Steady growth in Q2 for tablets, which now join smartphones in stemming declines

Worldwide tablet shipments recorded year-over-year growth of 22.1% in the second quarter of 2024, totalling 34.4 million units, according to preliminary data from analysts International Data Corporation (IDC). The results benefited from a favorable comparison to the prior year’s quarter and were driven by product refreshes from many top vendors and a replacement cycle combined with inventory replenishment.

However, volumes are comparable only to pre-pandemic shipment levels and not to the unprecedented sales witnessed during the pandemic. The Q2 24 results compare favorably with Q2 2019 when 32.5 million units were shipped, aided by a product refresh from Apple and the growing popularity of detachable tablets from Samsung and Huawei.

According to IDC, Apple shipped 12.3 million units and grew by 18.2% year over year in the quarter. With the launch of the 11″ and 13″ iPad Air and iPad Pro models, the company was finally able to record growth in the market. iPad volumes grew across the globe except for China, where competition from local players like Huawei and Xiaomi negatively impacted the company.

Samsung ranked second with shipments of 6.9 million units in 2Q24, which represents year-over-year growth of 18.6%. The vendor managed to grow despite not having any major product launches. Growth mainly came from several commercial deployments and a favorable 2Q23 comparable.

Lenovo captured the third position this quarter with year-over-year growth of 16.7% and shipments of 2.5 million units. The company’s detachable tablets recorded much higher annual growth (39.7%) than its slate tablets (11.7%).

Huawei held the fourth position this quarter with solid year-over-year growth of 40.3% and shipments of 2.3 million units. The vendor introduced a new tablet, MatePad 11.5S, which has shown great market performance and the June online promotions in China further aided growth.

Xiaomi finished the quarter in fifth position. The company’s shipments grew 94.7% year on year to 2 million units. Beyond China and Asia/Pacific (excluding Japan), the vendor has made significant gains in the European market with impressive growth in Russia, France, Germany, Italy, Spain, and many other countries.

“The [second quarter] results signal that the market has moved beyond the pandemic. We expect the refresh cycle and growth in emerging markets to continue aiding the recovery in the near term,” said Anuroopa Nataraj, senior research analyst with IDC’s Mobility and Consumer Device Trackers. “While new entrants to the market focus on their global expansion, long-term leaders continue to focus on improving technology (as in the case of OLED displays for iPad Pros), catering to the need for premium devices, and utilising the power of emerging technologies like AI.”

She added: “Long-term gains for the market depend on the vendors’ ability to build devices that can carve a niche for tablets – one that includes innovation and differentiation.”

Smartphones surge 12% in Q2

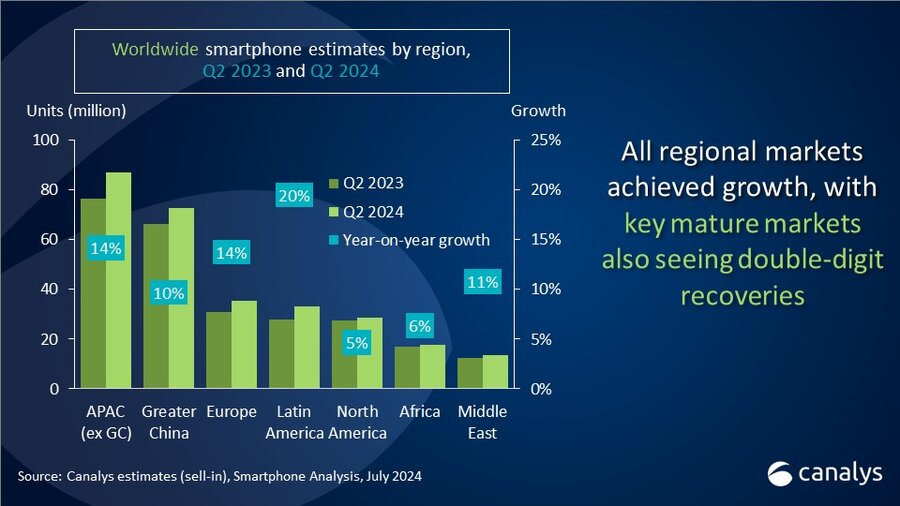

Adding to the positive news with tablets, the latest Canalys research reveals that the worldwide smartphone market continued to grow strongly in Q2 2024, with shipments reaching 288.9 million units. The market has now grown for three consecutive quarters.

Despite a modest 1% shipment increase, Samsung held onto pole position with 53.5 million units shipped. Its high-end product lines continued to boost value growth, while the revamped 5G A series maintained overall numbers. Apple held second place with 45.6 million units, bolstered by strong momentum in North America and APAC’s emerging markets.

Xiaomi, with its competitive product offerings, closely followed with shipments of 42.3 million units to achieve a market share of 15%. Making a return to fourth place, vivo shipped 25.9 million units for a market share of 9%. TRANSSION came fifth, shipping 25.5 million units and taking a market share of 9%.

“In the second half of 2024, Apple and Samsung will focus on solidifying their long-term strategies in mature markets, while other brands will hope to boost sales in emerging markets, having stocked channels in anticipation of higher operating costs,” said Canalys senior analyst Sanyam Chaurasia.

“In Q2, Europe and North America saw significant volume increases as vendors proactively stockpiled inventory for upcoming holiday sales seasons. Samsung will inevitably focus on integrating its Galaxy ecosystem to create strong value propositions for consumers via its flagship offerings with exclusive GenAI features,” he said. “Apple will look to accelerate replacement demand in these markets via its AI strategy, with hybrid models, enhanced privacy and personalized Siri features.”