The French regulator Arcep has released its quarterly numbers on the mobile market in France.

I’ll try to pick out some of the more interesting nuggets from in amongst the columns and rows of numbers.

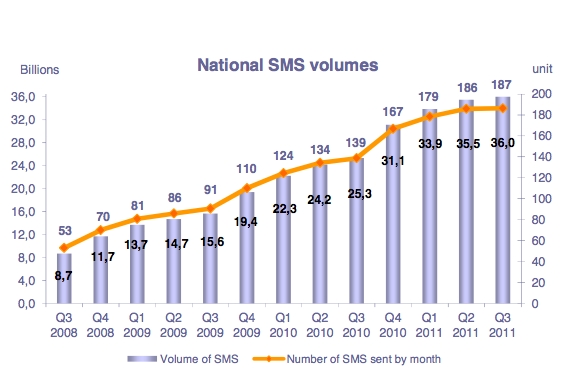

1. Has SMS peaked?

One item which I noted was this chart showing the slow down in growth in SMS volumes.

If you look you will see that the average number of SMS sent per user is beginning to stall, with only a very slight growth in the July/August/September quarter. There were 187 messages per subscriber in the quarter, compared to 186 per sub in the previous quarter. Total volumes stood at 36 billion, compared to 35.5 billion in the previous quarter. There may be some seasonality to this, with the French holiday season falling within the quarter, but it will be interesting to see what the next quarter holds. It will include Christmas, of course, which always generates a boost to SMS volumes — see the leap in Q4 2010 from 139 messages per user to 167 per user — but the overall direction should still be evident.

The question is, do flatlining or falling SMS volumes matter to the businesses of mobile operators? Do we see a consequent drop in either revenues or profitability? Do operators in fact benefit from uptake alternative mobile messaging technologies, as users take to Facebook and Twitter, and IM services on their mobiles? Does that drive smartphone and data package adoption in kind, and if it does so, does that form a more profitable line of business for mobile operators than SMS – which is increasingly being flung in as “unlimited” in many tariffs?

2. France now has a 100% penetration rate of active connections

Arcep reckons there are now 64.9 million active mobile connections in France, exactly the same number of people as live in France, according to INSEE. This level of saturation means that growth is slow, but still steady. There are now about 1.5 million more connections in France than this time a year ago, with the Christmas quarter still around the corner.

3. “Internet” and M2M SIMs still under-exploited

Of the 64.3 million “Metropolitan” connections, “only” 3.1 million of those are M2M SIMs, with a further 3 million embedded “internet” SIMs in the market. Although these are not small numbers, they show the level of growth opportunity that exists for embedded and M2M connectivity.

4. The rise of the MVNO

10.6% of French mobile connections are now managed by MVNOs, compared to 6.9% a year ago, and 5.6% two years ago. Much more startling is that the MVNO share of gross prepaid sales stood at 34.9% over the quarter. while MVNOs were responsible for 18.7% of all postpaid sales in the quarter.