRs [autonomous mobile robots] and other mission critical applications. Often this was deployed on Wi-Fi and there would be coverage gaps, which means stops and starts for the AGVs, etc. If that no longer happens, you see the ROI. I think that’s the main reason why this is happening so fast.” See graph below.

Of those customers that started with AGVs or AMRs, Williams says there is a cycle time increase of roughly 25% compared to Wi-Fi, “so that’s an immediate impact on productivity. Many of these customers are now expanding around them, adding licence plate recognition, or alarm buttons for our workers because they have that mission critical connectivity and often the edge too to deploy these [real-time] use cases,” she adds.

Edge is the beating heart

Williams continues, “the edge is very critical for us”. This is because in private networks, every deployment is different in terms of the location, the applications, the systems, the organisations’ activities and objectives, and so on. It’s not simply a case of replicating the same thing over and over, yet scale is essential in terms of speed, cost and simplicity.

“That’s why we lead with the edge,” Williams explains. “That’s why we deploy or pitch Nokia One Digital Platform because it is simpler and faster to deploy. It starts with the mission-critical in industry and digital edge is the beating heart of it. Of course, you can have private wireless deployed on it and Wi-Fi and they can work together, but edge is the beating heart and you can scale out from that.”

She adds, “First we work with partners to set up the network and make sure it can penetrate everywhere – no coverages holes and small cells in exactly the right places. Once it is deployed, as we found in the survey and some in-depth interviews, many customers say it is as easy to maintain as a Wi-Fi network.”

Williams continues, “more and more of the tech coming out needs that edge… and even the hyperlocal edge”. Nokia launched MXIE (for mission-critical industrial edge) at Hannover Messe in April for situational or AI-based cameras to detect if a worker has fallen or if a dangerous situation is imminent.

The second survey reveals that at the moment, about 39% of those early adopters have deployed an edge, with a further 52% planning to do so. She states this proves that, “The vast majority see the value of the edge because if the data is kept on-prem with low latency, industrial customers can deploy things like high definition video for quality control, for example.” See section on use cases below.

Which sectors enjoy the best ROI?

Did the survey give any indication of which sectors are gaining the greatest return on investment? Williams says the early adopters interviewed largely came from manufacturing – 44% discrete (that is the making of distinct items) and 31% process manufacturing (creating goods by combining supplies, ingredients or raw materials using a predetermined formula), petrochemical oil and gas. Transportation, ports, airports, warehouses and logistics made up 10% and a further 10% was energy.

| Discrete | Process | |

| Within 1 week | 2% | 3% |

| Within 1 month | 20% | 19% |

| Within 6 months | 52% | 61% |

| Within 1 year | 11% | 13% |

| Within 2 years | 14% | 3% |

So 83% of process manufacturers (26 out of 31) expect to achieve an ROI within six months, compared to 74% of discreet manufacturers (33 out of 44) over the same period.

Increase in Productivity:

| Process | Discrete | |

| Rank 1 | 23% | 20% |

| Rank 2 | 10% | 25% |

| Rank 3 | 19% | 2% |

| Rank 4 | 6% | 7% |

| Rank 5 | 0% | 0% |

| Overall | 58% | 55% |

Overall 58% of process manufacturers (18 out of 31) rank productivity as one of their top five benefits, compared to 55% of discreet manufacturers (24 out of 44). When analysing the top two benefits, the gap is more significant – 45% of discreet manufacturers (20 out of 44) select this as one of their top two benefits compared to 33% of process manufacturers (10 out of 31).

