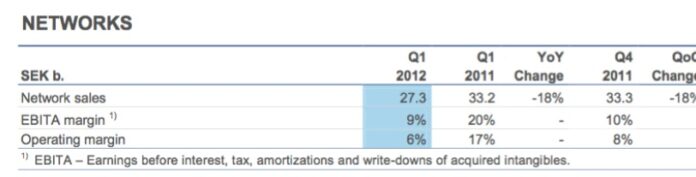

Ericsson's network sales in Western and Central Europe were down 29% year-on-year for the first three months of the year as a result of "cautious operator spending", the vendor said.

That reduction in spending was partially offset by modernisation projects, where Ericsson has made a strategic decision to increase its share. It added that it expected the average duration of these projects to be within 18-24 months. The company said that the lengthy project times reflected the increasing technical complexity of many network upgrades, and the need to conduct upgrades within specific maintenance windows.

Meanwhile, Ericsson's global services business grew 22% for the quarter in Western & Central Europe, and its Support Solutions unit saw sales decrease 37%.

Networks sales in the Mediterranean region were down 10%, services up 7% and Support Solutions down 39%. On a global basis, networks sales were down 18% year on year for Q1. Several markets were down as well as Europe, including Russia, the Middle East and India. The USA was a strong performer, however.

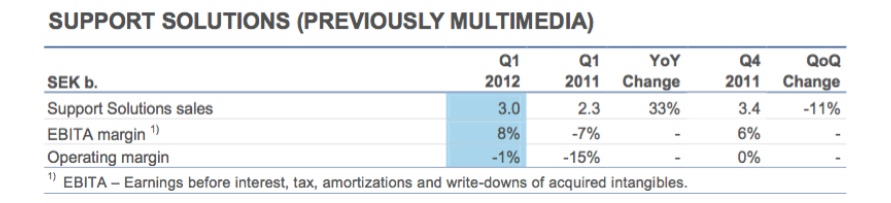

Professional services grew 18% year on year on a global basis, whilst the Support Solutions unit grew 12%: OSS sales were flat, and BSS sales had a slow quarter, with the main growth coming from TV and Ericsson's IPX business. Sales from the Telcordia operation are equally split between Support Solutions and Global Services