E-Plus analysis shows way forward for challenger operators

“Challenger” operators in mature markets could boost revenues and revenue market share by installing low cost networking equipment and pursuing speed and device-tiered pricing, rather than volume based tariffs, according to an analysis of E-Plus’ business by Nordic analyst Rewheel.

Rewheel’s Pal Zarandy said that E-Plus’ favourable spectrum mix in the 1800 MHz and 2.1 GHz bands, combined with new low cost ZTE SDR-based radio network equipment, could give E-Plus a competitive advantage over the “major” German operators (O2, Vodafone, T-Mobile) if it gets its marketing and pricing correct.

Rewheel said that E-Plus had been holding back investments into advanced technologies like HSPA, but late last year KPN’s management declared a strategy U-turn and in December 2009 teamed up with ZTE to accelerate the national rollout of a very cost efficient, high capacity HSPA+ network. Later on, during the spring E-Plus secured valuable spectrum resources among others in the 1800 MHz and 2.1 GHz band, well suited for the low infrastructure cost, low terminal subsidisation strategy, Zarandy said.

The strategy mirrored that of Telenor Group in Hungary, Zaranady said, where the operator switched out Ericsson equipment for ZTE, giving it a much lower cost base.

“Some people are still hesitant over the quality and performance of the cheaper equipment,” Zaranady said, “but we are not concerned about that at all.”

“What we are trying to say is that for challenger operators it’s worth considering radical steps on the supply chain side – as the network in becoming part of the competitive differentiation. If you can implement bullish pricing and optimise your network to swap to lower cost vendors then you can really get competitive advantage,” Zarandy said.

E-Plus has a distinct advantage in that it has plenty of spectrum, with four UMTS carriers, which means that it can deliver a very good user experience based on HSPA and HSPA+. That means that not only can it delay LTE investments for many years, but also that it needs to operate with much lower device subsidies.

But it is in pricing strategies that Zarandy thinks E-Plus is missing a trick. So far, E-Plus has pursued volume based pricing, but Rewheel thinks that by instead offering speed or device-tiered tariffs, E-Plus could accelerate its annual revenue growth rate to more that 6%, propelling the company to 25% revenue market share.

Zarandy said that device-based pricing is technically difficult, as it means limiting SIM use to defined devices. But speed based tariffing is already operating in many markets, he added.

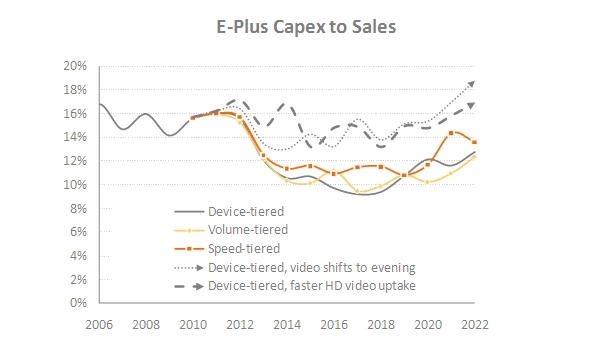

The motivation behind Rewheel’s analysis was to put E-Plus’s new strategy to the test and find out how far E-Plus could reach, if they leveraged their spectrum and supply chain based competitive advantages by taking a more aggressive data retail approach. The research report is a result of a bottom-up market demand forecast and dynamic network dimensioning projecting key financial indicators such as Capex to sales, EBITDA margin and EBIT for different market size scenarios, different E-Plus market shares and different data tariff pricing strategies including volume-tiers, speed-tiers and device category based tiers.

Rewheel said it carried out the research into E-Plus on its own initiative, and does not hold E-Plus as a client. It carried out the research to “put E-Plus’s new strategy to the test and find out how far E-Plus could reach, if they leveraged their spectrum and supply chain based competitive advantages by taking a more aggressive data retail approach”.

The key outcomes of Rewheel’s mobile data impact analysis are the following:

- Contrary to the common industry belief, missing out from the popular 800 MHz spectrum will not cause E-Plus a significant competitive handicap because their unique position in the 1800 MHz and 2.1 GHz bands will allow for rolling out a continuous high capacity mobile data network across their target footprint

- E-Plus’s data traffic, driven by video, will grow by a CAGR of 61% and the average monthly usage of smartphones, tablets and notebooks will exceed 4, 11, and 13 GB respectively

- E-Plus could comfortably accommodate the astronomic traffic increase on its HSPA 2.1 GHz network while providing a good user experience and without any significant LTE investments till 2017

- E-Plus’s network modernization program will prevent a Capex to sales hike during the rollout heavy period of 2010-2012. The new low cost, high capacity ZTE network can accommodate the traffic growth with a long term Capex to sales of 10%-12%, despite rolling out new 3G coverage sites near the edges of their footprint

- In the baseline scenario E-Plus’s mobile revenues will grow by a CAGR of 3.5% outperforming the market (CAGR 2%). Its revenue share will grow from 15% to 21% (connection share will grow from 17% to 24%)

- E-Plus’s mobile data revenue share out of total E-Plus revenues will grow from 4% to 52%

- By moving away from restrictive volume tiered tariffs and instead offering speed or device-tiered tariffs, E-Plus could fully unlock its data growth potential and accelerate its annual revenue growth rate to more that 6%, propelling the company to 25% revenue market share