If the lack of a business model for residential femtocells has been something worrying some operators, then research from Park Associates, commissioned by the Femto Forum, may give them some pointers.

To download the full set of slides, which go into more than I highlight in this note, you can gain access here. But I thought I’d pull a couple of points out that interested me – to do with business models and the business case.

Churn and retention

First off, 12% of UK and German customer, and 22% of Spanish customers whose current operator could not provide a femtocell, said they would be very likely to switch to a new provider if they had a femtocell offering.

But more interestingly, amongst those who said they were likely to churn within the next 12 months, there was a much higher indication that they would avoid churning if their operator were to offer them a femtocell “at a price that you like”. Around 30% of the European consumers said that they would be very likely to stay with their operator if that happened. That looks like quite a powerful customer retention tool – and potentially a much cheaper one to an operator in terms of subsidy than a free handset upgrade.

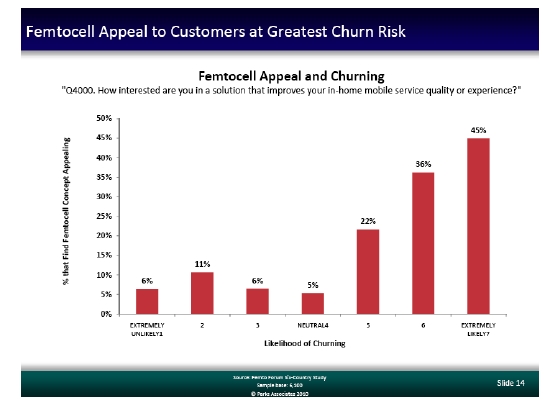

Parks also found that the level of interest in femtocells grew as consumers’ propensity to churn grew. Those who were extremely unlikely to churn were also unlikely to find femtocells appealing. Whereas 40% of those who were very likely to churn were interested in a femtocell. You have to add to this the fact that Parks also found that it is the highest ARPU customers who are most likely to churn.

In other words, femtocells do seem to provide an attractive option for those thinking of churning and that customer retention (especially) as well as customer acquisition should be built into the business model.

Which services might they pay for?

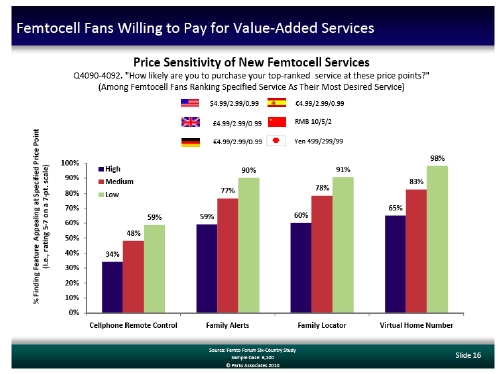

The other aspect of building a business model is in seeing the potential for using femtos to deliver Value Added Services. Parks asked its respondents about a number of services, giving them a high, medium and low price point for each service. The good news for operators is that there was substantial interest in most of the services, at all price points albeit amongst those already termed “femtocell fans”. For example, 65% of those polled expressed interest in the virtual home number, even at the high price point. And 98% expressed interest when the price was at its lowest. Services such as cellphone remote control, family alerts, virtual home number scored best. But even more unlikely products such as music sync and photo sync attracted some sort of interest – with 15% of the sample finding that feature appealing even at the highest price point.

NOTE: The Femto Forum commissioned Parks Associates to conduct this research in six nations: the U.S., the U.K., Germany, Spain, China, and Japan. The US research in fact dates back to April 2010 but the five other countries were surveyed in October 2010.