Policymakers will be left with fewer levers to pull to stimulate the market

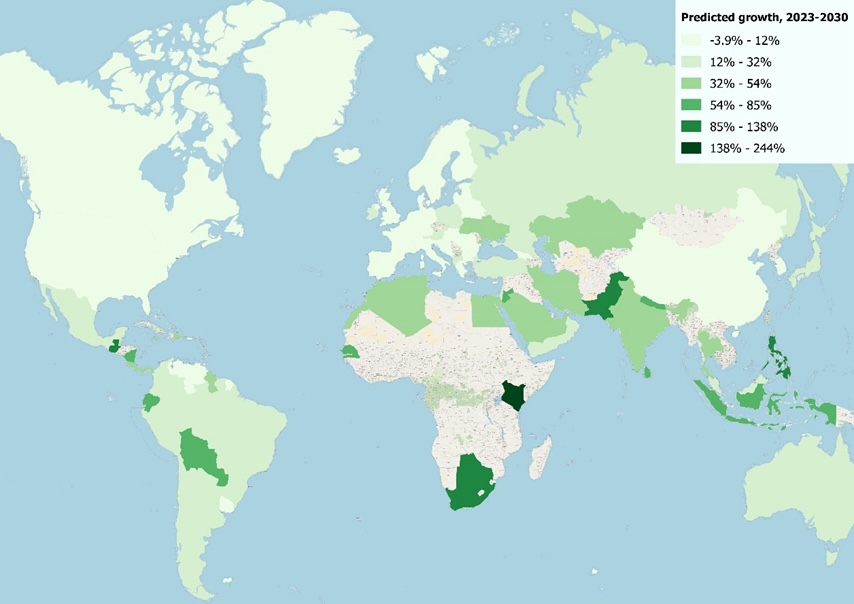

Declining populations and high fixed broadband penetration mean subscriber growth in Europe will flatline and the total fixed broadband subscriber figure in the emerging markets will almost match that in mature markets by the end of the decade. Western Europe will see the slowest growth, at 4.9% to 2030, despite global growth being forecast to grow by 15% to 1.6 billion in the same period, according to analysts Point Topic.

Eastern Europe will see 10.8% growth to 2030. The Western Europe growth contrasts with fixed broadband take-up in the Middle East & Africa, which will see 39.4% – the fastest growth region in the world, albeit from a much smaller base.

By the end of 2030 Western Europe will have 180 million fixed broadband subscribers leaving it a far-distant second behind Asia at 736m. Middle East and Africa will remain the smallest fixed broadband market with 95 million subscribers. However, this figure is only slightly lower than that forecast for Eastern Europe (101m), not least due to the impact of the Russia-Ukraine war.

Some mature markets will actually shrink according to Point Topic. “We predict a slight decline in fixed broadband subscribers in China by the end of the decade (-3.9%), given that the country’s fixed broadband market is already highly saturated. Moreover, 5G subscribers there are also approaching 1.5 billion,” said Point Topic. “Finland, another country with high fixed broadband penetration and high 5G availability, will also see negative growth.

Several countries in the Point Topic’s emerging category – which will see 36.8% growth – have been expanding fixed broadband infrastructure, especially focusing on fibre. “The demand for ultrafast broadband has been increasing at healthy rates in these generally large and growing populations and economies, with Indonesia and The Philippines just a couple of examples. [So-called] youthful countries will see the second highest growth rate at 11.8%,” said the analysts.

“Here fixed broadband take-up has already grown at high speed and so they will see growth rates slow down. To date, the growth curve of youthful markets has been the steepest, with the likes of China having invested heavily in their broadband infrastructure over the last decade.”

Compared to its previous forecast, the analyst’s current forecast of global fixed broadband take-up figures by end-2030 is 1.5% higher. This reflects higher than Point Topic previously expected growth in broadband take-up and addressable audiences in several countries. The higher forecast growth in such large markets as India (+26%), Morocco (+21%), and Malaysia (+20%), among others, has boosted the analyst’s global fixed broadband subscriber forecast for this decade.

Point Topic’s forecasts are based on its quarterly fixed broadband subscriber data up to Q2 2023 and include both residential and business connections.