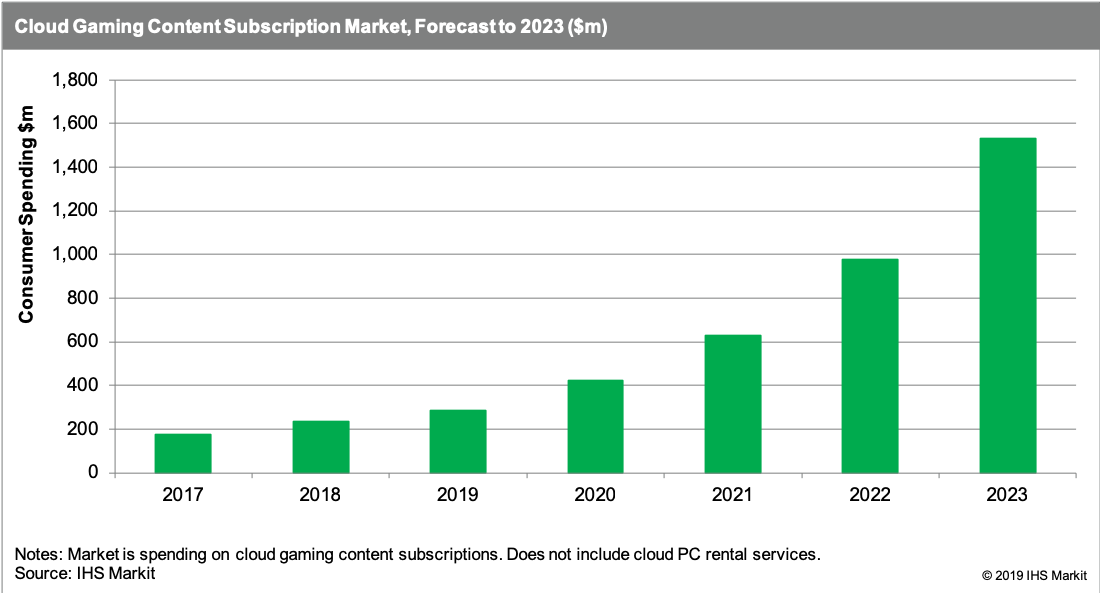

Consumer spending on cloud gaming content subscriptions is forecast to grow to $1.5 billion (€1.3 billion) by 2023, according to a new report from IHS Markit.

This is up from reached $234 (€206 million) million last year. Analysts at IHS Markit say this sector creates new opportunities for cloud service providers, pinpointing Microsoft and Tencent as particularly promising contenders.

Cloud services is also an area where telcos are trying to gain a foothold in the enterprise market. However, in a recent list of global top 10 cloud service providers by Canalys, only one telco appeared – NTT Communications, with the rankings dominated by IT providers and systems integrators.

Next generation cloud gaming

Next generation cloud gaming

IHS Markit’s Next Generation Cloud Gaming report identifies cloud service providers as potential tier-one competitors in the gaming market, due to their infrastructure advantages. In addition to Microsoft, Google and Tencent are preparing to launch their own services.

“Competitive differentiation in the next wave of cloud gaming services will be focused on two key areas: cloud infrastructure and content,” said Piers Harding-Rolls, games research and analysis director, IHS Markit.

“Microsoft is well-positioned in both these critical areas. It has ready access to its own Azure cloud data centres situated around the world, plus it has a strong portfolio of content to draw upon, for its upcoming cloud gaming service.”

He added that Tencent’s cloud services have less geographical coverage than other major cloud services providers, but the company has a strong portfolio of games content and it dominates the games market in China.

Potential to disrupt

Due to their cloud infrastructure and service delivery capability, cloud service providers have a significant commercial advantage over many companies already operating in the cloud gaming market or seeking to enter it, according to HIS Markit.

“If they build a compelling portfolio of games content, cloud service providers could potentially start to disrupt the established order of the console and high-end PC games markets over the next three to five years,” Harding-Rolls said.