Network security was the largest category, representing US$5.1 billion and growing 14.8%

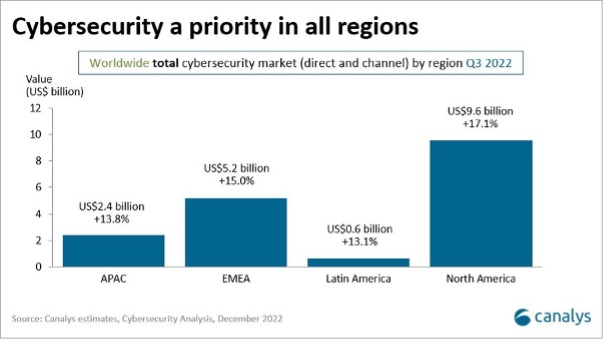

The worldwide cybersecurity market grew 15.9% year on year in Q3 2022, to $17.8 billion (€16.92 billion), despite deteriorating economic conditions, though vendors saw a tightening in the small- to medium-sized businesses (SMB) sector.

This is something of a worry as SMBs are often more vulnerable as they lack the resources of their larger counterparts, but the move to subscription-based models (see below) might help address this decline.

Winners and losers

The research found that Palo Alto Networks was the top vendor in the quarter, growing 24.9% year on year and increasing its market share to 8.4%, up from 7.8% a year earlier. Cisco was the second largest, with growth of 16.7% and a flat market share of 6.9%. Fortinet came third with growth of 29.9% to reach a 6.7% market share, up from 6.0% a year ago.

Endpoint security was the fastest-growing category, up 18.7% year on year at $2.7 billion. Network security was the largest category, representing $5.1 billion and growing 14.8%.

Shift to subscription model

The technology sector faces deteriorating economic conditions, increasing uncertainty and greater scrutiny of IT spending, factors that most vendors considered in their forecasts. Falls in new business, reductions in spending commitments and delays to subscription start dates were worse than expected, which will filter into future results.

“Many cybersecurity vendors have shifted toward subscription-led business models, which also helped to shield them from the immediate impact of the economic slowdown,” said Matthew Ball, Chief Analyst at Canalys.

“The move to subscription-based platforms and increased focus on upselling existing accounts will sustain revenue growth for cybersecurity vendors over the next 12 months.”