Despite some bright spots in its latest report, the mobile group warns “urgent policy reforms” are needed to secure critical network investment

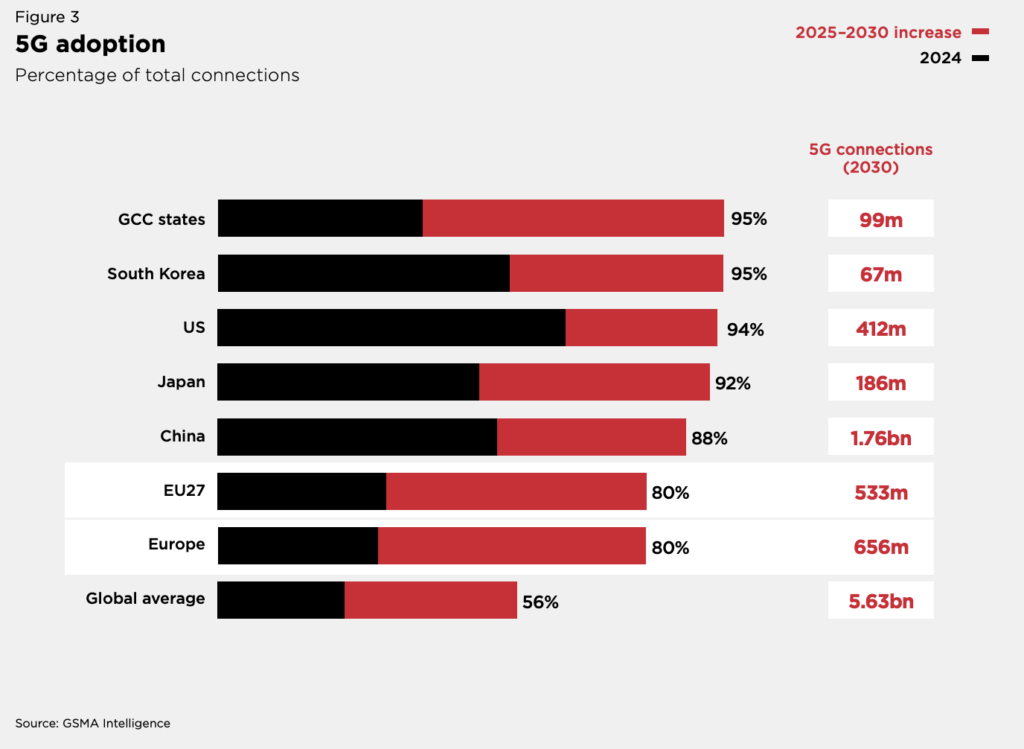

The GSMA’s latest Mobile Economy Europe report has revealed that Europe continues to lag behind other advanced regions such as North America, East Asia and the Gulf Cooperation Council states in 5G adoption, where many operators are now shifting their attention to the next generation of networks.

In Europe, operators are beginning to deploy 5G SA, providing opportunities for new applications like network slicing – provided customers want it. As of September 2024, 18 European operators had launched 5G SA services, including recent launches from EE in the UK and Free in France. In addition, 5G-Advanced is set to deliver new solutions for enterprises, enabling uplink and multicast services at better latency, provided enterprises want that, too.

At the end of Q3 2024, only around 15% of operators in Europe with live 5G networks had launched 5G SA, compared to over 30% in Asia Pacific and North America. This is indicative of the difficult operating conditions facing European operators. The speed of rollouts remains slower than many industry players anticipated a few years ago.

GSMA’s Connectivity Index (5GI), which ranks operators on 17 indicators has the majority of European operators sitting mid-table. Leading the way are developed economies in the Middle East, Scandinavia, Asia Pacific and North America. Most European countries included in the index have scores between 40 and 50, scoring well on spectrum and affordability but lagging behind leading markets in multiple indicators across the network, experience, adoption and market development pillars.

Europe’s score on the network pillar highlights the need to accelerate the deployment of 5G base stations (with 11 of the 15 European countries included in the 5GI scoring lower than 30 on this indicator). Europe fares better on coverage: 24 European countries reported over 90% 5G population coverage by the end of 2024. A combination of low- and mid-band spectrum has been deployed by operators to accomplish this. Extending the deployment of mid-band spectrum, particularly in the 3.5GHz range, is vital for delivering the network performance necessary for advanced applications.

Do something

The GSMA warns that unless key regulatory challenges that restrict investment capacity in the European sector are resolved, the increased adoption of these technologies in Europe will progress more slowly. Digital infrastructure will be key to helping Europe sustain global competitiveness, laying the foundations for advanced technologies but also supporting the expected three-fold rise in mobile data traffic by 2030.