Identifying the ‘right’ use cases

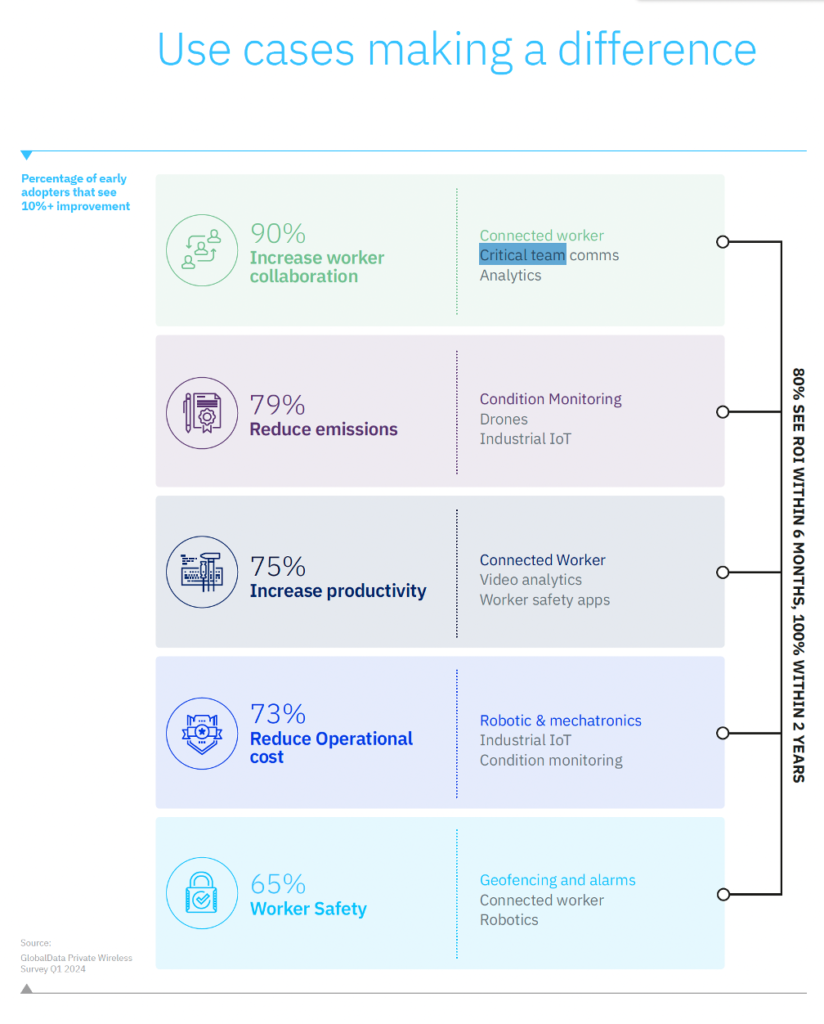

Williams says, “Another difference with the research the second time among the 100 early adopters is to break that down those business benefits and quantify them with numbers. We asked, “What do you see in terms of improvement in terms of all these work, collaboration, reduce reduction of emissions, productivity increases, etc?’.”

She says the most surprising was that work collaboration scored the most highly (see infographic below), with 90% of respondents said they have seen an improvement in work collaboration, ranging from 10% to 30%. The use case most commonly responsible for this increase was connected worker, the second was ‘critical team’ and the third analytics.

Three biggest reasons to invest in digitalisation

Another major finding, in Williams’ view, is three biggest drivers for investment in digitalisation. Number one is productivity. Number two is workers’ safety. Number three is sustainability – so the reduction of emissions and energy [consumption] to reach these ECG [economy for the common good] targets.

She says, “Let me start with emission reduction – 79% of the early adopters saw a reduction of over 10% in their remissions [as regulation bites, this is going to become ever more important]. The number one use case is condition monitoring, number two is drones, such as for inspections of difficult and dangerous to reach places, and number three is industrial IoT.”

Then 65% of the 100 early adopters saw an improvement of 10% in safety in the workplace, including a reduction in the number of accidents. Geofencing where alarms was the most deployed use case, but also connected worker and robotics to replace people in some of the dirty or dangerous work because they have a private wireless network and industrial edge deployed.

She says there are many kinds of connected worker use cases: “For example, big chemical and petrochemical plants want to go paperless so they’re giving all their workers handhelds and devices to provide data at their fingertips rather than on a clipboard. Workers no longer have to walk from one place to the next, often across huge plants, or drive. They have their devices to communicate with each other and access data. They have applications for remote maintenance, etc.”

And one thing tends to lead to another with connected worker. The report describes one instance one manufacturing business’ original use case was to connect hand scanners in the warehouse. This expanded to include automation and maintenance solutions, including employees wearing connected Google Glass devices so machine manufacturers to diagnose faults remotely. This means their engineers turned up knowing what they needed to fix and properly equipped for this job.

Let’s hope report number three focuses on new revenue streams.