Kearney’s 5G Readiness Index shows some revenue improvement but bold moves are needed to boost growth

Global consultancy Kearney said the US, Singapore and Finland score highest for 5G readiness, while two-thirds of the countries it surveyed now have at least one operator with speed-differentiated 5G tariffs. Now in its third year, Kearney’s 5G Readiness Index tracks spectrum availability and 5G deployment by countries and telcos worldwide.

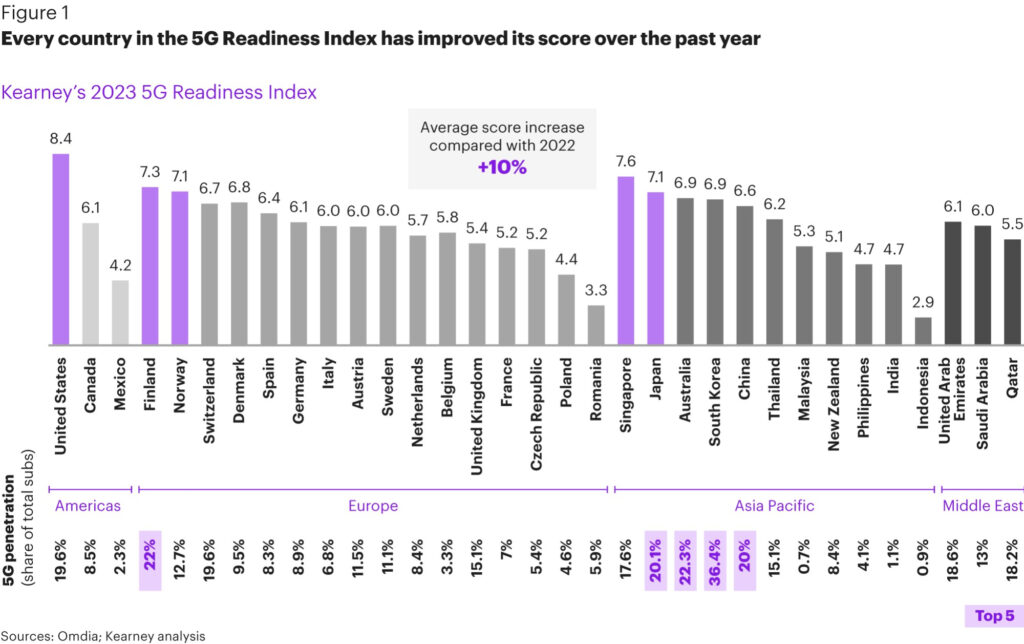

This year’s Index found that every country included has seen its readiness score increase, on average by 10%, as 5G takes further hold. Once again, the United States, developed Asia, and a sprinkling of Northern European countries lead, Western Europe and the Middle East are in the middle, and developing Asia and Eastern Europe have seen the slowest advancement.

Kearney, which falls into the 5G “offers tremendous potential” school of thought said it was disappointed to find that little had changed since its last report. “More countries have standalone cores, and more operators have expanded their commercial offerings, but few stand out with anything truly innovative,” the report surmised.

However, the findings it revealed suggests the competing “5G is just another G” camp may be closer to the truth. Until 5G Standalone networks, running 3GPP Release 17, are more widespread new 5G revenue streams will rely on tweaking mobile plan prices. Kearney highlighted the fact that industry is spending billions every year on capital expenditure, yet the average revenue per subscriber is static or sinking.

That said, the consultants said telcos are mostly aware of the problem and it applauded efforts by GSMA Open Gateway initiative and Ericsson’s Global Network Platform Initiative to help magic up new revenue streams.

“Risk inversion is the key term, meaning operators that are hoping to wait out the risks will only see their inactivity create new problems as competitors edge ahead,” said Kearney partner Jesper Larsson, who added 10% growth in the Index will not be enough to see the industry truly embrace the potential of the technology and opportunities it presents.

“5G offers a huge advantage in enabling operators to open their networks to external innovators and third-party developers,” he added.

Some notable trends

For 2023, the Index expanded from 28 to 33 countries and Kearney noted some progress on standalone networks, which are the only way to deliver some of the most advanced features 5G offers. Seventeen countries now have at least one operator with a standalone core versus 11 last year.

