For first time, survey shows operators seeing enterprise connectivity and services as the primary goal of their B2B strategy, ahead of enterprise connectivity

GSMA Intelligence has launched a new report, The opportunity for operators in B2B technology services – sizing prospects for growth in financial services, manufacturing, automotive and aviation. Its main message is that operators must look beyond connectivity-driven solutions and services to take advantage of the market.

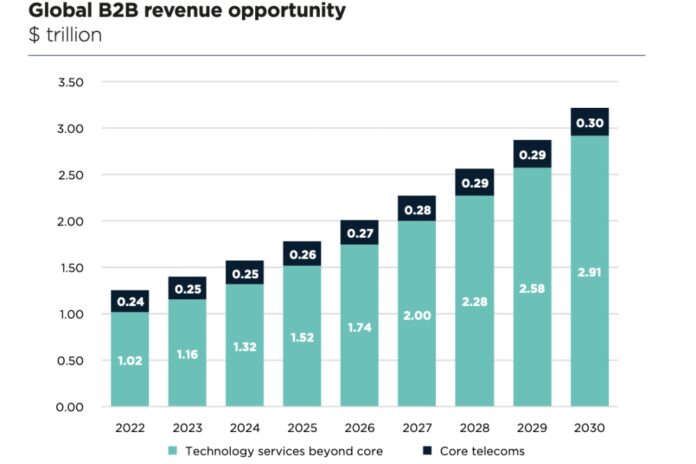

Currently services like SD-WAN, unified communications and mobile voice and data acccount for 70% of operators’ B2B revenues, which equated to about $250 billion in 2023. GSMA Intelligence says such services only offer the opportunity of about 3% compound annual growth rate (CAGR) from now to 2030.

Conversely, enterprise spending on tech services beyond those core services – including cloud and datacentre, cybersecurity, IoT, analytics, AI, blockchain and network APIs – is around five times the spend on traditional communications. It was worth $1.16 trillion in 2023, with a CAGR of 14% expected up to 2030, growing to become a market worth $2.91 trillion.

Tim Hatt, Head of Research, GSMA Intelligence, said, “Telcos looking to monetise their investments in 5G need to look beyond consumer centric and basic connectivity driven use cases. Greater focus is needed on offering advanced network solutions such as network slicing and private networks in the short term and developing end-to-end solutions to support a variety of enterprise use cases combined with integration capabilities in the longer term.

“Enterprises are increasingly looking for service providers to integrate a blend of technologies that fit their specific technology environments and business needs. Though the competition is fierce, telcos have assets and capabilities they can leverage to play in over one-third of this trillion-dollar market.”

Manufacturing and financial services offer biggest opportunities

The report highlights four key verticals: financial services, manufacturing, automotive and aviation. In 2023, these sectors presented big addressable opportunities for telcos, valued at $59 billion, $61 billion, $22 billion and $16 billion respectively. Collectively, they accounted for 37% of the total addressable market, amounting to $159 billion. Projections indicate growth for these markets, with expected CAGR of 10.9%, 12.1%, 12.0%, and 8.4% from 2023 to 2030.

Jo Gilbert, Technical Director and GSMA Connected Manufacturing and Production lead, said, “To bolster operational efficiency, resilience, agility, and flexibility, manufacturing companies are investing in advanced connectivity, IoT, edge, and AI technologies. These innovations are generating massive data volumes across factories, requiring stronger data management capabilities to unlock business value. Furthermore, the growing convergence of IT and OT systems has expanded cyberattack surfaces, making cybersecurity a key priority for manufacturers.”

The outstanding 63% of telcos’ addressable market comprises diverse sectors, from healthcare and the public sector, to retail, media, smart cities, energy and utilities, agriculture, oil & gas, transportation & logistics, professional services, personal & consumer services, mining and ports.

Be prepared to compete

To meet the demands of the market, operators face competition from their peers, equipment vendors and an array of other players, including hyperscalers and security firms. In the survey, 24% of operators view hyperscalers as formidable competitors in edge networking and cloud, while 41% identify security vendors as key competitors in that area.

The report says operators must invest in building new capabilities, enhancing offerings in areas like security and exploring partnerships in others such as cloud. By balancing internal investments with external partnerships, operators can remain competitive, optimise resources, and meet evolving demands.

Beyond connectivity gains ground

The latest research tracks earlier findings from GSMA Intelligence’s Enterprise Opportunity 2024 survey, published in March 2024. It found that 36% of the operators surveyed said that market leadership in enterprise connectivity and services is the primary goal of their B2B strategy. Leadership leadership in enterprise connectivity was their second goal. In previous surveys, this has always been the other way round.

Th new survey is the first time operators have identified connectivity and services as their primary goal. Furthermore, 64% of participants said they have already launched 5G services beyond connectivity for enterprises such as 5G IoT, private networks and Mobile Edge Compute. This signals a shift towards services and the capability of bundling connectivity with services for enterprises.