“Europe is at a crossroads in its development of the digital infrastructure that its businesses and citizens will need to succeed. It is concerning to see it falling further and further behind other large markets around the world,” said GSMA chief regulatory officer, John Giusti.

“Urgent action is needed from the European Commission and other authorities within the European Union to deliver the policy reforms that Europe’s digital economy needs to support strong, sustained network innovation and to re-establish a leadership position in the global technology marketplace by 2030,” he added.

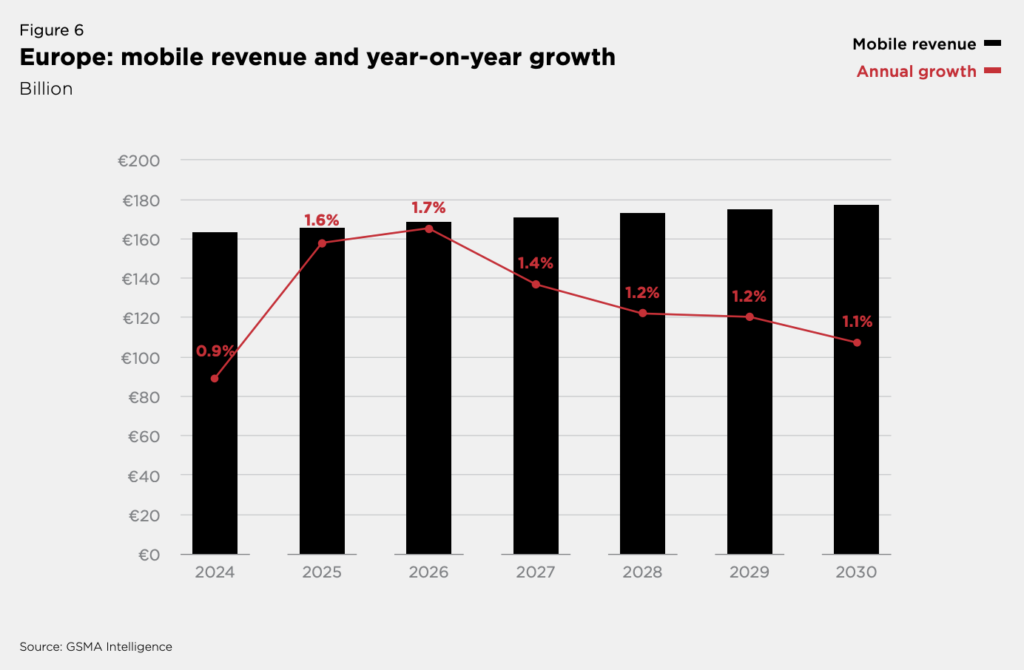

By page 26, GSMA gets to the crux of the issue for MNOs. Europe’s highly competitive mobile market has restricted prospects for revenue growth, leaving mobile ARPUs significantly lower than those in other advanced regions. This constrains the ability of operators in the region to invest, with Europe’s revenue weakness mirrored by lower mobile capex per capita. These financial challenges underscore the need for strong policy actions to drive a turnaround in Europe.

GSMA’s suggested measures to reverse these trends include completing the Digital Single Market to allow the mobile industry to develop and deploy services on a cross-border or pan-EU basis, initiating a review of the EU Merger Regulation and taking a more long-term view on investment and innovation effects and establishing a pro-investment and more predictable approach to EU spectrum policy. Somewhat more controversially, the GSMA also suggests implementing additional measures to ensure fairness in the internet value chain.

Bright spots for 5G

The report is not all doom and gloom for Europe. It found 5G accounted for 30% of mobile connections in Europe at the end of 2024 – equivalent to 200 million connections – against a global average of 24%. It will become the dominant mobile technology on the continent by 2026 and already accounts for the majority of connections in Germany and Switzerland, while adoption rates in Denmark, Finland, Norway and the UK have exceeded 40%.

By 2030, the GSMA claims it will provide an additional €164 billion boost to the overall economy, with 80% of the continent’s connections forecast to be 5G, compared to 4G’s 18%, by the end of this decade. These stats are always difficult to measure but it is undeniable there has been a positive impact to Europe’s economies from more 5G coverage and uptake.

For example, 5G fixed wireless access (FWA) has emerged as an important use case in the consumer and enterprise segments, complementing operators enhanced mobile broadband offerings. To date, operators in 24 European countries have launched 5G FWA services.

Europe is also the leading player in the GSMA Open Gateway, with committed operators representing more than 20% of signatories despite accounting for only 10% of global mobile connections. Participating operators include BT, Deutsche Telekom, Orange, Telefónica, Telenor, Vodafone and more.

By 2030, there will be almost 550 million licensed cellular IoT connections in Europe. Germany will account for around a quarter of these, while the UK, France, Italy and Sweden will each account for around 10%.