With commercialisation, pricing tweaks are commonplace but remain unsophisticated. Two-thirds of countries have at least one operator with speed-differentiated tariffs (via smartphone or fixed wireless access). Some already had them on 4G, but it’s a lot easier on 5G and one of the most obvious upsells.

Some offered throttled speeds (for unlimited browsing at 10 Mbps, for instance) that even make 4G look fast, but this isn’t the innovation that 5G promised. Other models include offering 5G to only the most expensive plans, like Australia’s Telstra initially, forcing subscribers to upgrade plans to use newly acquired 5G-compatible phones.

Ericsson’s recent Mobility Report demonstrated this clearly, showing that 5G service launches in its top 20 5G countries, have been followed by a positive revenue development of 3.5% (CAGR) in the past two years (2021 and 2022), or a total increase of 7%. Telcos have been monetising the early 5G uptake focusing on the “top customer pyramid” driving larger data buckets with faster speeds and therefore shifting to higher mobile tariffs, while adding value for consumers.

While the moves have stabilised ARPUs in some regions, even Ericsson concluded that this early monetisation strategy will not last forever. As telcos need to penetrate a broader segment in a competitive environment, prices will go down.

Operators in 25 markets now offer 5G private networks or multi-access edge computing but, according to Kearney, only the US and Singapore demonstrate true innovation through 5G-focused APIs and active ecosystem development.

While there was no huge jump in take-up (5G connections as a percentage of all connections Q4 2022 versus Q1 2022), Thailand and United Arab Emirates showed the most improvement, each increasing their take-up by more than 8%. Most other countries saw a 2-6% increase.

Poland, Belgium, and Spain have improved the most. Poland has seen its penetration triple to 4.6%. Thailand’s operators have launched services across all three bands. Belgium and Spain have opened up new bands to operators. All three show signs of 5G commercialisation (but no API). Japan, Qatar, and Canada have changed the least.

Not mmWave-ing, drowning

Movement in mmWave is still slow, compounded by slow adoption of compatible devices. For example, several devices from the largest suppliers support mmWave in the US market only with non-US countries supplied with alternatives.

For now, mmWave is primarily being used for offloading traffic in congested network hot zones, typically using carrier aggregation, fixed wireless access and indoor enterprise applications.

Only three new countries have made spectrum in that band available so that 14 now have it, compared with 11 in 2022. Operators in only two of the new countries, Finland and Singapore, have launched mmWave. Kearney said “Use it or lose it” applies here, as a regulator’s suspension of a Korean operator’s high-band licences illustrated.

Risky business

Kearney warns that the telecom industry has moved beyond being risk-averse towards what it calls risk inversion – a state whereby the risk increases that operators will become customers of others’ innovations rather than profiting from their own offering. Elements of this are already appearing in the relationships between telcos and the hyperscalers.

Partner Nikolai Dobberstein claims telcos could increase revenue streams by offering: “radically new services such as subscriptions to optimised videoconferencing via slicing, or on-the-spot boosts such as low latency for gaming.”

“It’s time for telecoms businesses to be bold, lead from the front,” he said. “The market leaders will be those that explore these options while taking a minimum viable product to market and iterating until higher monetisation levels are reached.”

Three steps to beat inversion

To do this, he recommends three actions, which to be fair, are already high on operator priority lists. The first is to collaborate through opening up their networks to external innovators and third-party developers, while taking advantage of opportunities like Open Gateway.

The second is not to be afraid of failure – the old fail-forward in management speak. This means trying new business-building concepts and see what works: partnering with ecosystem players to co-create new services, launch a platform, and unleash telco network capabilities to third-party developers, letting them innovate on telco infrastructure.

Finally, do all of this more quickly. This means going to market with a minimum viable product and iterating. And not waiting for simple pricing differentials and services to pay off.

Methodology explained

Kearney’s 5G Readiness Index is based on three factors in each 5G band class: spectrum availability, deployment and commercialisation. The Index also considers the overall maturity of the telecom market and the socioeconomic context of the countries. Kearney analyses 5G rollouts and commercialisation, including only those operators that clearly state an active commercial offering, rather than trials, or that only list use cases on their website.